More than $1.33 bln worth of crypto has been wiped out over the past 24 hours, according to crypto derivatives market data provider Bybt.

This comes after the price of Bitcoin plunged by more than 11 percent in the span of five minutes to its intraday low of $10,559 that was touched on 04:42 UTC on the Bitstamp exchange.

Top cryptos whipsaw traders

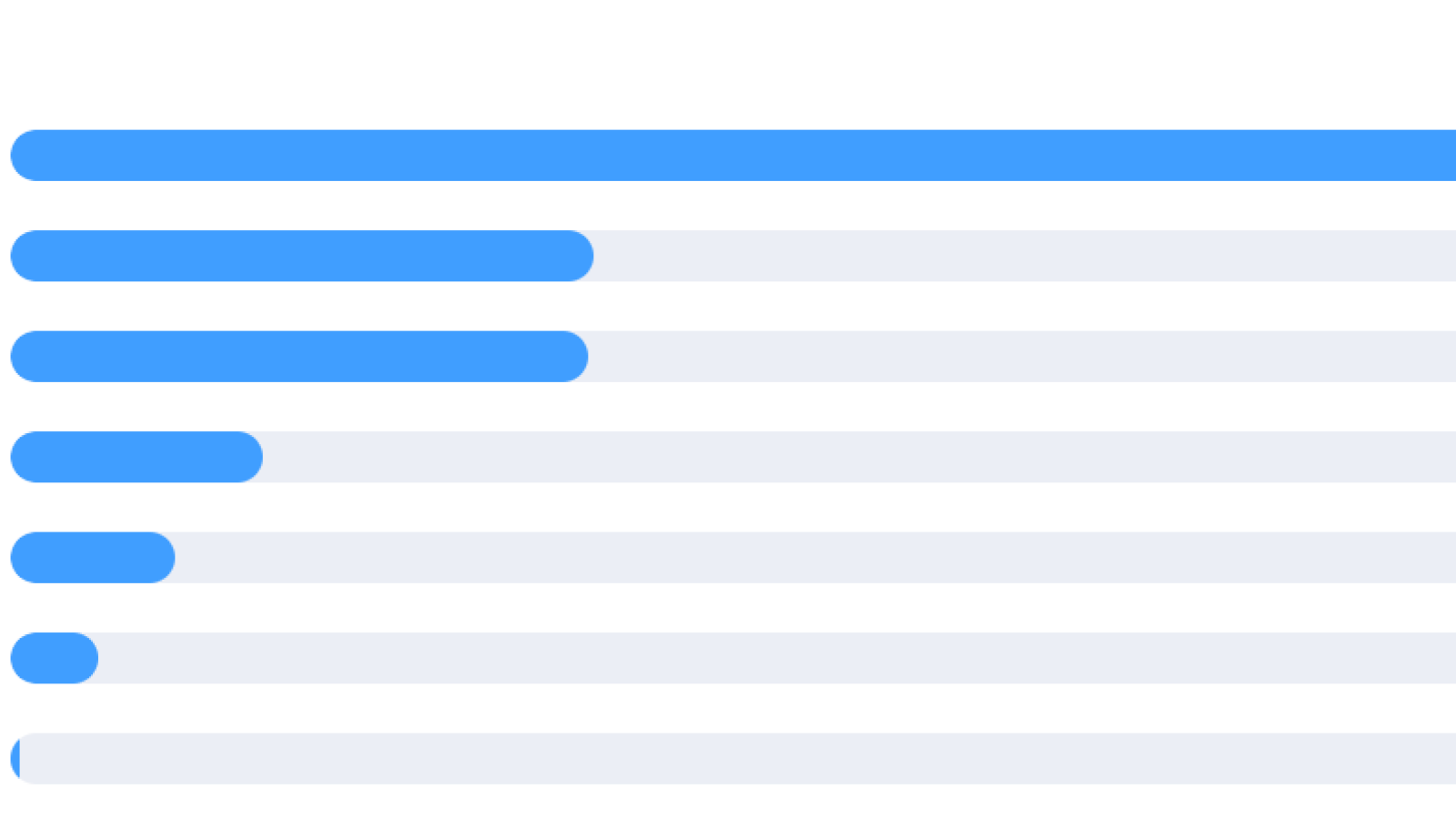

82 percent of all liquidations were long positions, which shows that the bulls were caught off-guard by the recent market turnaround.

Bitcoin and Ethereum both reached $12,000 and $400, respectively, for the first time since January 2018, right before the uptrend hit a major snag.

ETH plunged by more than 21 percent in mere minutes, accounting for $246.66 mln worth of all liquidated crypto.

EOS is in third place ($82.79 mln), followed by Bitcoin Cash ($63.86 mln) and XRP ($54.95 mln).

While Bitcoin and other major alts are yet to recover from today’s crash, Chainlink (LINK) has become an outlier by taking it in stride and soaring to a new daily high of $8.79.

Open interest tanks 16 percent

OKEx had the biggest chunk of liquidations (34.74 percent), with Bybit occupying a close second place (34.25 percent).

BitMEX, which ruled the roost in the crypto derivatives market back in 2018, is only third with a 15.09 percent share. However, the exchange’s Bitcoin perpetual swap did record the largest liquidation of $10 mln (936.2 BTC) at 07:24.

Open interest (OI), the total value of all outstanding derivatives contracts, plunged by 16.02 percent, with Binance taking the biggest hit (-20.93 percent).