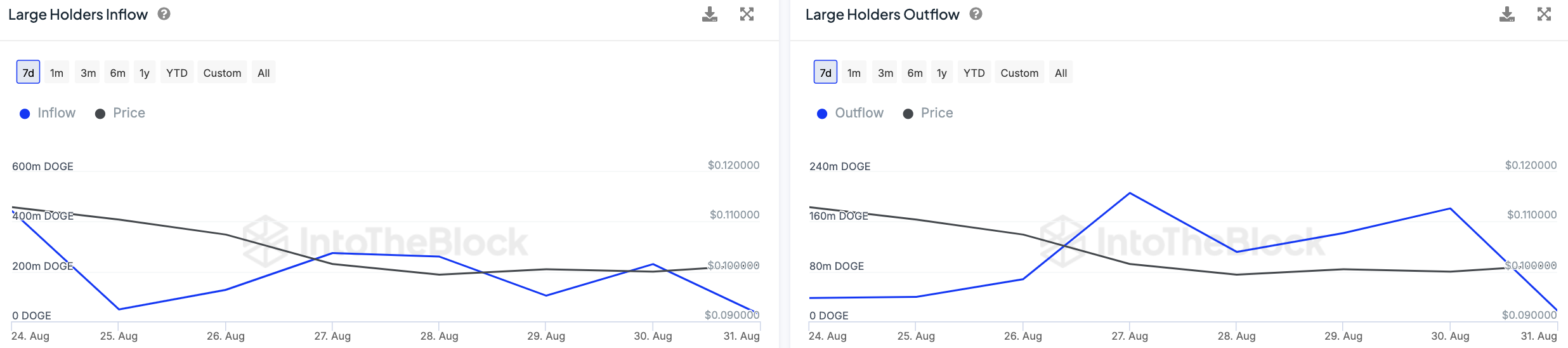

Disturbing developments have been observed behind the scenes of the popular meme cryptocurrency Dogecoin (DOGE). According to IntoTheBlock's metrics tracking inflows and outflows to the wallets of large investors, i.e., those holding at least 0.1% of the circulating supply of DOGE, whales have significantly reduced their on-chain activity since the beginning of September.

In particular, the inflows have decreased from 229.49 million to 27.96 million DOGE per day, a decrease of 87.81%. As for outflows, the statistics are as follows — outflows from the wallets of major investors fell to 17.42 million DOGE from 181.29 million tokens, that is, by 80.7%.

As a result, the net flow of Dogecoin into whale wallets is 10.54 million DOGE, four times less than the day before.

Interestingly, whale activity in Dogecoin declined just before September. As many may know, September is often a challenging month for cryptocurrencies due to a mix of seasonal and market factors.

DOGE's September

Historically, this month sees weaker performance across financial assets as investors return from summer vacations and reassess their portfolios, often leading to profit taking and selling pressure.

On the other hand, September has historically been a positive month for DOGE, and for example, the average profitability of the meme cryptocurrency over its history is 11.3%. For Bitcoin, for example, this figure is set at -6.21%.

What awaits Dogecoin in the next 30 days and whether this is a decline in activity from the major players remains an open question. However, there is no doubt that if DOGE shows any major price movement, there will be major players involved.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin