In an interview with CNBC, Dan Morehead, the CEO of Pantera Capital, has mentioned that U.S. giant PayPal is already absorbing more than 100 percent of all newly mined Bitcoin:

We have buyers now, like PayPal, who just themselves are consuming more than 100 percent of all the Bitcoins that are issued.

A little over a month ago, Pantera Capital estimated that PayPal alone was gobbling up 70 percent of the cryptocurrency's fresh supply. With its competitor, Square, their cumulative share was well over 100 percent.

PayPal's pivot to crypto—which was officially announced on Oct. 12—has received plaudits from (almost) all corners.

On top of making Bitcoin more attractive for mainstream audiences, the company also ended up making its stock more attractive for analysts, with major advisory firm Evercore Partners recently giving it a much-coveted shout-out.

PayPal's crypto volumes are likely to grow even bigger when the company begins to allow the spending of digital coins at merchants in early 2021. Over 65 percent of its users are ready to use the feature, a December survey showed.

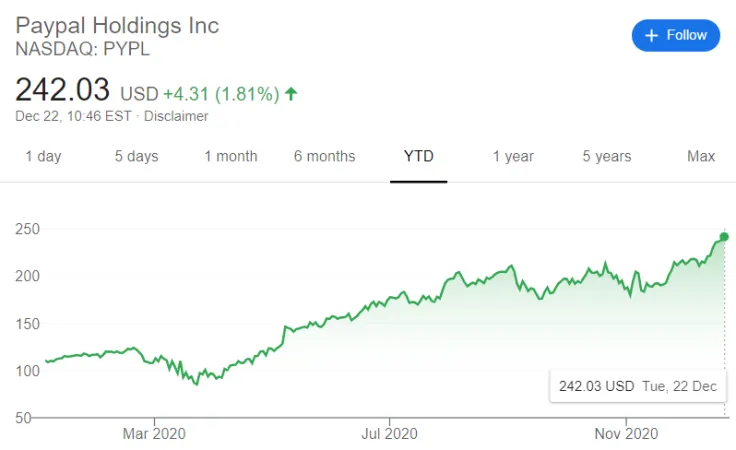

The PayPal stock (PYPL) is up 120 percent year-to-date.

A supply crunch is real

Morehead's words are the latest confirmation of an ongoing supply and liquidity crisis that is believed to be the main catalyst for its head-spinning 125 percent rally.

As reported by U.Today, only 12 percent of Bitcoin's total circulating supply is actually liquid.

In the interview, Morehead also took notice of the drastic shift in a market climate that is now dominated by big-wig investors and large institutions:

In 2017, there was obviously a media frenzy around it. There were all kinds of newly issued tokens that really didn’t have any basis to exist. There really was a speculative frenzy. This is being driven by the most famous global macro investors. This is being driven by public companies like Square, PayPal, and MicroStrategy.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov