According to a recent report published by Boston Herald, the Federal Reserve Bank of Boston has joined forces with the Massachusetts Institute of Technology (MIT) to explore the possibility of issuing its own cryptocurrency.

One of the first steps will be developing the software that would be capable of addressing the needs of America’s 328.2 mln population.

Combining Bitcoin and fiat

The Boston Fed’s senior vice president Jim Cunha says that they have a forward-looking approach to working on its own digital currency:

“We’re not building this for tomorrow, we’re building this for future years.”

Last January, MIT researchers developed their own cryptocurrency that is focused called Vault that aimed to solve the scaling problem that continues to throttle the progress within the cryptocurrency space.

Together with the Fed’s assistant vice president Robert Bench and the MIT’s blockchain engineers, Cunha will work to explore the ins-and-outs of the bleeding-edge technology:

“We’re really trying to understand what the technology can offer and if it’s a path we’d like to go down”

Advertisement

The central bankers find Bitcoin’s security very compelling, which is why they want to combine its properties with dollars and cents.

As reported by U.Today, the New York Federal Reserve actually categorized Bitcoin as fiat money back in June, drawing scathing criticism from the cryptocurrency community.

The stakes are "way too high"

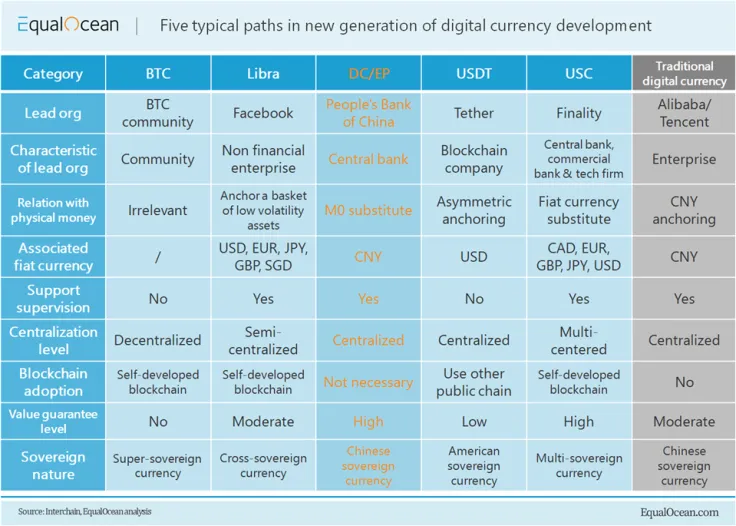

The U.S., despite being at the forefront of the internet boom, is lagging behind China (big time) when it comes to digitalization as the latter is already close to rolling out its DCEP digital currency.

Bench claims that the stakes are way too high when it comes to the U.S. dollar, the global reserve currency. He notes that the process of adopting new technologies has to be fast but deliberate.

Last week, Lael Brainard, governor of the U.S. Federal Reserve, revealed that they’d been experimenting with a digital dollar for the past several years.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin