Chart provided by data aggregator Glassnode shows that long-term holders are actively accumulating Bitcoin and are sending it to cold storage vaults.

While the flagship cryptocurrency is consolidating, Bitcoin believers and recently converted ones are buying the dip.

“Long-term hodlers grabbing Bitcoin as it’s consolidating around $55,000”

Twitter user Dylan-BTCization has shared a Glassnode chart which demonstrates that the Long-Term Holder Net Position Change indicator has turned green after a long period of staying in the red.

Now, that Bitcoin is trading sideways in a consolidation near $55,000 after dropping from the $58,000 area, financial institutions and other long-term hodlers are buying BTC on the dip to sit tight on their digital gold.

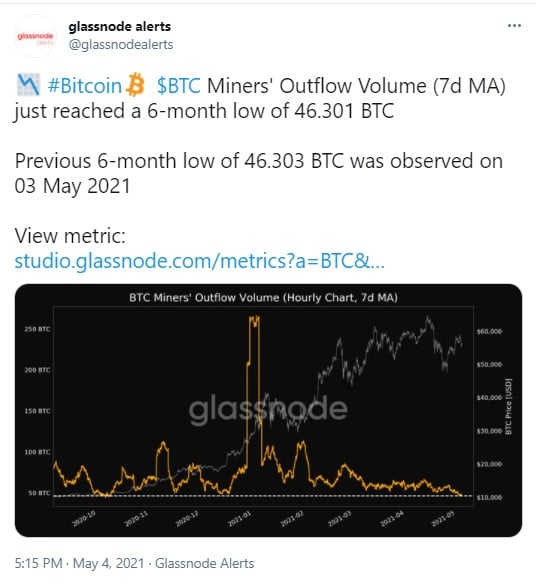

Bitcoin miners’ outflow hits a half-year low

Another chart from the Glassnode analytics team indicates that Bitcoin miners are not so eager to part with their BTC and are accumulating it instead of sending crypto to exchanges to sell.

The data shows that the BTC Miners’ Outflow Volume (seven-day moving average) has hit a six-month low and at the moment totals 46.301 BTC.

The previous half-a-year low was noticed on Monday, May 3.

Schiff debates Barry Silbert on Bitcoin

Earlier today, the founder and CEO of Digital Currency Group (parent company of Grayscale), Barry Silbert, shared his optimistic view about “wealth creation happening in the cryptoland” at the moment on all levels and everybody can take part in it.

A regular Bitcoin opponent Peter Schiff, who prefers gold to BTC, disagreed. The Euro Pacific Capital CEO keeps tweeting that all profits made in the crypto space with Bitcoin and other digital assets are simply the flow of wealth from the buyers into the pockets of the sellers.

No wealth is being created, it's being transferred from the buyers of crypto to the sellers. In the process significant resources are being wasted that could otherwise have been put to productive use.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin