Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

As of right now, Bitcoin is trading below important resistance levels, and a lot of investors are focusing on the $60,000 mark as the next big target. But in order for Bitcoin to get there, three things must line up perfectly.

Short orders with high leverage

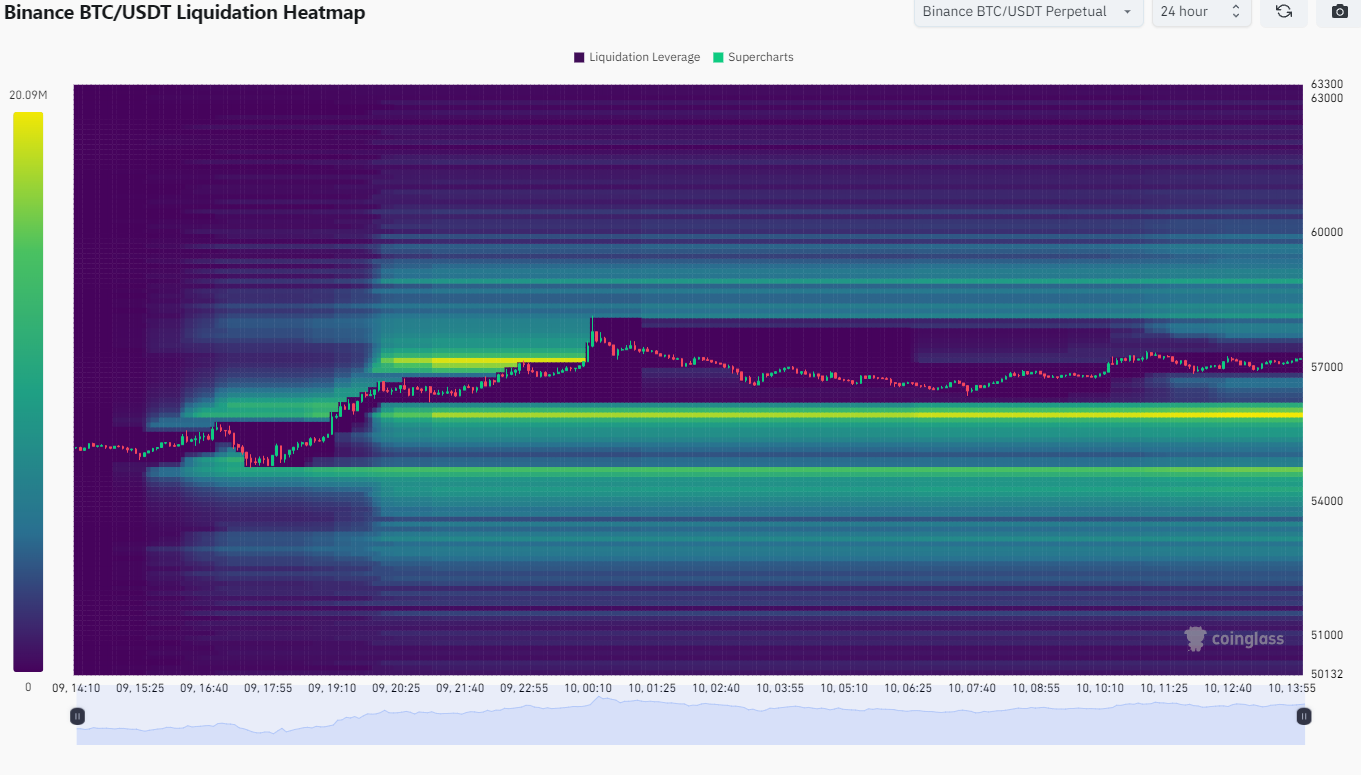

The liquidation of high-leverage short orders is one of the main factors pushing up the price of Bitcoin. A short squeeze results from numerous traders being compelled to liquidate their leveraged positions as BTC gets closer to higher price levels. Since they are compelled to do so, the price of Bitcoin is forced higher. Significant leverage is seen between $58,000 and $60,000 in the Binance heatmap data, suggesting that liquidations at these prices could push Bitcoin to all-time highs.

Investment inflows from institutions

The price of Bitcoin is still heavily influenced by retail traders, but institutional inflows are necessary for long-term growth. BlackRock is currently among the few institutional investors actively boosting cryptocurrency inflows, albeit the majority of its attention has been focused on Ethereum.

More institutions must enter the market if Bitcoin is to reach $60,000. The weekly asset flow chart for cryptocurrency demonstrates the recent decline in institutional participation, with negative flows affecting the mood of the market as a whole. Large financial institutions showing renewed interest would provide Bitcoin the confidence and liquidity it needs to overcome its resistance levels.

Change in sentiment

The mood of the market right now is on the verge of extreme fear. Massive selling pressure has halted every recent attempt at a bull run, keeping Bitcoin from rising further. This sentiment needs to get better if we are going to see a sustained push toward $60,000.

More buyers are probably going to enter the market as fear fades and confidence in it grows, which will accelerate the upward trend. Positive developments on the market, along with a shift in sentiment, could be the impetus needed for Bitcoin to finally break through the $60,000 mark.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin