According to a recent survey published by global decision intelligence company Morning Consult, only a fourth of Australians support the issuance of a central bank digital currency (CBDC).

Only 5% of those Australians who took part in the poll would "strongly" be in favor of such an initiative.

Notably, support for CBDC issuance is significantly higher in emerging markets. For instance, 61% of Columbians would want their government to issue a CBDC. Sixty-six percent of Indians would also throw their weight behind such an initiative. Japan has the lowest support for CBDCs: only 3% of its residents would support such an initiative.

Such a disparity might be due to the fact that people from developing countries have limited access to traditional banking services, which is why many see CBDCs as a tool for promoting financial inclusion.

Threat to financial stability

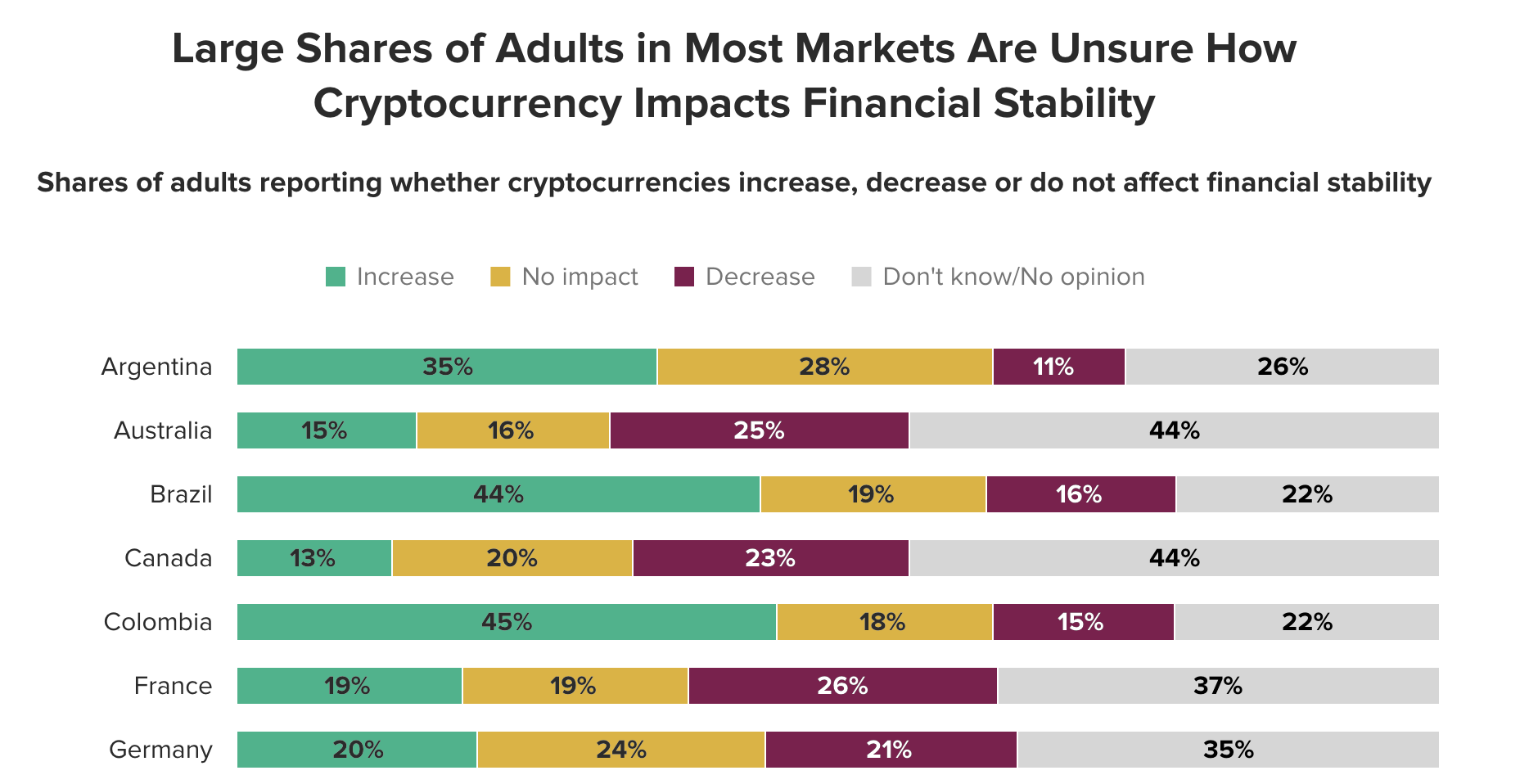

However, a significant share of poll respondents from both developed and emerging markets agree that private cryptocurrencies, such as Bitcoin and Ethereum, would pose a threat to financial stability.

In Australia, only 15% of respondents are convinced that cryptocurrencies would be able to increase financial stability. At the same time, nearly half of respondents in India view cryptocurrencies positively.

Notably, most of the respondents who think that private cryptocurrencies pose a threat to financial stability also oppose the issuance of CBDCs. Only a third of the survey participants in that category would want central banks to issue their own digital money. Conversely, people who view private cryptocurrencies positively also support the adoption of CBDCs even though Bitcoin proponents tend to be at loggerheads with central bankers.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin