Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

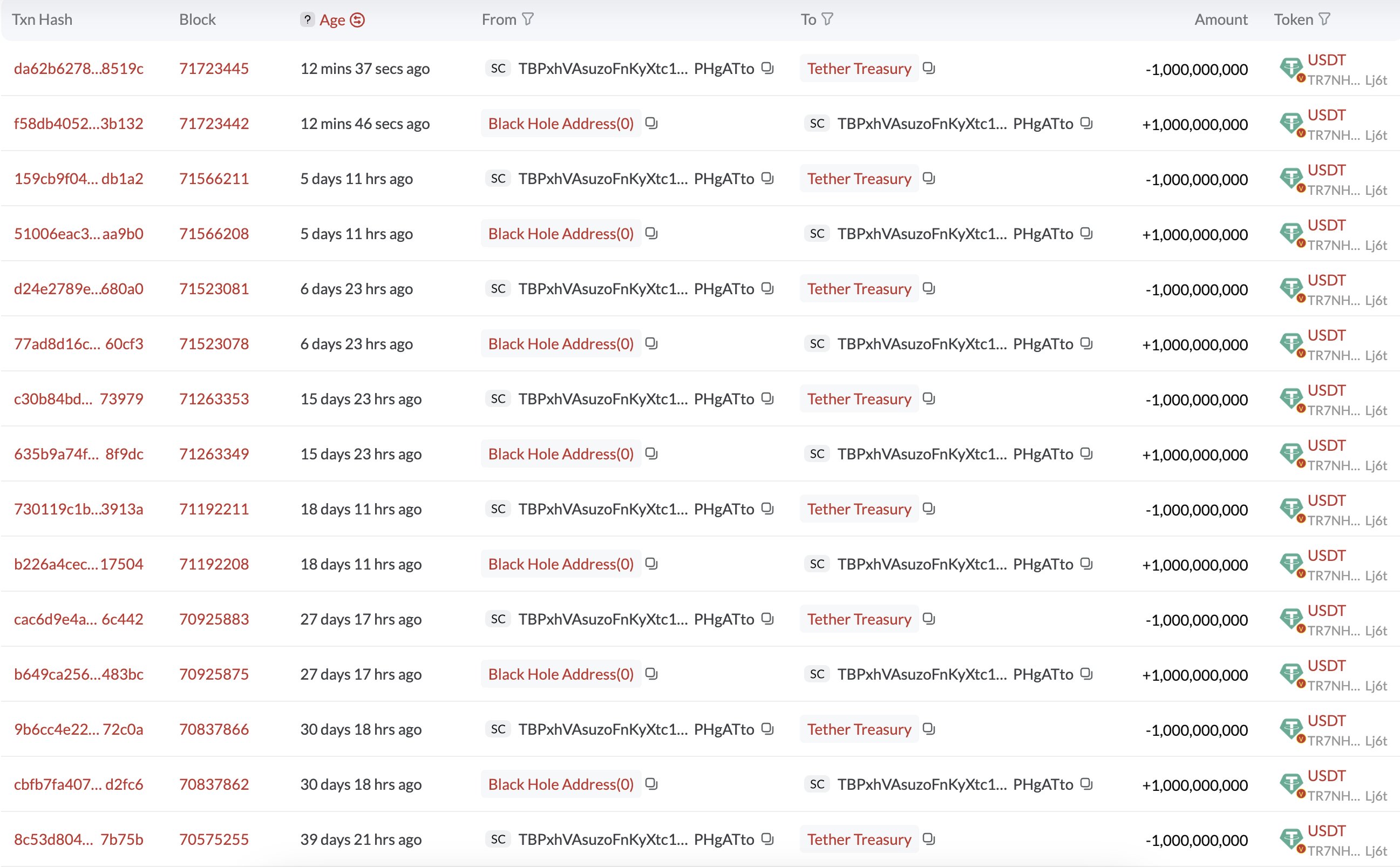

On the TRON network, Tether has made an additional $1 billion USDT in the past day. This is not an isolated incident; rather, it is a component of a larger trend. Tether has printed an incredible $12 billion USDT on TRON alone since Jan. 29 2025. The entire USDT supply on TRON has now exploded to $71.7 billion with this most recent batch.

This is not just trivia for those who are paying attention. In the past, significant Bitcoin rallies have frequently been preceded by extensive Tether minting. Simple liquidity mechanics are at play here; magic is not. It functions as dry powder for exchanges ready to be implemented into Bitcoin and other cryptocurrencies when fresh USDT floods the system.

More purchasing power results from a fresh stablecoin supply. More purchasing power also tends to drive up asset prices, particularly in a liquidity-starved environment. You have already seen it unfold. Bitcoin has recently surpassed significant resistance levels and is now trading close to $95,000 on Bitstamp.

The daily chart displays a clear breakout above the 50, 100 and 200-day moving averages. This type of technical move is not random. Momentum indicators like the RSI are heating up, volume is soaring and the whole cryptocurrency industry seems to be emerging from a coma.

The link is clear: Bitcoin flies, USDT mints and liquidity injects. Skeptics will undoubtedly highlight the dangers. All of this is a house of cards if Tether's support is not as strong as they contend. That being said, flows determine short-term market behavior, and the current flow is clearly bullish, regardless of whether you believe Tether to be legit or a ticking time bomb.

Tether appears to have set the stage for a new phase in this bull run, printing $1 billion in a single day and $12 billion in just three months. It remains to be seen if this will eventually lead to a disastrous unwinding or to new all-time highs.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov