Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

After another tremendous week for the popular cryptocurrency XRP, which ended with a gain of over 24%, there are some worrying signs that the bullish euphoria for the token may be coming to an end in the near future.

In the last six days, the price of XRP has soared 35% to a new all-time high of $3.4 — something not seen in the last seven years. What's more, the price action of what is now the third largest cryptocurrency has not been in line with broader market trends, but has happened on its own.

For example, XRP gained 12% against Bitcoin (BTC) and a staggering 26% against Ethereum (ETH). At one point, it was even 30% stronger than Bitcoin, but at 0.0000342 BTC for 1 XRP, the market seems to have reached a ceiling in valuations between the two cryptocurrencies.

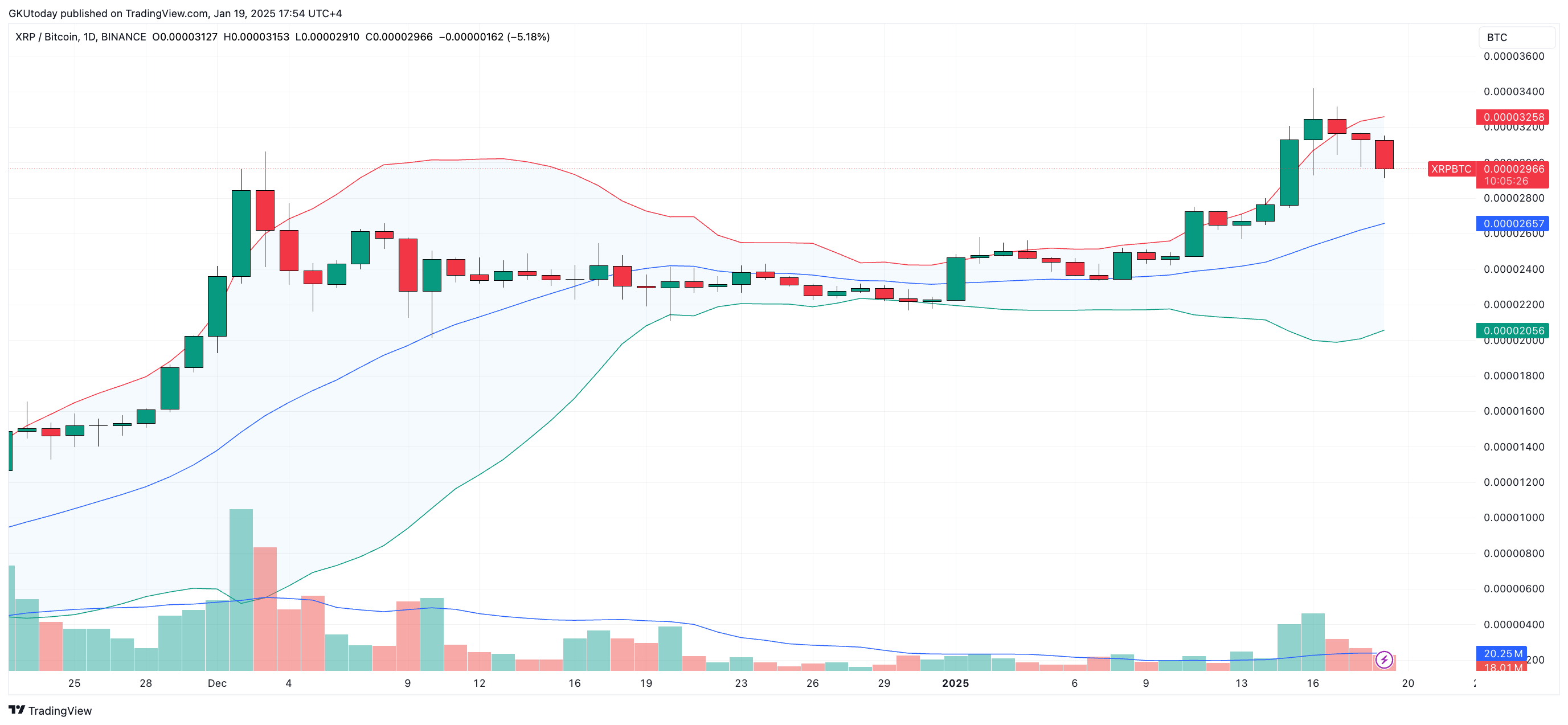

A popular indicator such as Bollinger Bands also tells us that there is some sort of ceiling in the pairing of XRP against the leading cryptocurrency. This technical analysis tool, developed by John Bollinger, consists of two price divergence curves and a median to form a price range within which traders can estimate how oversold or overbought the asset is.

In the case of XRP against Bitcoin, the price of the former has reached the higher band against the latter on a daily and weekly basis. Taking these factors into account, it can be said that the altcoin's fall against BTC is more likely at the moment than a continuation of the rise.

If this is the case, XRP could see a drop of 10% if the median provides strong support, or 31% if the decline continues until the lower band is reached.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin