The cryptocurrency ecosystem has evolved in a lot of ways, providing more ways than one for anyone to earn a side income. While this is naturally not the fundamental focus of digital currencies, their unique nature has resulted in the advent of many new opportunities to benefit consumers.

One of the ways to maximize crypto is the emergence of decentralized finance (DeFi), with the accompanying offering tagged “Yield Farming.” Though new even to the cryptocurrency ecosystem, yield farming has proven to be an innovative avenue to bring value to crypto holders or users in general. As the term may appear quite new to many people, let us take time to break down and explain the concept.

Yield farming (or liquidity farming) is the act of locking your digital currency assets to power a wide range of activities on a smart contract-controlled protocol. These activities are usually fee-generating and include but not limited to liquidity provisions, and lending.

The workings of yield farming may be complicated per the outlook, and often reserved for a few tech-savvy crypto individuals at the early stages. This is generally no longer the case, however, the rate of evolution and advancement in DeFi has continually presented the concept of yield farming as an enigma on most platforms that offer the services.

In yield farming, anyone who supplies liquidity to the protocol is often rewarded in the form of new crypto or token. The liquidity supplied is usually in the form of fiat pegged stablecoin which may range from USDT, BUSD, and DAI amongst others. The rewards are paid out either as Annual Percentage Return (APR) or Annual Percentage Yield (APY). While both terms are used interchangeably, it should be noted that the latter takes into consideration the effect of compounding while the former does not.

Grasping the nitty-gritty of Yield farming is usually arduous and so is trying to explain to a newcomer. Though many articles exist about the new product niche in DeFi, users often muse that reality is so different from literature. Oftentimes, I have tried to school some of my friends and family on how to get around yield farming. While some get around it eventually after many sessions, it is usually not without getting stuck in one of the various processes involved.

Various platforms offer yield farming products today, each with a unique tilt to the generally accepted norm and APYs. The diversity brought in has stirred enough competition to give users enough choice to pitch tents with.

Joining the Game with a Difference: Nominex in the Yield Farming Scene

Just as noted earlier, there are different outfits with a lot of varied offerings for yield farming and Nominex is one of the emerging ones with a unique model. Nominex is a cryptocurrency exchange that combines the features of a centralized trading platform, with decentralized finance functionalities.

The first exchange with a utility token and utility farming. This utility farming feature allows trading with a 100% discount. In general, you get the maximum income from a vibrant affiliate program. After the launch of the Binance brokerage program, users can trade on Binance for free and at the same time constantly farm NMX, the exchange’s native token.

With Nominex, you not only get to access trading pairs or markets with enough liquidity, but you can also stake your crypto and take advantage of other unique product offerings. Nominex’s involvement in decentralized finance is preceded by a number of customer-driven incentives including but not limited to;

- Unusually High Withdrawal Limits: Users can withdraw up to 3 BTC daily even though they have not completed their KYC requirements;

- Users get to fund their accounts to purchase BTC through either Visa or MasterCard;

- Nominex users get 50% off when using the NMX tokens to pay the trading fees;

- A smooth, easy-to-use trading interface, and;

- Smart contracts audited by Unhash.io under the supervision of industry veteran Alexey Makeev, also credited for auditing the Aave protocol; (view report)

As an innovative trading outfit set out to take the competition by the horn, Nominex does not only offer these benefits to users, it devised a super simple way to diffuse the difficulty in accessing nascent DeFi products like Yield Farming. Through Nominex, the yield farming that confuses many and keeps others away can now be enjoyed with its accompanying high yields.

The Yield Farming on Nominex

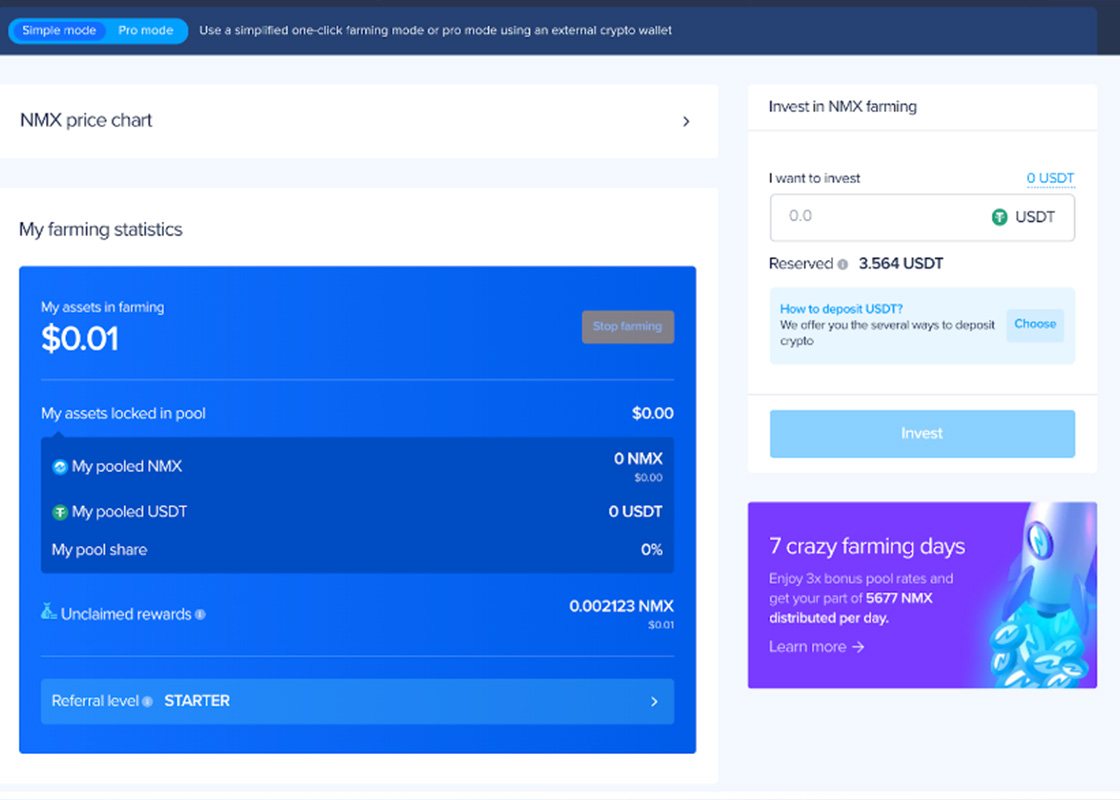

Nominex offers its yield farming products in two models, including the simple farming mode and the Pro model. Let us look at the workings of both individually.

What is Simple Farming Mode?

As a cryptocurrency believer and DeFi user, you probably remember how your immersion into the ecosystem and farming in particular began. Based on the lack of technical know-how, you likely began to do some actions only after a long time, because the first time it was pretty hard to comprehend. Nominex has finally solved this problem by introducing the Simple farming mode.

Just as the name implies, this is a new way of farming, for which you only need to have USDT in your exchange wallet. To activate it, you will only have to press one button and all the other actions will be done by the Nominex system. This type of farming was designed for new users who had no prior experience with DeFi, without taking either the yield rate from them.

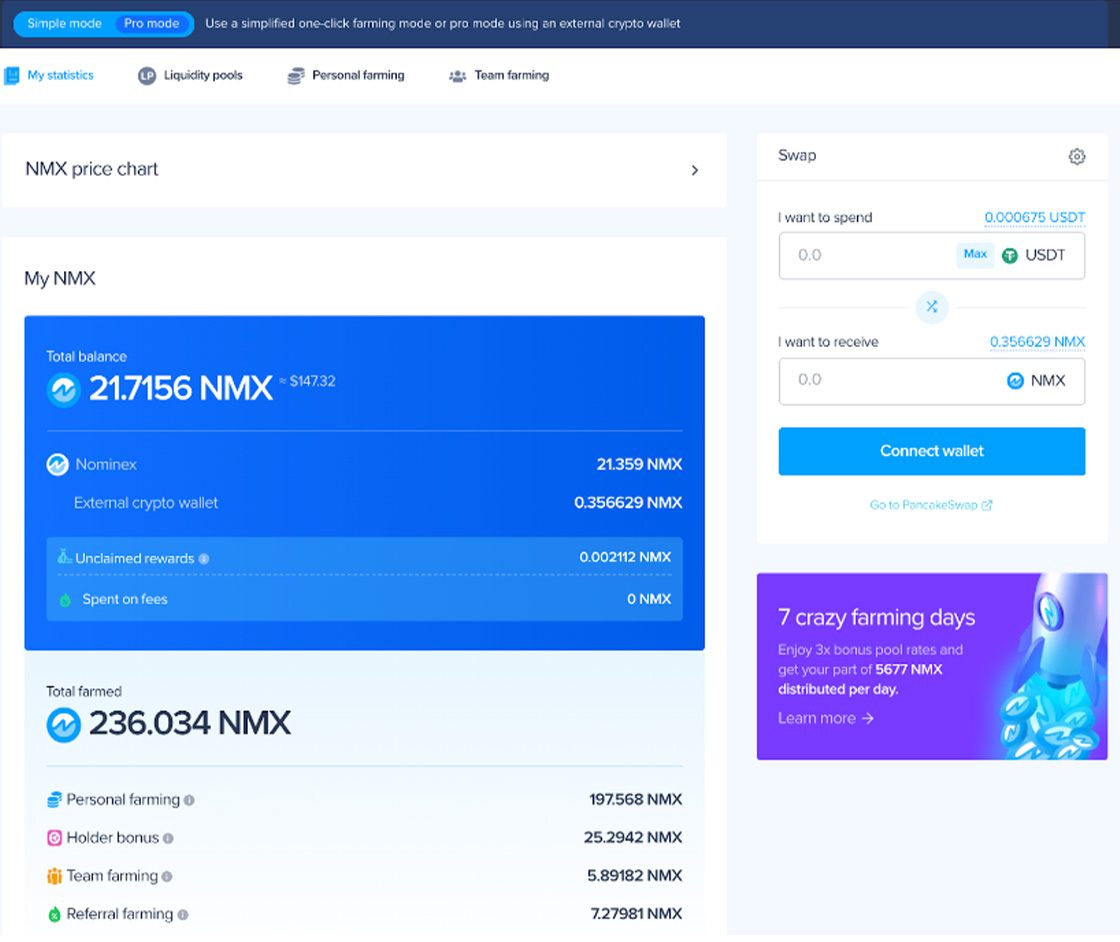

The Pro Farming Mode

This is the first farming model launched by Nominex and it follows the traditional way of DeFi in which you connect your account to Metamask or other third-party wallets. Now with two options available to Nominex users, it should be noted that choosing Pro mode over the Simple mode will not affect profitability, bonuses, and the host of other incentives attached to the platform.

While the only difference is in the technical and interface parts. You can easily switch between these two modes as needed. The interface for the Pro Mode is shown below with the link to connect to a wallet boldly indicated on the bottom right corner.

With the simplicity of the Nominex farming models combined with the high yielding reward of the platform’s affiliate program, which allows you to receive up to 40% of the tokens farmed by your referrals and the entire partner structure in general, it will be much easier for you to explain to those closest to you (friend, father, or grandfather, and those far from crypto, and DeFi), about the Nominex projects.

This way, anyone can start farming on Nominex within 10 minutes after registration.

Which of the Two Models is Better?

All of Nominex’s offerings are thought out and tested with the global customer base before being launched. The choice of either the Pro or Simple mode is entirely subjective as it depends on the choice of each user.

Nominex understands that the technical aspects of liquidity farming are particularly difficult for some, a situation that naturally keeps them away from ever commencing their farming journeys. Now it's in the past! Nominex wants to attract even more users, to make the entrance for people “not from the crypto” much simpler and easier.

For veteran crypto traders and investors, Nominex offers an APY of 373% based on a weekly reinvestment, a proven competitive rate in today’s vibrant decentralized finance ecosystem. The ease of getting started alongside the security of assets is one stronghold that makes the duo of Nominex farming options a must-try for all investors.

It should also be noted that through Nominex, users can opt for Personal Farming in which they make their assets work for them, and they can also decide to do Team Farming in which they can earn the associated rewards with family and friends.

Beyond Farming: Nominex Serves all

One of the definitive advantages of DeFi is the flexibility and the diversity in products and services that users can choose from. Beyond its Farming offerings, Nominex has a number of other products and use cases bordering around its NMX token that are easily accessible to all users.

If not farming, users can take advantage of the staking program to also earn competitive returns. Additionally, partaking in the referral program, campaigns, and tournaments all designed to reward the growing Nominex community.

Conclusion

Cryptocurrencies have come to stay, and this reality has continued to stir the birth of new projects, products, and services to benefit all believers. The ultimate aim of this growing asset class is to primarily change the structure of traditional finance and open a more secure, trustless, and highly beneficial ecosystem that users can have better control over the legacy banks.

While a series of products including yield farming remains one of the key ways DeFi is choosing to reward users, Nominex has taken the opportunity to a new level by offering a very simplified model that offers equally great rewards.

Nominex’s Simple farming and all of its yield farming options are designed with the average or newest users in mind. Beyond the desire to get you to derive more value from DeFi, it is seeking to power a more mainstream adoption of crypto by removing all visible, long-standing bottlenecks.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov U.Today Editorial Team

U.Today Editorial Team