Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In a recent post, crypto analytics platform IntoTheBlock noted that Bitcoin is on the verge of a major breakthrough, as it experiences a positive price surge. The key resistance level to watch is $29,200, a point of acquisition for over 1.77 million addresses.

Over the past couple of weeks, Bitcoin has witnessed an impressive rebound, surging by more than 8.3% from its local low of $24,900, and it currently stands at approximately $27,000 per BTC. This marks the highest price point in the last three weeks, creating a buzz of excitement in the cryptocurrency community.

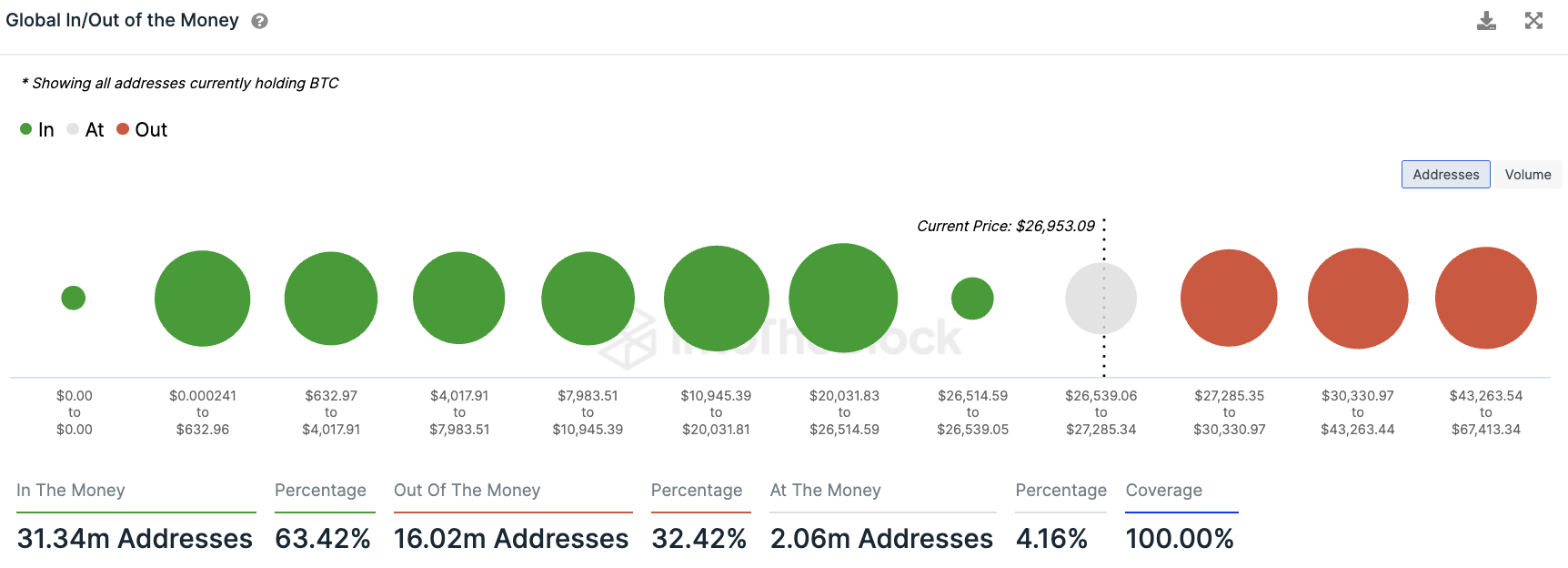

A deeper dive into the statistics regarding address concentration by IntoTheBlock reveals intriguing insights. Presently, there are 31.34 million addresses holding a collective sum of 12.03 million BTC that are in the green. Conversely, 16.02 million addresses, holding a total of 6.43 million BTC, find themselves in the red.

The most significant concentration of loss-making addresses, approximately 5.61 million in number, falls within the price range of $43,260 to $67,400 per BTC. However, the highest concentration of loss-making coins, 2.23 million BTC, were bought in the range of $27,285 to $30,330. Interestingly, this range corresponds to the very recent prices observed for the cryptocurrency.

As Bitcoin's price surge continues, the focus remains firmly on the $29,200 resistance level, where the hopes and decisions of almost two million investors hang in the balance. With market sentiment acting as the ultimate arbiter, all eyes are on the unfolding action in the crypto space.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov