Larix, a multi-purpose decentralized finance (DeFi) ecosystem, is going to democratize the peer-to-peer lending segment on red-hot smart contracts platform Solana (SOL).

Building top-notch DeFi on Solana: What is Larix?

Introduced in early 2021, the Larix project is among the first mainstream decentralized ecosystems to leverage unmatched security and 50,000 TPS of Solana (SOL) blockchain.

In August 2021, its codebase and smart contracts architecture successfully passed a third-party security audit by one of the most reputable vendors in the segment, SlowMist.

At its core, Larix harnesses a dynamic interest rate model to create more resource-efficient risk management pools. Larix maximized the range of assets accepted as collateral: its client can collateralize digital coins, stablecoins, synthetic assets, NFTs, as well as assets from the “physical world” (account receivables, invoices, mortgages and so on).

Technically, Larix promotes itself as a “lending gateway” to Solana’s most crucial DeFi products, i.e., Raydium and Serum. Larix is the first Solana-centric protocol to introduce “live mining” functionality for its tokenholders.

Also, Larix pioneered the sphere of partially open-source retail decentralized finance protocols on the Solana (SOL) blockchain platform.

One token, many use cases in DeFi

Eponymous token LARIX is a pivotal element of the product’s economics and a crucial passive income tool for its enthusiasts.

How to maximize the rewards of LARIX:

— Larix (@ProjectLarix) September 29, 2021

1. LP in Raydium: https://t.co/WgF3liJT2F

Staking LP LARIX/USDC on the Farms page, APR: 350%

2. LP in Solfarm: https://t.co/7CZUkARuPB

Staking LP LARIX/USDC on the Vaults page, APY: 2000% pic.twitter.com/21jeHly46g

Currently, the most profitable options to use LARIX in “yield farming” include locking it into Raydium and Solfarm liquidity pools.

On Raydium, the best APY rates are offered in LARIX/USDC pairs in the “Farms” segment while, in Solfarm, the best rates (up to an unbelievable 2,000% APY) are available in LARIX/USDC pairs in the “Vaults” segment.

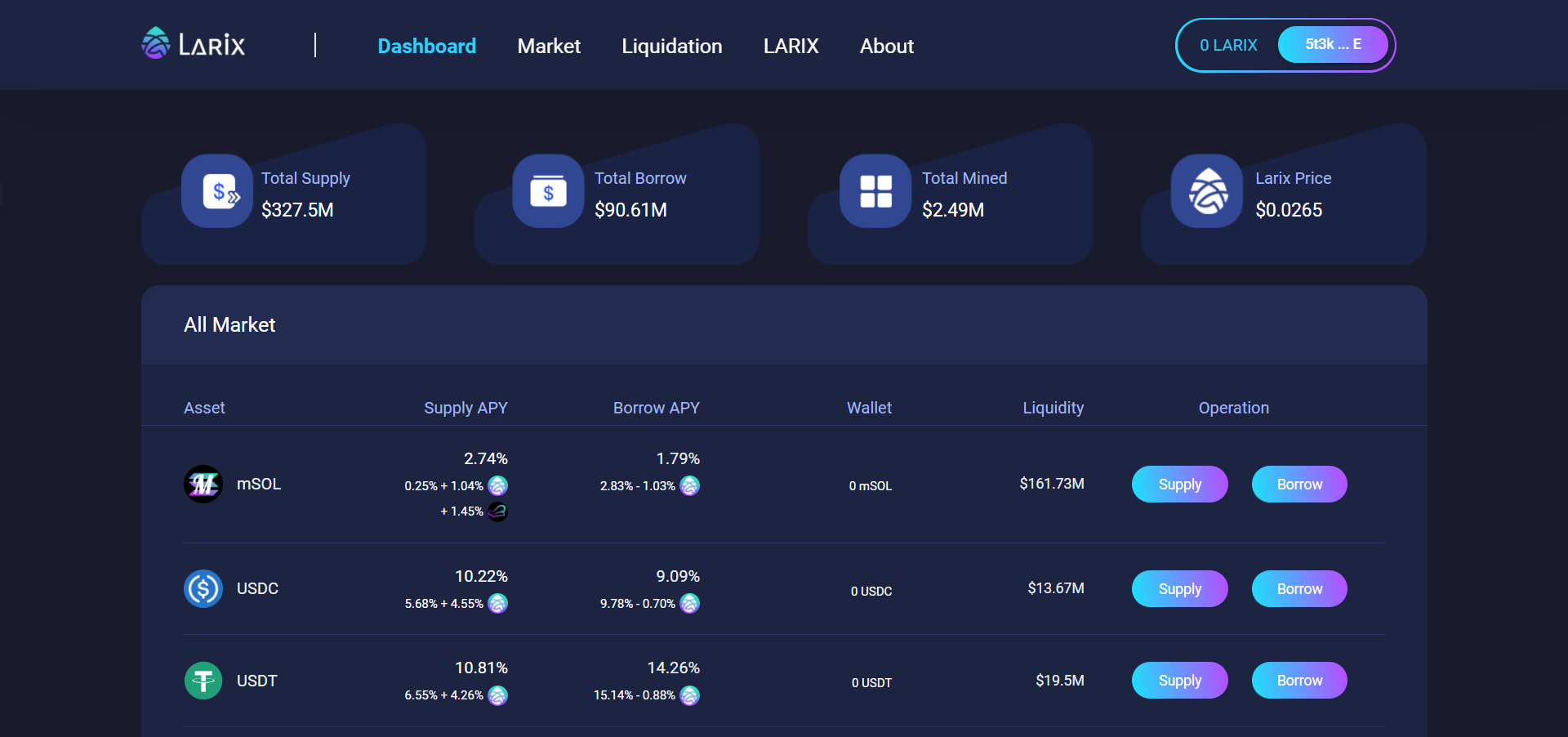

Attempting to provide all its users with unmatched DeFi experience, Larix created an easy-to-use interface that displays all crucial metrics for traders and investors. ‘Dashboard’ section shows the performance and status of assets in the user's portfolio in real time.

‘Market’ module demonstrates the overall statistics of Larix’s markets on various products. ‘Liquidation’ module displays the history of liquidations that took place on the platform: value of assets to seize, debt ratio, and so on.

‘LARIX’ module shows the information about distributions, circulation and market capitalization of core native assets of the ecosystem.

Project Larix addresses building an ecosystem crucial for the entire Web3.0 scene. With its instant liquidity and ability to collateralize real-world assets, it is going to evolve into a viable alternative to ‘centralized’ banking instruments.

Also, Project Larix explores the opportunities at the intersection of the hottest crypto segments, i.e. NFT and DeFi.

Arman Shirinyan

Arman Shirinyan Tomiwabold Olajide

Tomiwabold Olajide Alex Dovbnya

Alex Dovbnya