Nothing worth having in life ever comes easy, but that doesn’t mean it has to be hard. Take tax for example. If you’re a cryptocurrency user, your taxes are destined to be more complex than those of the average man or woman, but they needn’t be fiendishly difficult. In fact, with a little planning and the right tools, you can breeze through tax deadline day in the knowledge that you’ve dotted all the I’s, crosses the T’s and accurately allocated everything that’s due to Caesar. Whether you’re a statist or a libertarian, the peace of mind that comes from knowing your taxes are done and dusted in good time is hard to beat.

The following guide explains how to prepare and file your cryptocurrency taxes, using a dedicated CPA financial tool developed by Blox for assistance. It’s not the only crypto-friendly software on the market for tax-filing purposes, but it’s one of the more comprehensive and user-friendly, making it ideal for this walkthrough. Despite all the well-founded grumbles about vague and conflicting tax legislation, the truth is that filing your crypto taxes can be surprisingly quick and painless. Here’s how to get the job done with the minimum of fuss.

Getting Started With Blox

Just as cryptocurrency doesn’t exist solely on the Bitcoin blockchain, your crypto assets don’t reside in a single wallet. If you’re anything like the average multicoiner, you’ll have tokens liberally scattered all over the place; in MetaMask, in DEXs, in centralized exchanges, Electrum wallets, mobile wallets, desktop wallets, staked, locked up, and stored in interfaces both custodial and non-custodial. It’s a hot mess of assorted blockchains and storage solutions which can make the task of calculating your crypto taxes seem onerous. Breathe easy – it needn’t be.

The first step in aggregating all of you crypto data into one place is to create a Blox account. Signing up is free, and you can log in via your Google account to save time. The Pro plan, which you’ll be started on automatically, covers up to $50K of AUM and allows storage for 100 transactions. To access enhanced features such as CSV export, or to cover up to $20M AUM, you can upgrade to the Business plan for $99 per month. While you’ll probably want to do the bulk of your tax prep using the Blox web app, there are also mobile versions available for Android and iPhone which are handy for determining your current tax obligations and for checking your portfolio on the go.

Organize Your Crypto Holdings

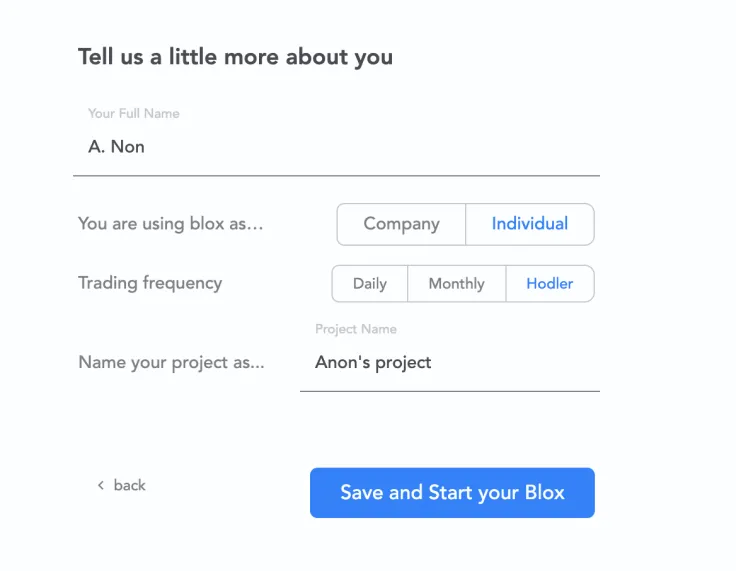

During the setup process, you can select whether you’ll be using the Blox app as a company or individual, and can also set your trading frequency, choosing between daily, monthly or ‘hodler’.

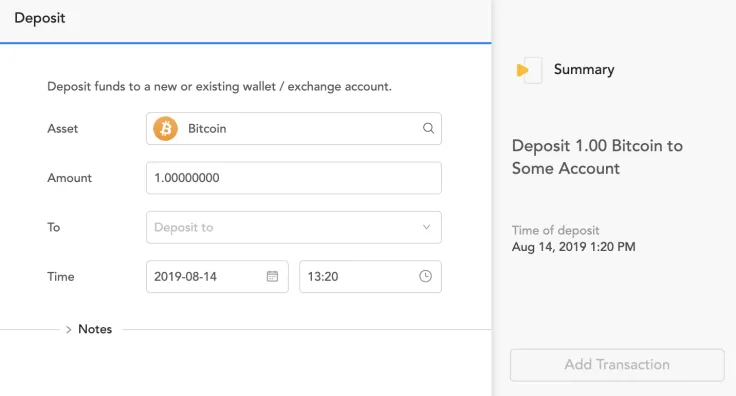

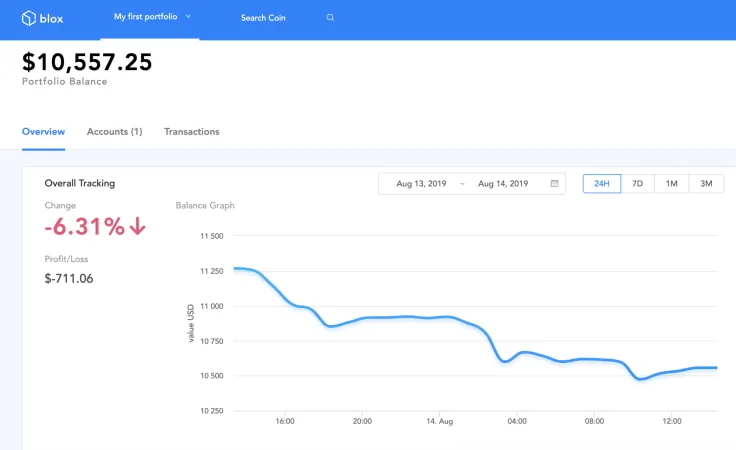

You’ll then be taken to your dashboard, where you’ll be presented with three primary options: sync wallet account, sync exchange account, or add manual transaction. In the top menu, you can create additional portfolios, and can add particular coins to your current portfolio, choosing from a list of thousands. You can also alter the default fiat currency for displaying the value of your holdings.

Blox allows you to import and label all of your wallet addresses or exchange data manually or via API. The list of exchanges and wallets supported is extensive, with new integrations periodically added. With Blox, you can also tag all of your transactions with predefined labels such as “Income” or “Sale” with a corresponding color for ease of reference. You can assign custom labels or written notes too, to ensure that you don’t miss a thing.

Prep Your Taxes

With your portfolio created and your various holdings set to auto update, via Blox’s handy sync feature, you’ll have ticked off the first obstacle to preparing your cryptocurrency taxes. Save for any new wallets you create and utilize, or trades you perform on exchanges that aren’t supported by API, your portfolio should manage itself from hereon in. The next step is to prepare and submit your taxes. To do so, you’ll need to establish your capital gains. FIFO is the most commonly used method, though there are other options available such as LIFO. As Blox notes in a handy guide it’s assembled on self-reporting cryptocurrency taxes, “Generally in crypto, the oldest tokens held have appreciated the most, selling the “first in” tokens could create a significant tax bill.”

An important point to note is that if you’re an entrepreneur or startup with major expenses, as is customary when launching a business, these costs can be offset 1:1 against your crypto capital gains. Naturally, the amount you’re due in capital gains from cryptocurrency will depend on where you’re based, with some territories levying higher rates than others.

Submit Your Tax and Relax

If you’d prefer to entrust tax calculation and submission to a CPA that specializes in crypto, go ahead: there’s an array of companies willing to do the honors. Blox enables you to export your crypto data as a CSV (provided you’ve upgraded to the Business plan), or if your CPA also uses Blox, they can import the data directly into their bookkeeping software. Having reached this stage, however, and organized all of your crypto activities, you may decide it’s cheaper and easier to complete the process yourself.

Obtain the requisite tax reporting documentation from your national tax agency, which can typically be downloaded online, and fill in the various forms. With all of your crypto holdings and capital gains obligations clearly recorded and labeled in Blox, determining your crypto tax bill is fairly straightforward. If in doubt, have a qualified CPA double check your calculations the first time around and, provided you’re on the right track, you’ll have the confidence to go it alone the following year.

While it would be stretching the truth to state that calculating your crypto taxes can be pleasurable, it’s no exaggeration to say that it isn’t a chore – not even close. With the right software, and a little preparedness, you can save time and money on taxation, minimizing your obligations and reducing the stress that comes from fretting over whether you’ve overlooked anything. With your portfolio balanced and your tax taken care of, you can sit back and relax. Better still, you can focus on building your business, with no distractions to prevent you from reaching your goals.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov U.Today Editorial Team

U.Today Editorial Team