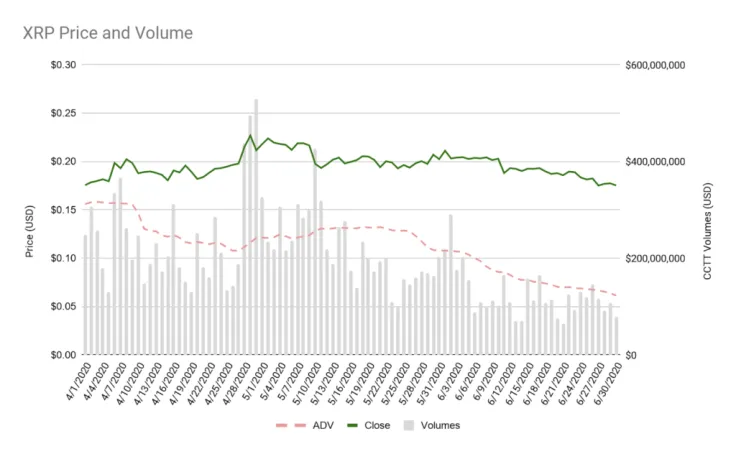

Blockchain company Ripple has just published its Q2 report where it reveals that the global XRP volume recorded on top-tier exchanges plunged by 40 percent (from $29.68 bln to $17.86 bln).

Aggregate XRP volumes recorded by CryptoCompare’s top-tier crypto exchanges, which account for 40 percent of all trading activity, also plunged by 39 percent.

More liquidity, less volatility

It is worth noting that the drop reflects the overall trend in the cryptocurrency industry, meaning that XRP wasn’t an outlier.

In fact, it ended up being the fifth most traded cryptocurrency when liquidity and volume are taken into account.

According to Ripple’s global institutional markets team's leader Breanne M. Madigan, new developments in the options and derivatives market helped to deepen XRP’s liquidity.

Binance introduced XRP options contracts while Huobi DM (Huobi Futures) introduced perpetual swaps for XRP.

XRP’s volatility dipped by 6.2 percent compared to the previous quarter to 3.0 percent. It was less volatile than both Bitcoin and Ethereum.

ODL sees 11x growth

XRP users paid the lowest among of fees ($20,138) during the previous quarter despite the XRP Ledger recording 85 mln transactions.

The company also states that On-Demand Liquidity, a payment corridor that leverages XRP as a bridge, is now responsible for 20 percent of the RippleNet volume.

Speaking of half-year results, Ripple noted that its ODL transaction volume saw an 11-fold increase compared to H1 2019.

“Ripple is reducing its emphasis on large treasury payments—which are traditionally used to fund businesses and services in the absence of real-time transfers—to support individual, low-value transactions, addressing the growing need in remittances and small- and medium-sized enterprise payments.”

Tomiwabold Olajide

Tomiwabold Olajide Yuri Molchan

Yuri Molchan Gamza Khanzadaev

Gamza Khanzadaev Godfrey Benjamin

Godfrey Benjamin