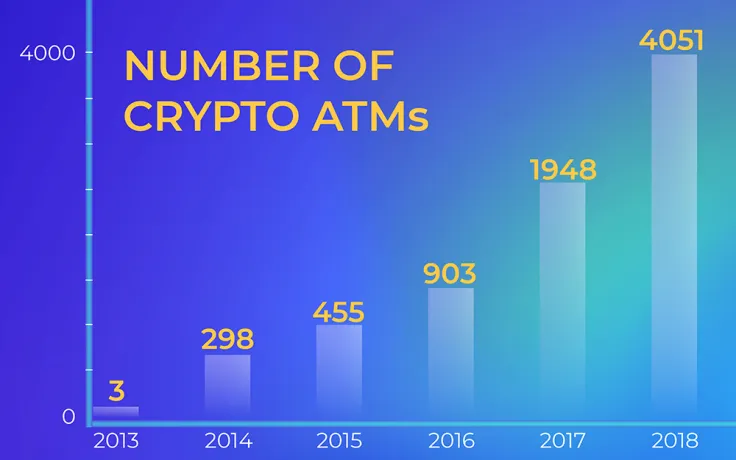

With 2018 coming to a close and famous Jingle Bells already ringing in the distance, it’s time to look at this year’s latest crypto stats. While many vitals are still being kept down by the stubborn bears of the economy, it turns out that the number of crypto ATMs has doubled this year compared to 2017.

Number of ATMs

With only 3 crypto ATMs in 2013, their number grew almost a hundredfold in 2014, taking the total to around 300, increased by a further 150% in 2015, taking the total to over 450, then doubled in 2016, taking it to over 900, increased by a further 215% last year, taking the total figure to almost 1950, and finally more than doubled again this year, giving us today’s impressive total of 4051 crypto ATMs worldwide.

Type of ATMs

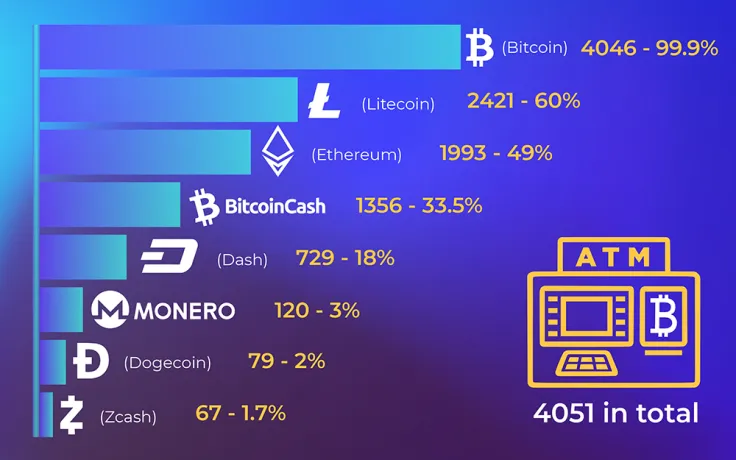

With these ATMs, the situation is as follows:

Of the 4051 crypto ATMs in total, all but five of them support Bitcoin (4046); around 60% support Litecoin (2421); almost half of them support Ethereum (1993); close to 35% support Bitcoin Cash (1356), i.e. before the fork and subsequently BCH ABC and/or SV thereafter; almost 20% support Dash (729); 3% support Monero (120); 2% support Dogecoin (79); and just under 2% support Zcash (67).

Conclusion

Bear in mind that crypto ATMs are not just ATMs in the traditional sense of the word. Crucially, they allow users not only to receive money like any other machine of the kind, but also—by its very nature—conduct fiat-to-crypto as well as crypto-to-fiat exchanges on the spot. In other words, one can momentarily trade cryptocurrencies through these ATMs by either putting local fiat in (i.e. ‘deposit cash and buy crypto’) or taking local fiat out (i.e. ‘sell crypto and withdraw cash’).

The former option is arguably more common in many third-world countries among those wishing to escape hyperinflation, while the latter is arguably more popular in first and second world countries among those looking to spend some of their savings.

Granted, not all of these ATMs are spread widely as very many are concentrated in the crypto hubs of the world, among them places like San Francisco, Amsterdam, and Buenos Aires. Be that as it may, the overall positive trend is there, and where it takes us exactly we shall see soon enough, in 2019.

Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya Tomiwabold Olajide

Tomiwabold Olajide Caroline Amosun

Caroline Amosun