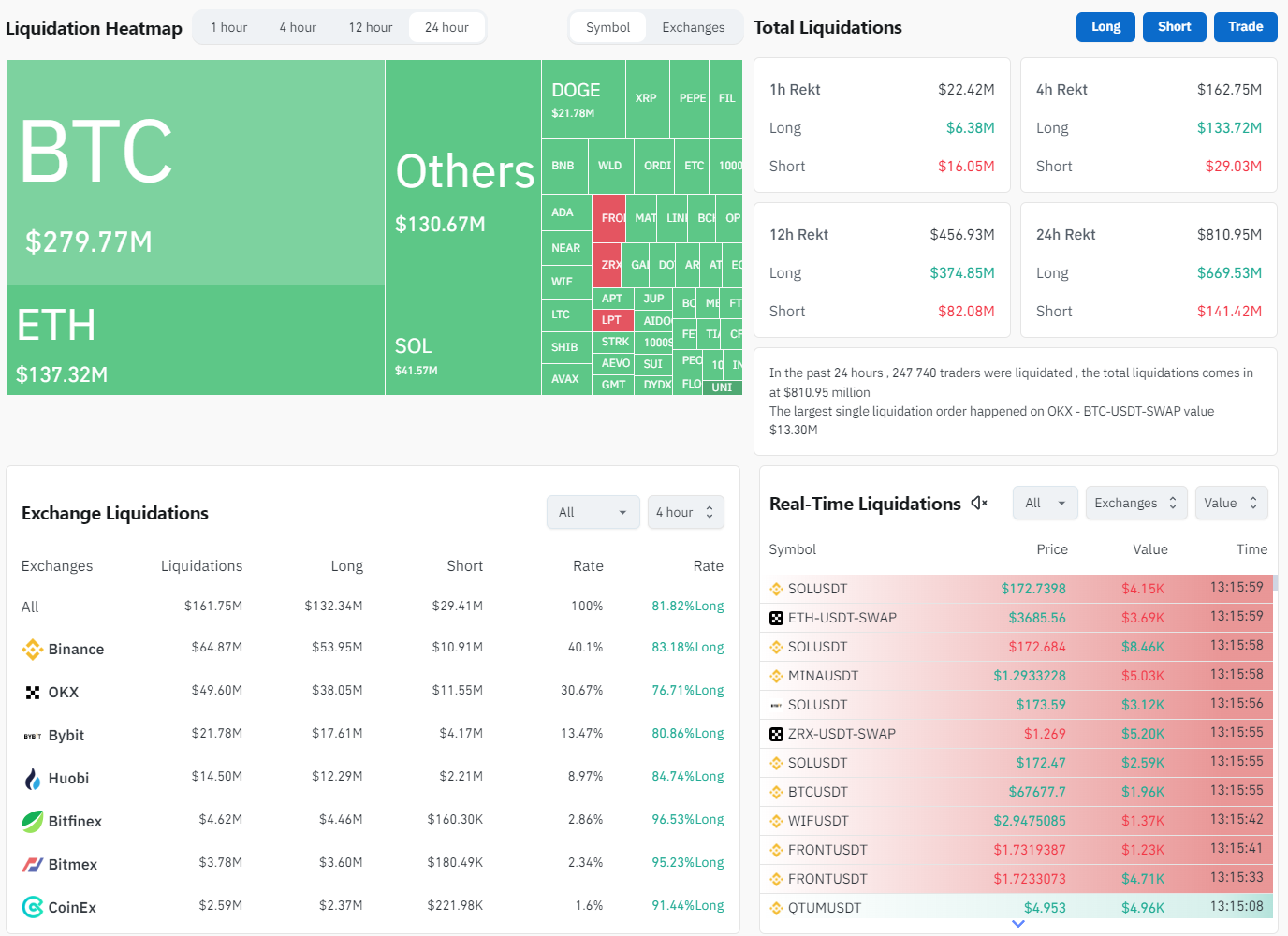

The crypto market has undergone a severe shockwave with a staggering $740 million worth of positions liquidated, as Bitcoin and other cryptocurrencies faced a precipitous decline. Enormous liquidation has affected the trading landscape, calling into question the future of this bullish rally.

The liquidation heatmap provides a glaring snapshot of the market's turmoil, with Bitcoin and Ethereum bearing the brunt of the liquidations. In particular, Bitcoin witnessed a massive $27.75 million liquidation event, indicative of widespread overleveraging by bullish investors, who were caught off-guard by the sudden downturn. The cascading effect of these liquidations likely compounded the sell-off, as automatic sell orders were triggered en masse.

The chart provided for Bitcoin illustrates the scale of the price correction. After a sustained upward trend, BTC experienced a sharp downturn, breaching key support levels. Previously, the cryptocurrency found strong support at around the $63,000 level, which aligned with its 50-day moving average. However, the current situation saw prices slicing through this line, signaling a shift in market sentiment from bullish to bearish.

A detailed technical analysis of the chart reveals that BTC has now approached its next critical support level at the $59,000 mark, corresponding with the 100-day moving average. This price point is crucial; if it holds, it could prevent further downward spirals and offer a staging ground for a potential rebound. On the flip side, if this support crumbles under selling pressure, the market could brace itself for even lower troughs.

The reasons behind this sharp correction are multifaceted: from traders taking profits after a period of significant gains, thereby inducing a market correction, to an overheated market correcting itself after periods of excessive euphoria. Furthermore, the excessive leverage used by some traders in the futures market likely amplified the price movements, resulting in a domino effect of liquidations.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov