Peter Schiff, the CEO of Euro Pacific Capital, is on the same page with the New York Federal Reserve when it comes to categorizing Bitcoin as fiat, according to his new tweet.

Schiff, who’s a relentless critic of Fed’s policies, also believes that the flagship cryptocurrency doesn’t actually bring anything new to the table.

He is certain that investors will flock back to gold once confidence in both government-backed and ‘crypto fiat’ is eradicated.

As innovative as CryptoKitties

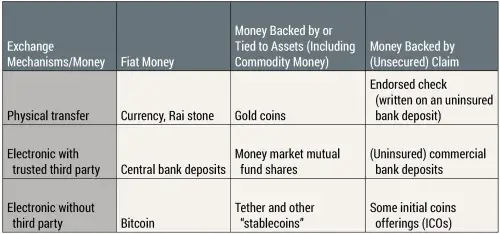

In a blog post jointly written by economists by New York Federal Reserve’s economists Michael Lee and Antoine Martin, they argue that Bitcoin doesn’t represent a new asset class.

Instead, the two believe that the cryptocurrency is yet another form of fiat money, which flies in the face of its ardent proponents.

Going by the definition offered by the Fed, Bitcoin is tantamount to ancient Rai stones since both of these assets are ‘intrinsically worthless objects.’

Bitcoin’s only innovation consists in its transfer mechanism, but it also applies to stablecoins and even CryptoKitties.

An energy-backed asset

While even Donald Trump believes that Bitcoin is backed by nothing by thin air, its proponents argue that it represents the first energy-backed cryptocurrency behind the most powerful computing network in the world.

As reported by U.Today, PlanB explained that ‘billions and billions’ were being invested in mining equipment and facilities.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin