Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

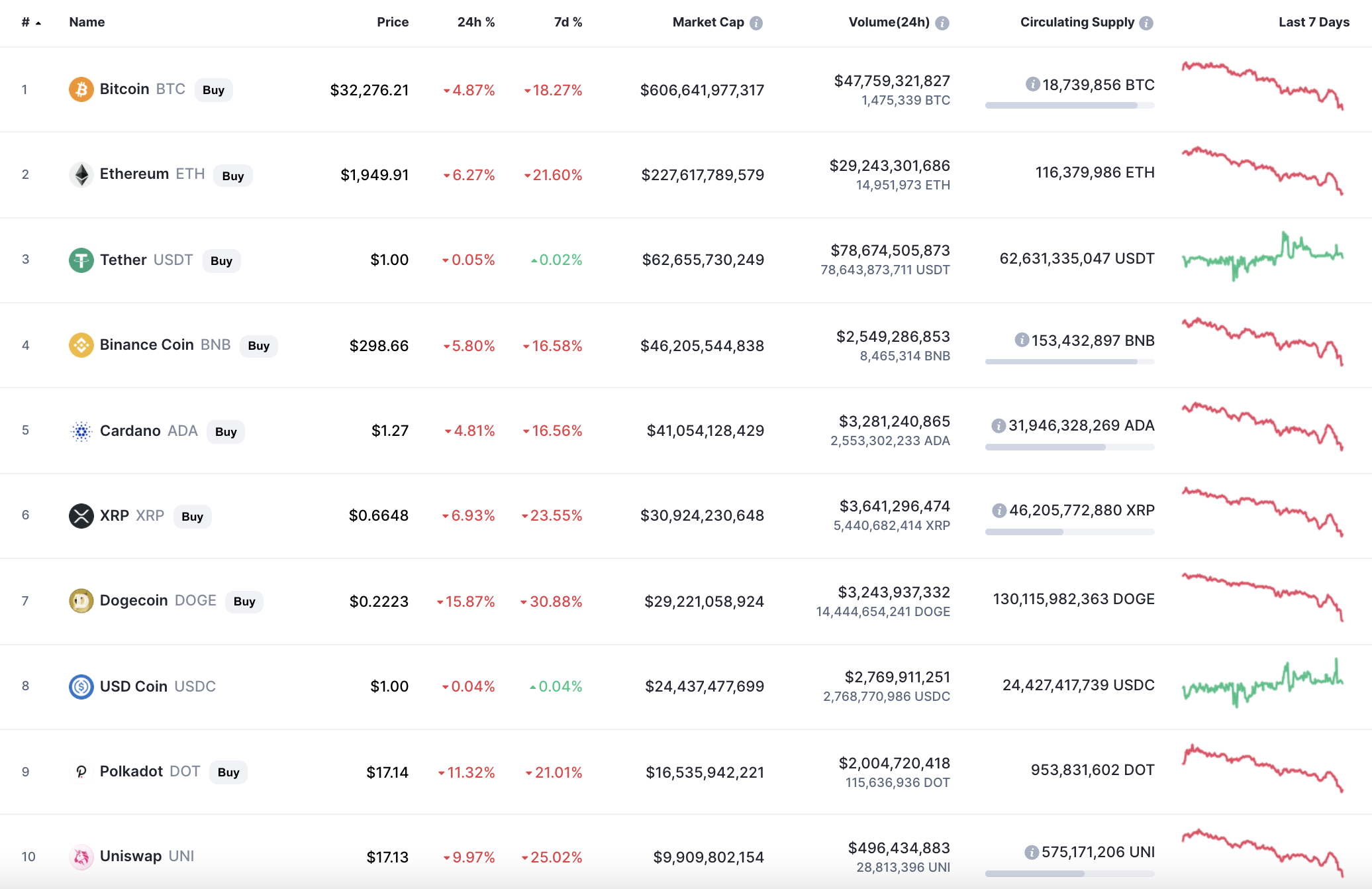

The new week has started with the continued fall of the cryptocurrency market as all top 10 coins are in the red zone.

ETH/USD

The rate of Ethereum (ETH) has declined by 7% since yesterday while the price change over the last week has accounted for -23.54%.

On the 4H chart, Ethereum (ETH) broke the support at $2,040 having confirmed the bearish influence. Despite the decline, the ongoing fall may continue supported by the high selling trading volume.

In this case, there is a high chance to see the price decrease to the next level at $1,730.

On the bigger chart, the mid-term scenario is also more bearish than bullish as Ethereum (ETH) has already fixed below the vital level at $2,000. Respectively, sellers might get the rate of the chief altcoin to $1,520 within the next days.

On the weekly time frame, the fall seems like it's not going to stop. That is why, Ethereum (ETH) can get to the level at $1,000 if bears can break the zone around $1,500.

Ethereum is trading at $1,956 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov