Decentralized finance is one of the fastest-growing areas of blockchain, albeit very controversial and subject to hacks of all sorts. The Coingecko crypto analytics vendor conducted a survey of 694 people in March 2020 to find out which trends characterize the current landscape of this sector.

Gender gap

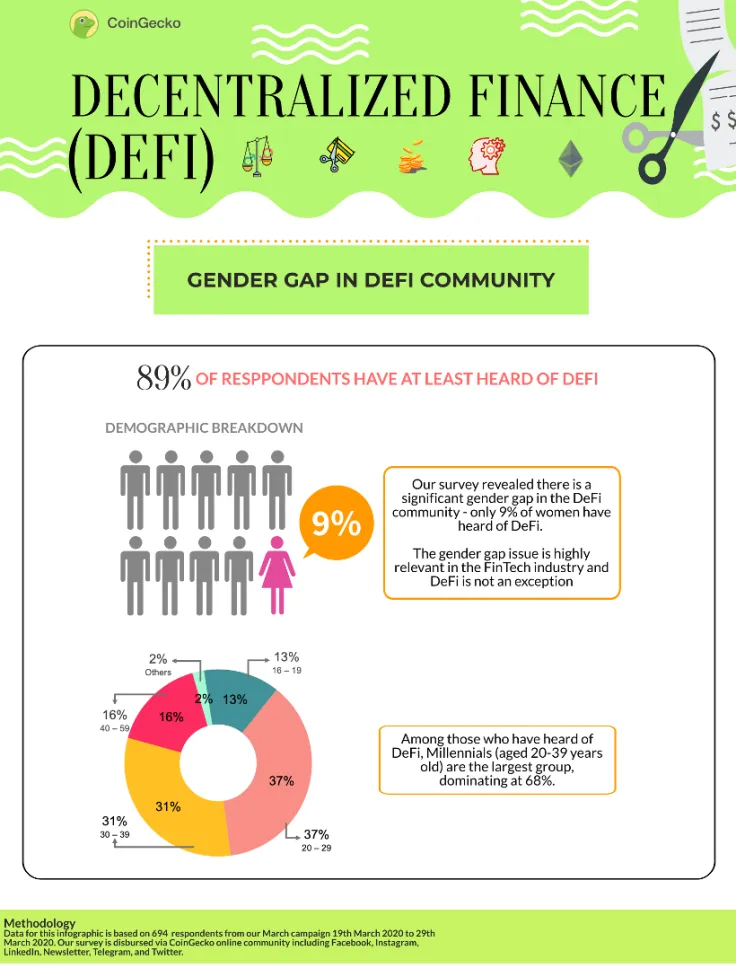

First of all, the Coingecko survey unveiled that the DeFi sector is rather male-dominated. Only 9% of women have heard about DeFi. For the male population, this number is an order of magnitude higher.

Millennials (aged 20-39) constitute the largest groups of all demographic segments with 68% awareness of DeFi. Generation Z turns out to be a potential klondike for DeFi developers as only one in 100 under 16 years of age has ever heard about decentralized financial instruments.

Stablecoins, an entry ticket to DeFi

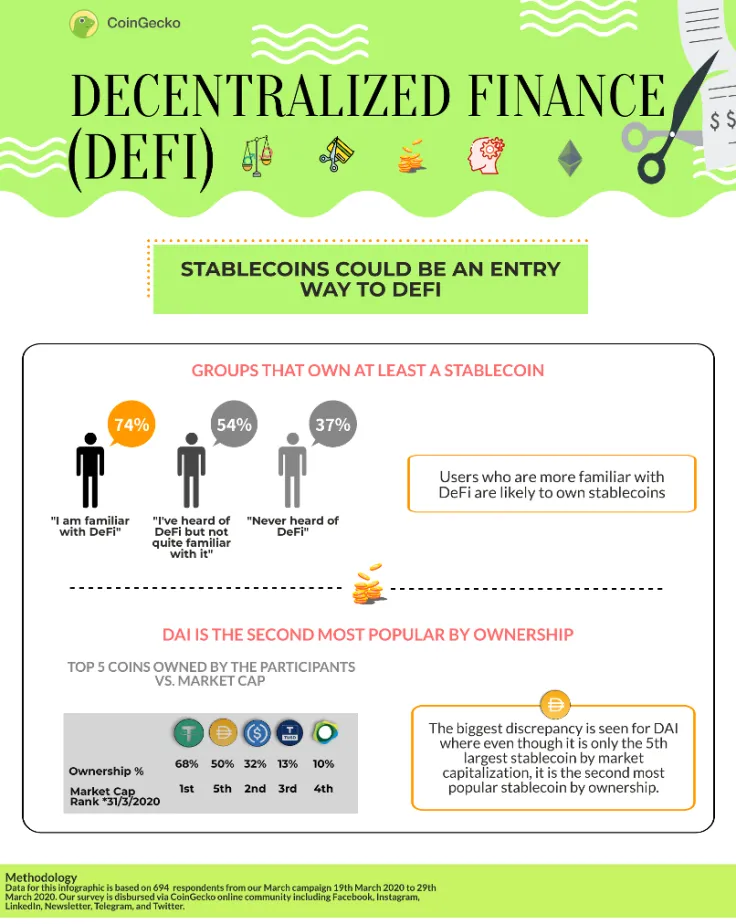

Coingecko experts found that 74% of crypto users familiar with DeFi own at least one stablecoin. Only 37% of the stablecoin holders have ever heard about DeFi. This means that they use stablecoins for trading on centralized exchanges.

USDT is the most popular stablecoin, but it is followed closely by DAI. DAI is considered a DeFi-oriented stablecoin: it surpasses the USD Coin by 18% while demonstrating the fifth largest capitalization.

High brand awareness, low usage

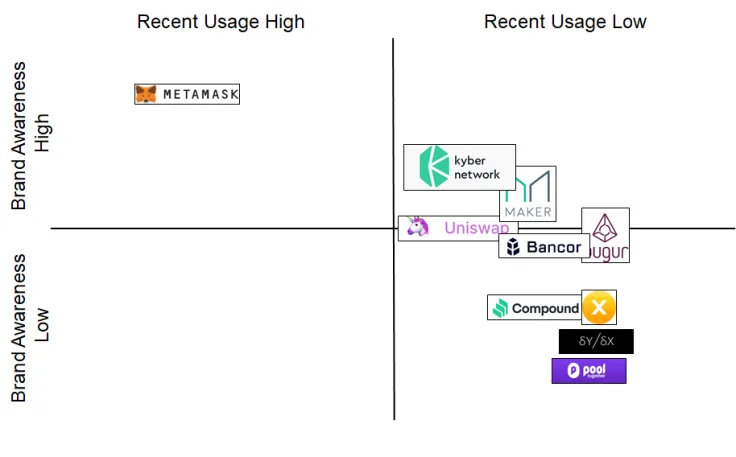

The survey also unveils that the brands that gained popularity in the 'pre-DeFi' epoch remain the most recognized. The MetaMask in-browser Ethereum (ETH) wallet is a textbook example.

Kyber Network and Uniswap reveal a similar story in terms of brand awareness but have significantly lower usage. Platforms associated only with the DeFi sphere (e.g. dy/Dx and Compound) haven't yet reached a high level of popularity.

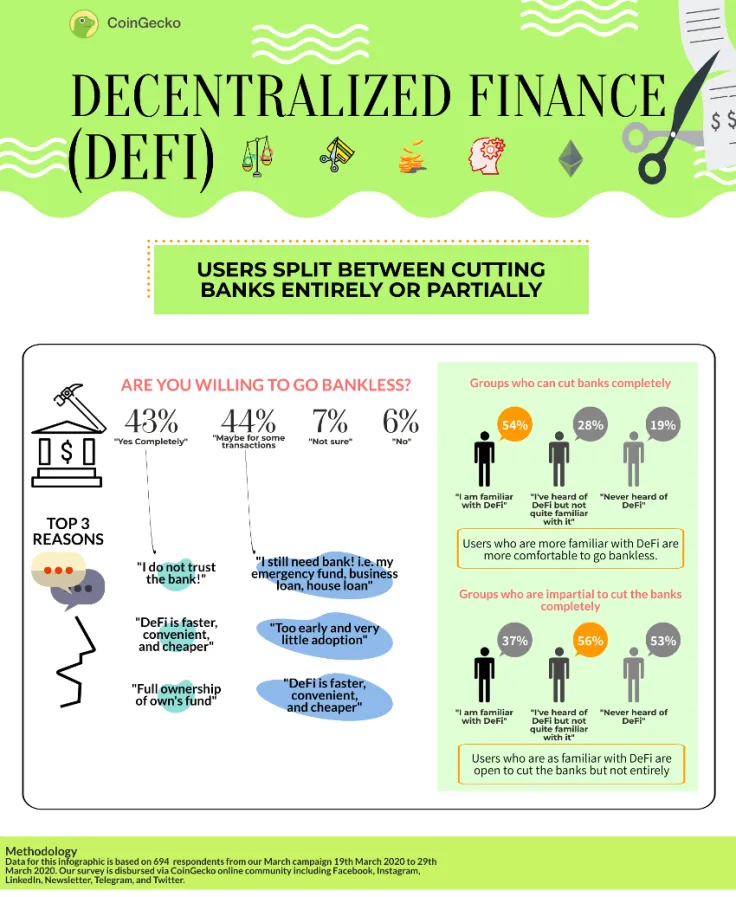

Banks on borrowed time

The most inspiring conclusion of the survey is the fact that 91% of respondents familiar with DeFi are ready to cease using banks for operations either completely or for a portion of their transactions.

A loss of trust in the banking system, as well as the high speed and low fees of DeFi, are among the top reasons for respondents' unwillingness to use classical banking services.

All in all, the survey reveals that DeFi, despite still being in its infancy, is gaining steam and is on its way to building a solid and passionate community around its top products.

Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk