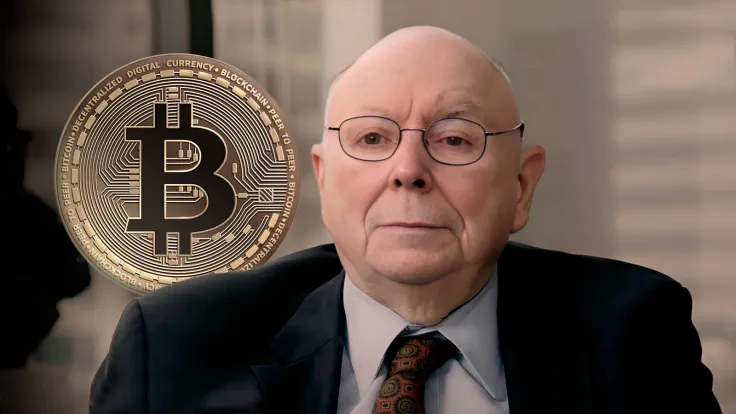

Charlie Munger, Berkshire Hathaway's vice chairman and Warren Buffett’s long-time business partner, delivered a sharp critique of Bitcoin and other cryptocurrencies in a recent interview with the Wall Street Journal.

The 99-year-old investor, whose net worth hovers near $3 billion, did not mince words when discussing the digital asset class, which he views as a destabilizing and unproductive financial invention.

Munger's sharp criticism

Munger likened the introduction of Bitcoin to throwing a "stink ball" into a well-refined recipe of traditional finance.

He underscored the importance of a strong currency in the transition from primitive societies to advanced civilizations, pointing out that whether it is seashells or gold coins, the currency's solidity has always been paramount.

Munger's colorful language conveys his belief that Bitcoin, as an "artificial" currency, disrupts a financial system that has long served its purpose effectively.

Earlier statements from Munger have echoed this recent critique, with a notable increase in intensity. He has previously called for an outright ban on Bitcoin and similar digital assets, likening them to "gambling contracts" rather than legitimate investments.

Munger's investment advice

During the recent interview, Munger suggested that the average investor might best be served by putting their money into index funds.

Just as one would not design their own household appliances without expertise, there's little reason to pick individual stocks without a distinct advantage, the investing legend notes.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov