Cathie Wood’s Ark Investment asset management firm will not issue an ETH ETF, according to Bloomberg. Earlier, Ark filed documents to the SEC in partnership with 21Shares for becoming an ETH ETF issuer.

The company will continue its partnership with 21Shares regarding the Bitcoin spot ETF, launched earlier this year.

In its official statement, the company noted that it continues to believe in Ethereum’s “transformative potential and long-term value.” However, Ark will no longer pursue an Ether ETF product.

While the reason for the sudden change remains unclear, Bloomberg analyst Eric Balchunas thinks the decision was caused by the ongoing “fees war” in the market, which makes it harder for issuers to stay profitable.

Earlier, it was reported that Ark hit record $100 million outflows on Thursday.

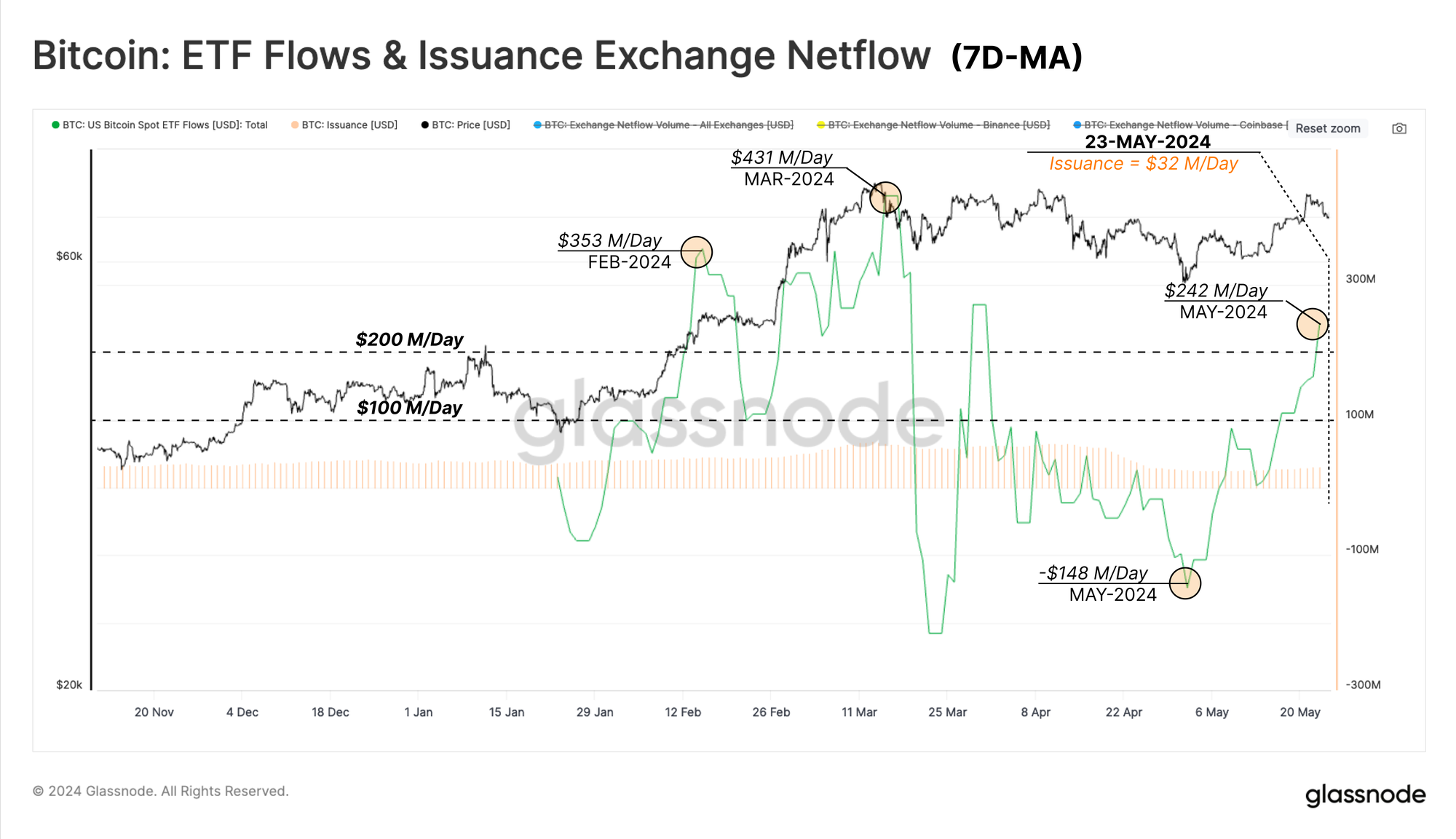

According to CNBC, Bitcoin ETFs have not gained traction among financial advisors. Concerns about market timing and regulatory compliance, along with clients' preference for stability and long-term growth, are key reasons. In fact, some dealers limit Bitcoin ETF purchases, while others prohibit advisors from selling them.

Initially, Bitcoin ETFs were seen as a way for advisors to help clients invest in cryptocurrency, but six months later, most advisors are avoiding them. Few are discussing Bitcoin ETFs with clients, and those with older, conservative clients are especially dismissive.

Despite advisors’ lack of confidence in Bitcoin ETFs, investors do not seem to lose appetite for it. On Friday, BlackRock's Bitcoin ETF saw inflows of $169 million, according to Arkham data.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin