Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin has yet to recover from the market correction that we have seen for the past several weeks. However, a broader picture in the world of finance offers a new hope – if we assume that Bitcoin is a risk asset for institutional investors.

Risk-on market

A risk asset is any asset that carries some level of risk. This term generally applies to assets with significant price volatility, such as stocks, commodities, high-yield bonds, real estate and currencies.

In the banking sector, a risk asset is one whose value may fluctuate due to changes in interest rates, credit quality, repayment risk and other factors.

Early cryptocurrency investors experienced exponential gains, prompting others to invest in hopes of building wealth, often with varying levels of understanding of the potential risks. The expectation of rapid returns continued to draw new investors, a phenomenon sometimes described as hype or "overhype."

In a risk-on environment, investors venture further along the risk spectrum, with stocks typically outperforming "safer" assets like bonds. They seek substantial rewards from risks they deem worthwhile in a growing market environment.

Bitcoin as risk asset

Bitcoin has retained its position as the largest digital asset throughout the last 16 years and commands over 52.7% of total industry value. Bitcoin dominance is a metric that is often referred to by analysts for assessing market cycles.

Bitcoin's market cap dominance has reached 54.5, according to data provided by TradingView. This marks the highest value in this metric for Bitcoin since July 2021.

Bitcoin dominance tends to grow during bear markets and early bull markets as capital seeks relatively safer havens. Bitcoin dominance has historically declined during the more speculative phases of bull markets as risk appetite increases.

According to Ark Invest, the Bitcoin network actually embodies characteristics of risk-off assets, promoting financial sovereignty, reducing counterparty risk and enhancing transparency.

However, with the launch of Bitcoin Spot ETFs, a large proportion of BTC market has now migrated to “paper.” As institutional investors now see Bitcoin as a risk-on asset, its price movement is likely to correlate with the general risk appetite.

Despite the launch of BTC ETFs, which many thought would lead to a stronger correlation with traditional finance assets, BTC displayed minimal correlation with major asset classes. As of today, Bitcoin correlation to the S&P 500 is at its lowest.

Current market situation

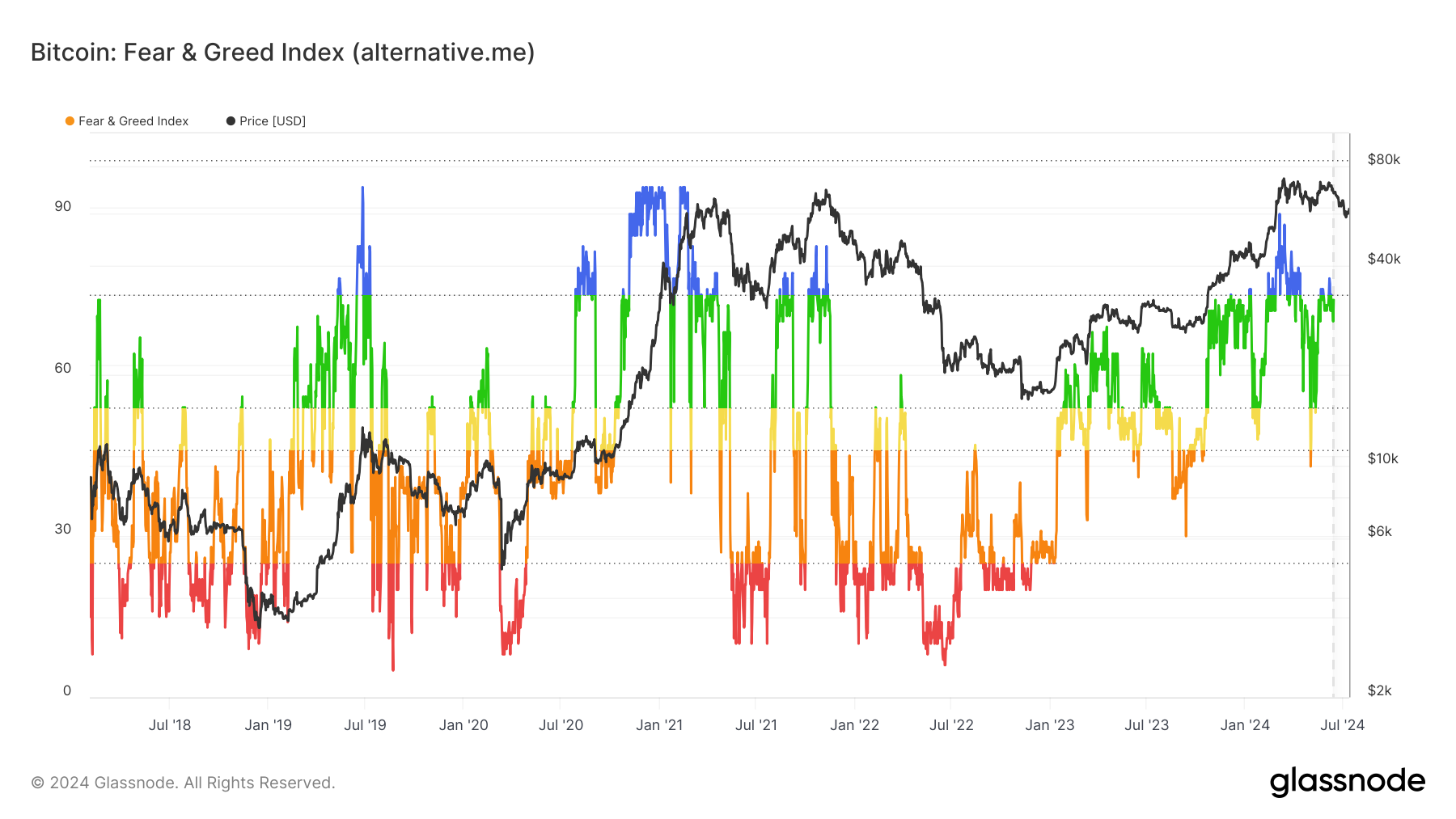

The crypto Fear & Greed index is currently in “extreme fear.” This does not come as a surprise, considering the recent market correction that took 15% off BTC's price.

Despite that, BlackRock, Fidelity and other BTC ETF issuers are buying Bitcoin. After several weeks of outflows, BTC ETFs are showing remarkable results.

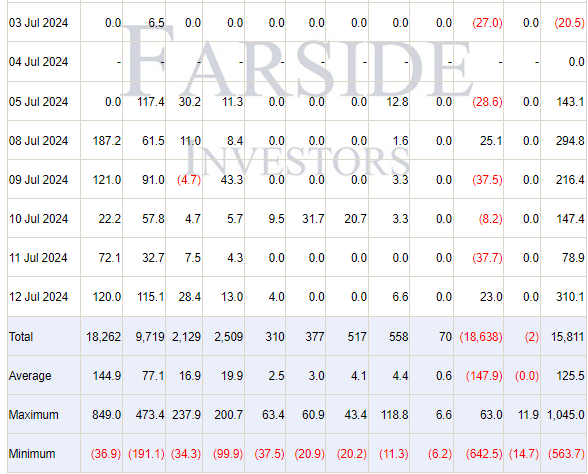

This Friday, the total daily inflow of Bitcoin ETFs has reached more than $300 million, according to Farside data.

Historically, capital tends to migrate toward Bitcoin as the largest asset during market downturns and during the immediate recovery from them. Bitcoin tends to lead the market during bear markets and early bull markets but lags during the more speculative phases of late-stage bulls.

If we look at investor sentiment on the financial markets, we do not see any signs of risk appetite decline. This means that BTC ETF inflows will probably continue.

This poses a crucial question: are institutional investors buying the dip? A strong argument could be made to support a positive answer. In this case, a potential bull run is more likely to lead to further price declines.

Tomiwabold Olajide

Tomiwabold Olajide Dan Burgin

Dan Burgin Gamza Khanzadaev

Gamza Khanzadaev