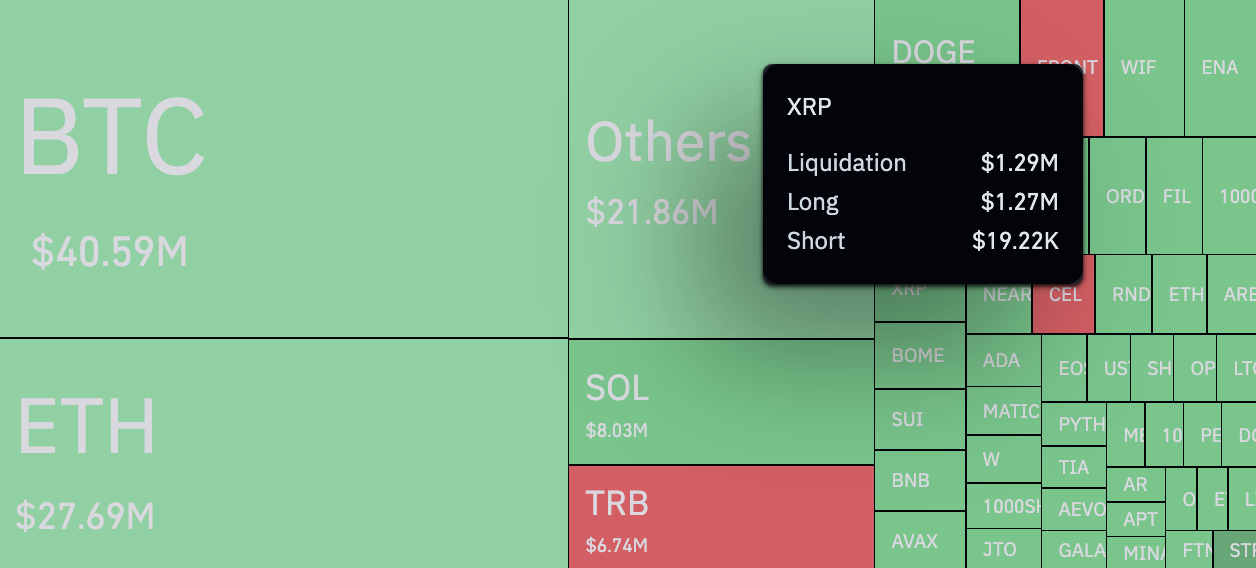

In a notable deviation from recent market trends, XRP has seen a remarkable surge in bullish liquidations, presenting a stark contrast to the relatively subdued activity on bearish positions. According to data sourced from CoinGlass, the past 24 hours have witnessed a noteworthy $1.27 million in liquidations associated with long positions, dwarfing the comparatively modest $19,220 liquidated from short positions.

This substantial variance, totaling a remarkable 6,350%, has captured the attention of market analysts and participants alike.

The surge in bullish liquidations coincides with a 3.85% decline in XRP's price, signaling a shift in sentiment among investors. However, the precise catalyst behind this significant discrepancy in liquidation patterns remains elusive, prompting speculation and scrutiny within the cryptocurrency community.

The repercussions of this anomaly extend beyond liquidation figures, with derivative trading volumes for XRP witnessing a notable decline of over 55% within the same period. This decline reflects a broader trend of reduced trading activity amid heightened market uncertainty.

Looking ahead, analysts suggest that the aftermath of these unusual liquidation patterns may usher in a period of relative stability, with XRP potentially poised for a rebound from key support levels. However, the anticipated recovery is expected to be driven primarily by institutional investors and larger market participants, rather than retail traders.

As bears capitalize on the falling price of XRP to secure profits, bullish stakeholders find themselves nursing wounds inflicted by the recent downturn.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov