Nowadays, there are numerous types of money — from traditional banknotes and coins to cryptocurrencies, a newfangled asset class. However, money has to be legally recognized in order to achieve widespread adoption. While many regulators are still reluctant to give crypto legitimacy, the whole industry remains in a limbo.

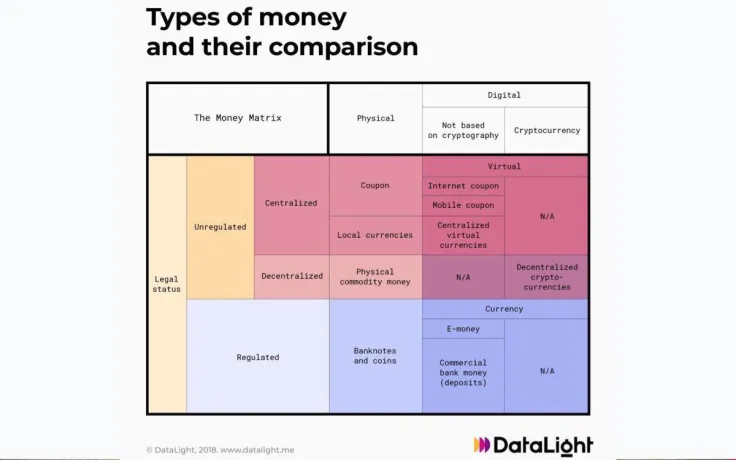

A recently published DataLight report shows the place of decentralized digital assets in the big Money Matrix in terms of their legal status. It groups all types of money into “unregulated” and “regulated.”

As expected, crypto makes an appearance in the unregulated section along with decentralized digital assets that are not based on cryptography — Internet coupons, mobile coupons, and centralized virtual currencies. Meanwhile, e-money and banknotes (coins) issued by commercial banks are normally regulated by a country’s central bank or treasury.

Godfrey Benjamin

Godfrey Benjamin Yuri Molchan

Yuri Molchan Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan