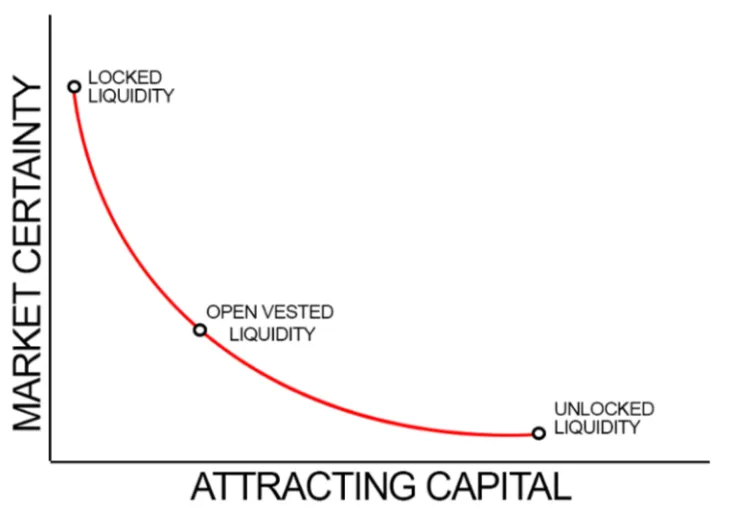

Typically, Ethereum-based trading projects suffer from liquidity uncertainty due to the "free flow" of assets to and from exchanges. When initiating a trade, the token holder cannot be sure of the amount of liquidity for this or that marketmaker. Here's how CoreDEX addresses this issue.

Bringing certainty to crypto derivatives trading

According to its official announcement shared on Medium, the CoreDEX product by Delta Financial implements the concept of Open Vested Liquidity (OVL). It prevents liquidity instruments from getting exhausted during impressive volatility spikes.

OVL implements a "block time schedule" to lock a predetermined amount of liquidity. During the vesting period, liquidity for a given asset looks more or less predictable.

Meanwhile, through integration with other liquidity control instruments, Open Vested Liquidity (OVL) makes possible all of the conditions for the free inflow of capital within a healthier market environment.

The Open Vested Liquidity (OVL) solution also enables users to unlock "frozen" assets over a pre-scheduled timeframe.

CoreDEX shares details of its migration

Also, CoreDEX migrates to a new liquidity providers' token. A newly introduced asset, CORE token, can be locked in the coreDEX Migration Contract and earn owners' fees from both coreDEX alpha and beta iterations.

Another asset, DELTA, will be used to solve the impermanent losses of traders.

To celebrate its latest milestones, CoreDEX launches an on-chain referral program. Referrals will receive an additional 10 percent bonus while the referrer will enjoy a five percent bonus in credit and five percent in Ethereum (ETH).

Finally, the introduction of a new Liquidity Rebasing Token (LRT) will limit the minting process of liquidity providers' tokens. Both assets will be governed on-chain.

Tomiwabold Olajide

Tomiwabold Olajide Caroline Amosun

Caroline Amosun