Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

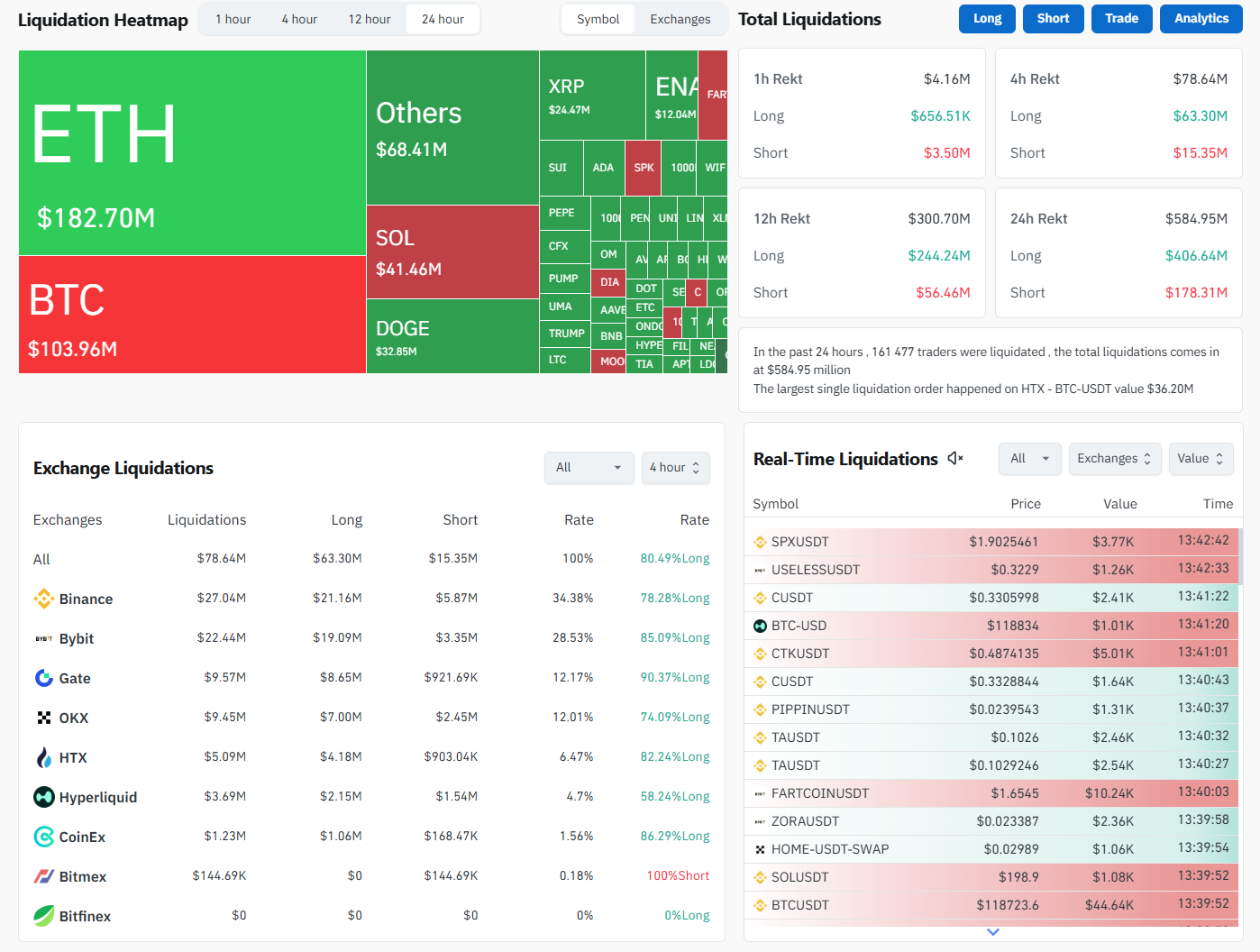

A startling $585 million were liquidated on the cryptocurrency market in the past day, with 161,524 traders losing money as overall volatility surged. With $182 million in wiped-out positions, Ethereum was the most affected, followed by Bitcoin with $104 million. The magnitude of the liquidation cascade indicates that as markets try to absorb the most recent price fluctuations, stress and uncertainty are increasing.

With over $26 million liquidated, Binance held the largest share from an exchange standpoint, followed by Bybit and OKX. With over $407 million in long positions, the majority of these liquidations indicated that traders were overwhelmingly positioned for further gains. Stop-outs were widespread, though, as the market pulled the rug with abrupt downward corrections.

Ethereum, which recently attempted a break above $3,800, showed signs of exhaustion with a steep pullback. A steep retracement and a decline in volume suggested that buyers might be tired. Bitcoin is currently battling a declining trendline that has been broken, trading just below $120,000. Despite the fact that it is still structurally sound, the lack of volume follow-through casts doubt on bullish conviction.

A test of lower support levels around $114,000 - or even $110,000 - may occur if Bitcoin is unable to break through the $120,000 barrier with any degree of certainty. In a broader sense, the increase in liquidations indicates that the market was excessively leveraged. Moves that deviate from that positioning cause a cascade of events rather than merely a sell-off.

The likelihood of additional downside or chop rises as Ethereum and Bitcoin both exhibit indications of momentum loss and a shift in sentiment toward caution. The situation is changing even though it might not be full-fledged carnage just yet. Because there may be more volatility ahead, traders should avoid overexposure to volatile assets. Whether or not this was a normal flush or the start of a more serious unwinding will be determined in the coming days.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin