According to Tom Lee, the CEO of Fundstrat, the recent Bitcoin (BTC) price spike made the Bitcoin Investment Trust (GBTC) premium rise to 36 percent. It means that more institutional net buyers are interested in Bitcoin, and it’s yet another reason why 2019 is shaping up to be ‘way better’ for cryptocurrencies than the painful 2018.

CRYPTO: $GBTC premium to NAV creeping up to 36% on heels of $BTC surge to ~$4,000

— Thomas Lee (@fundstrat) February 19, 2019

Rise in premium is a sign of institutional net buying (easier to buy this ETN from @GrayscaleInvest than buy via a crypto exchange)...

...another sign 2019 way better than 2018 for crypto pic.twitter.com/hdFh8y3sY9

The correlation between BTC and GBTC

GBTC, which is offered by Grayscale Investment, appeared the OTC market back in 2015 as the first publicly traded Bitcoin instrument. It gave investors an opportunity to trade Bitcoin on the stock market. Historically, GBTC served as a contrarian indicator for Bitcoin — GBTC inching closer to losing its premium could usually mean that there was another bull run in the offing.

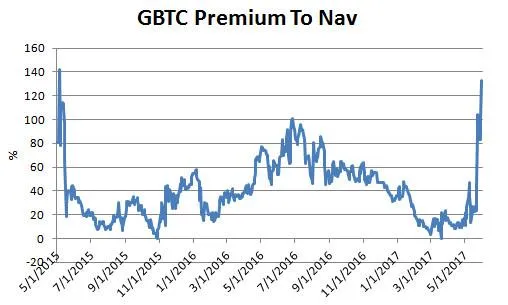

On top of that, the GBTC premium has a very mercurial nature as the graph below shows (it would go from zero to 142 percent).

Is Lee getting it right this time?

In 2019, Lee’s year-end prediction for Bitcoin was $25,000, but the bull run never happened. Eventually, the Bitcoin uberbull quit making predictions, but it seems like he’s at it again. This time, however, Bitcoin has a much better chance given that a slew of institutional investors are finally taking baby steps towards embracing crypto.