Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

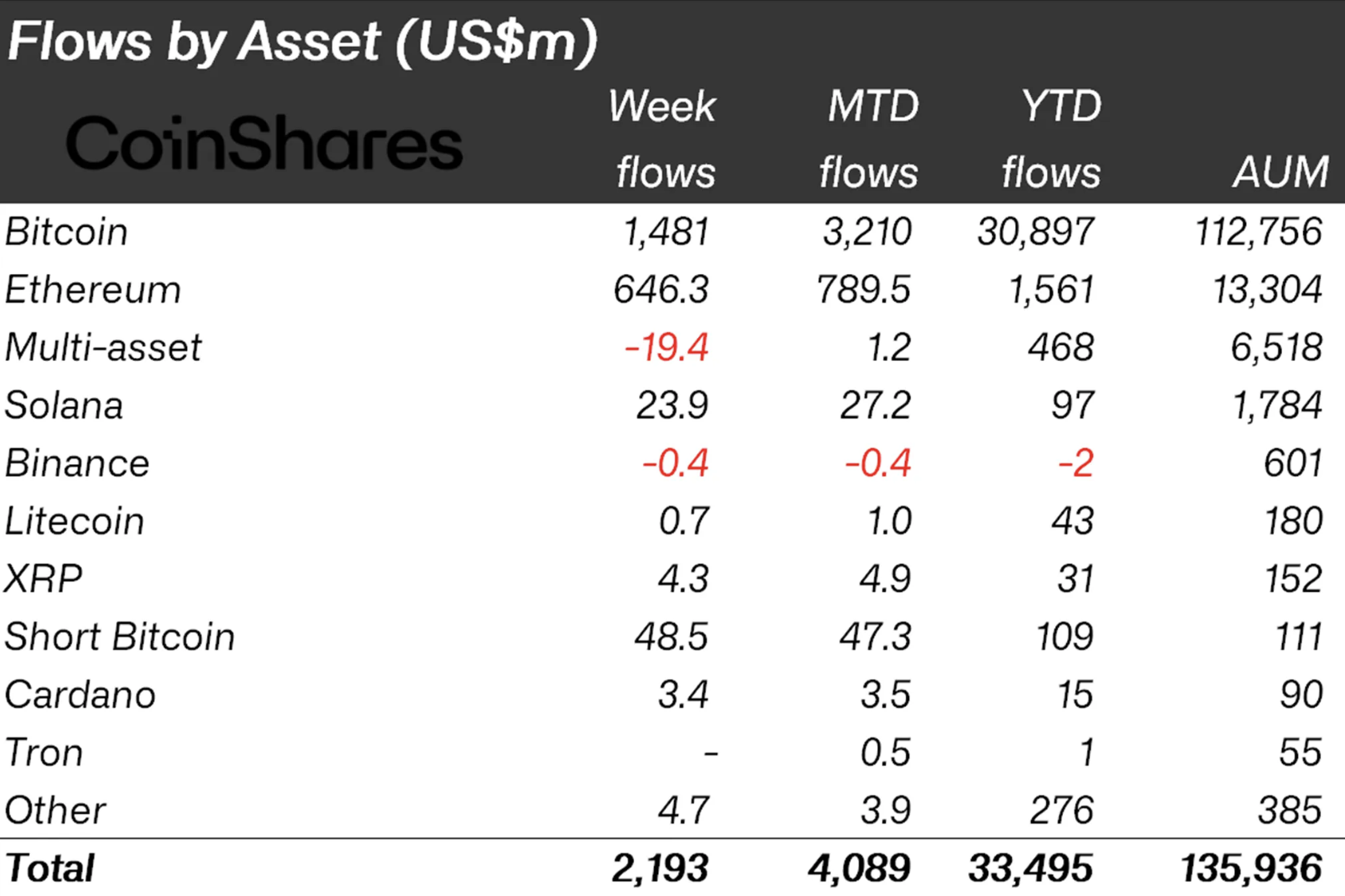

Last week, inflows into investment products tied to the popular Cardano (ADA) cryptocurrency rose more than 3,400% year-over-year, according to a weekly report from CoinShares. Thus, while, as of Nov. 8, inflows into exchange-traded products tied to the ADA token amounted to a lot of nothing, $100,000; in the following seven-day period, that figure was already $3.4 million.

As a result, Cardano ETPs for a month and a half before the end of the year demonstrate positive net inflows of $15 million. By this indicator, ADA-oriented investment products are inferior to all other alternative cryptocurrencies, except perhaps Binance Coin (BNB) and Tron (TRX).

Currently, such investment products are represented by AADA 21Shares Cardano ETP, WisdomTree Physical Cardano FI, ETC Group Physical Cardano (RDAN) and Valour Cardano SEK.

Cardano (ADA) price goes ballistic

Despite the fact that the entire market of crypto-oriented investment products has been swamped by a wave of investor money with a cumulative value of $2.193 billion, investors clearly had a special interest in Cardano.

Over the past week, the price of ADA has literally skyrocketed 57%, going from a low of $0.5192 to $0.8192 at its peak. Thus, the price of the ninth largest cryptocurrency reached highs not seen since 2022, and the influx of investor money into the crypto investing market added fuel to this fire of green candles on the price chart.

It is definitely worth keeping an eye on how inflows into Cardano ETPs will change further, as this will be an important indicator of investor sentiment outside of the crypto market toward the token. If the inflows at least do not fall into the negative zone, we can assume that the demand for ADA remains.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov