Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

With total unrealized profits now surpassing $102.5 billion, MicroStrategy's Bitcoin holdings have produced an impressive return. Under the leadership of Executive Chairman Michael Saylor, the company's aggressive dollar-cost averaging strategy has paid off in the context of Bitcoin's recent bull run.

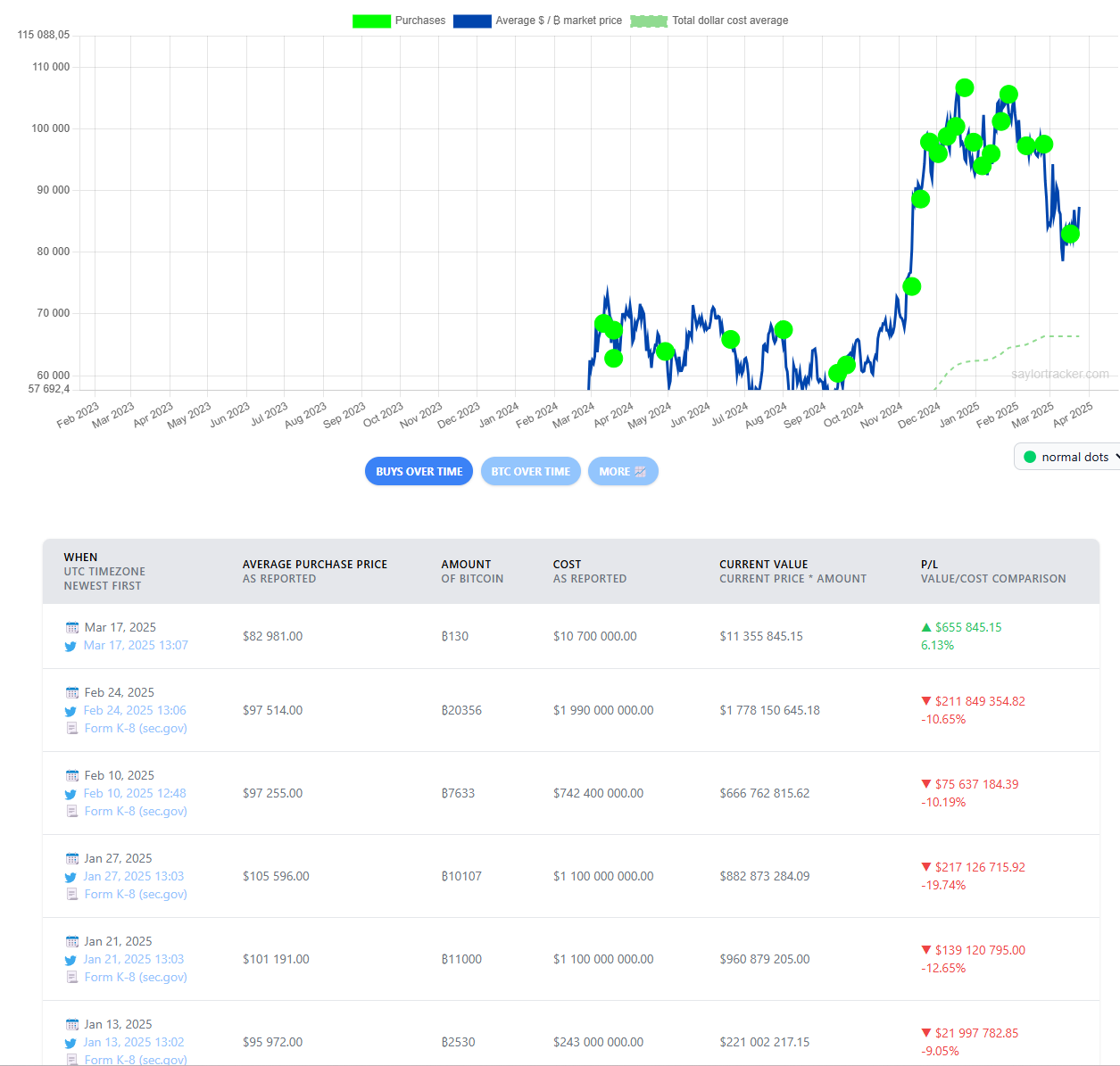

According to the most recent data, MicroStrategy's nearly 500,000 BTC acquisition cost averaged $66,384, while the price of BTC is currently trading above $87,000. Bitcoin's recent surge, which saw prices rise from below $30,000 in early 2023 to new all-time highs in Q1, 2025, has significantly strengthened the firm's portfolio position. With cumulative gains, the company's holdings now total an astounding $43.66 billion, representing a 31.74% increase in overall position value since inception.

Despite the encouraging headline, a closer examination of MicroStrategy's past acquisitions shows that the majority of its most recent acquisitions are still pending. High-volume purchases made in late 2024 and early 2025, including several entries worth over $1 billion at average prices between $97,000 and $105,000, are still losing money.

For example, the purchase of 10,107 BTC on Jan. 27 at $105,596 currently represents a 19.74% loss, while the purchase of over 20,000 BTC on Feb. 24 at $97,514 represents a 10.65% decline. However, the company's long-term approach of building up during declines and retaining through volatility is starting to pay off.

Large purchases made between 2020 and 2022 at prices under $30,000 and under $40,000 now greatly outweigh short-term losses. This supports Saylor's argument that Bitcoin is an excellent treasury reserve asset with room to grow in value over time. MicroStrategy's wager seems more and more appropriate with supply constraints associated with the halving of Bitcoin and the strengthening of inflows into Bitcoin's spot ETF's approach.

Even though some positions have not yet reached break-even, the firm's unwavering accumulation strategy continues to outperform that of many institutional counterparts. MicroStrategy's continued dedication positions it as a leading corporate force in the Bitcoin space as the digital asset landscape develops its more than $10 billion in unrealized gains.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov