Litecoin (LTC) has never been the loudest name in the crypto space. No constant hype, no daily social media talks. But sometimes, steady growth speaks louder. And lately, LTC has been making moves that are hard to ignore, reports Santiment.

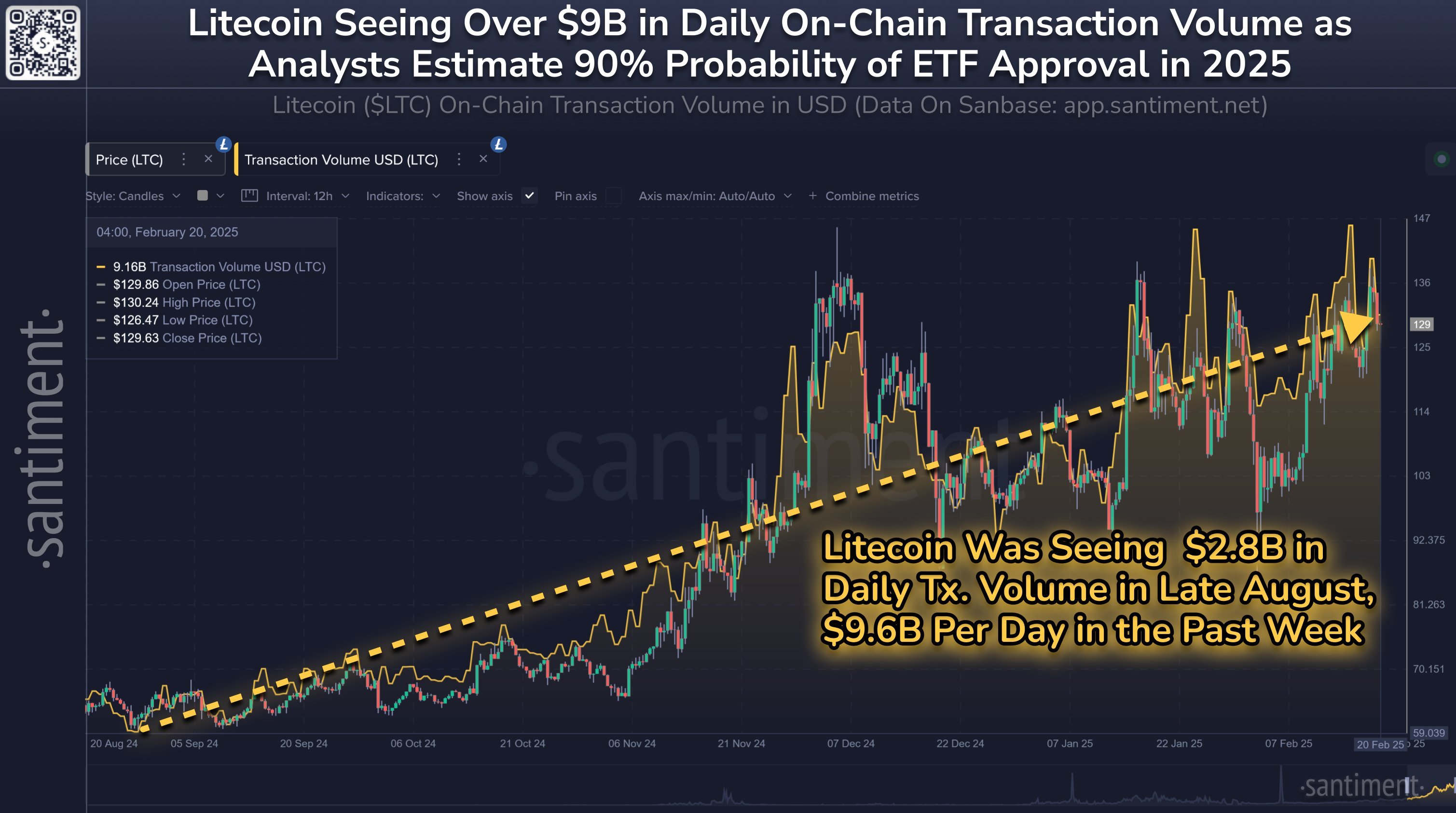

Over the past few weeks, something interesting has been happening. Litecoin’s market cap? Up 46% in the last two weeks. Network activity? In late August 2024, the blockchain was processing $2.8 billion in daily transaction volume. Fast forward to this past week — it is now handling $9.6 billion per day. Booming.

What’s driving this? ETF talk as CoinShares, a well-known financial firm, has filed to list a Litecoin ETF on Nasdaq, and the SEC has already started its review process.

No guarantees, of course, but market analysts are throwing around a 90% probability that approval could come by the end of 2025. Given the current regulatory environment, it’s not a stretch.

Bitcoin got its ETFs first, back in early 2024. Now, Litecoin is being watched closely as a potential next-in-line. If approved, an ETF would allow investors to gain exposure to LTC through a regulated stock market — no need to manage private keys, no need to deal with crypto wallets or make it to centralized offshore exchanges.

That’s a big deal for institutional adoption.

And then there’s the bigger picture. If Litecoin pulls this off, it could open the door for more altcoins — XRP, Solana, maybe even Chainlink — to get their own ETFs. The crypto market is maturing, slowly but surely.

Litecoin is not the flashiest crypto out there. But right now, it is moving in a direction that is hard to ignore. Steady, calculated and possibly on the verge of a major breakthrough.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov