Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

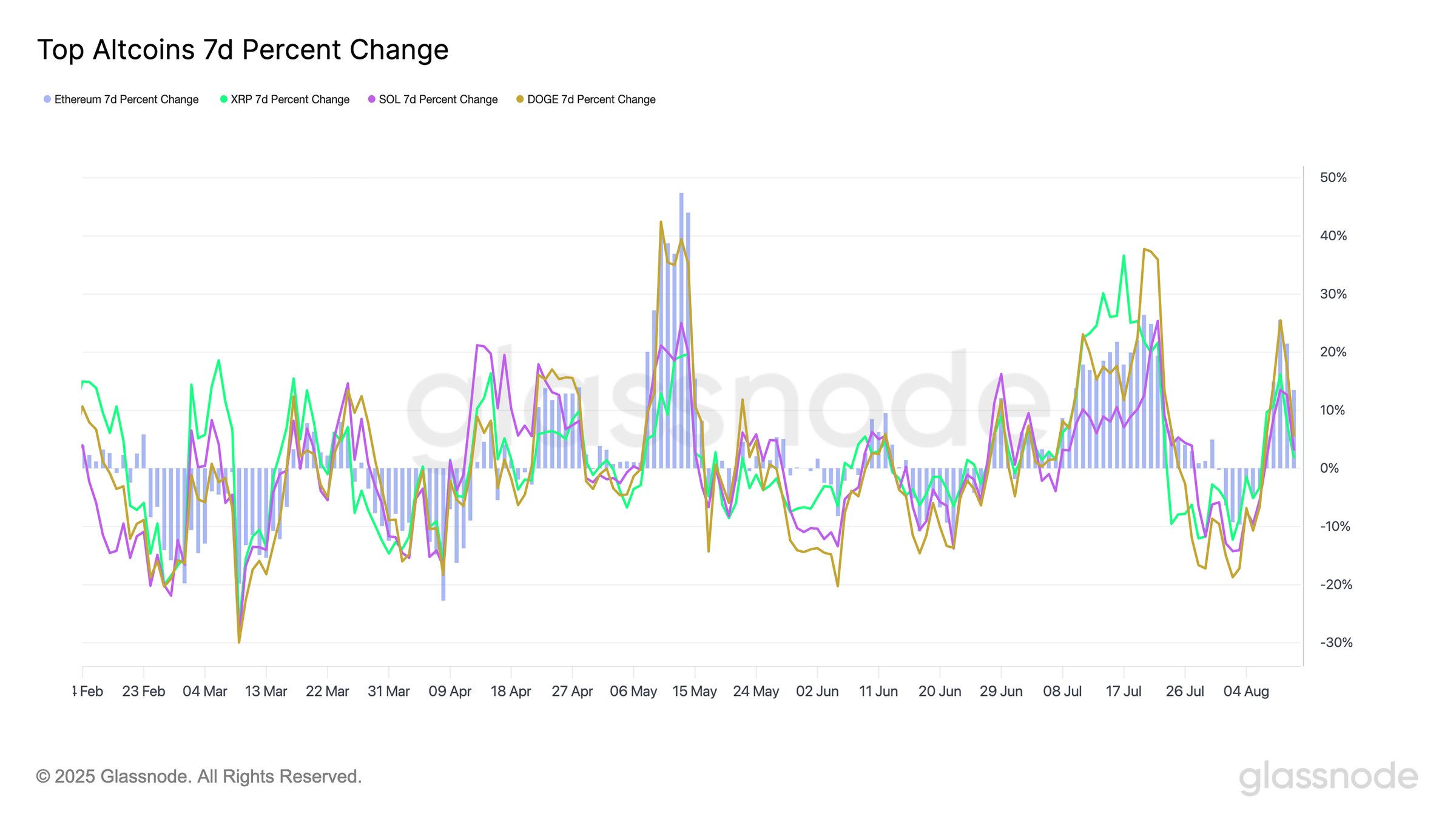

This week, popular cryptocurrencies Dogecoin (DOGE) and XRP emerged as leading large-cap altcoins, catching capital that moved out of Bitcoin into assets considered higher-risk than BTC itself. According to Glassnode data, both DOGE and Ethereum posted gains of 25.5% over the past seven days, while XRP advanced 16.2% and Solana added 13.6%.

This indicates a market environment in which participants are seeking exposure beyond the dominant pair of BTC and ETH. They are distributing flows into coins with higher beta and the potential for rapid short-term price appreciation.

Historically, DOGE responds quickly to periods of expanding liquidity. The price of the meme coin accelerates due to retail engagement and speculative positioning. Dogecoin is prone to abrupt, outsized moves when sentiment tilts toward risk.

Remember 2021?

XRP's performance is less volatile on a daily basis but more consistent over an extended period. Currently the third-biggest cryptocurrency, XRP, has risen 54.53% since April, compared with DOGE’s 44.65% gain. This is a great mirror of an accumulation trend tied to its payments-focused narrative and Ripple's successful business and political connections.

Altcoin summer

Many market participants were pessimistic in August, but the early summer set the stage for these moves. June saw compressed volatility and narrow trading ranges across the altcoin sector — conditions that often precede directional breakouts. July’s expansion in price action created the momentum for August’s increase.

Both assets are currently trading near the upper boundaries of their multi-month ranges. There is no doubt that the probability exists for either a consolidation phase to absorb recent gains or an upside extension if market breadth and risk appetite remain in play.

A sustained rotation into altcoins would support a so-called "altcoin season." But be careful — a reversal in sentiment could trigger a reallocation toward Bitcoin and stable assets.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov