Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

On the last day of the week, the cryptocurrency market is located in neutral mode as neither bulls nor bears control the situation at the moment.

BTC/USD

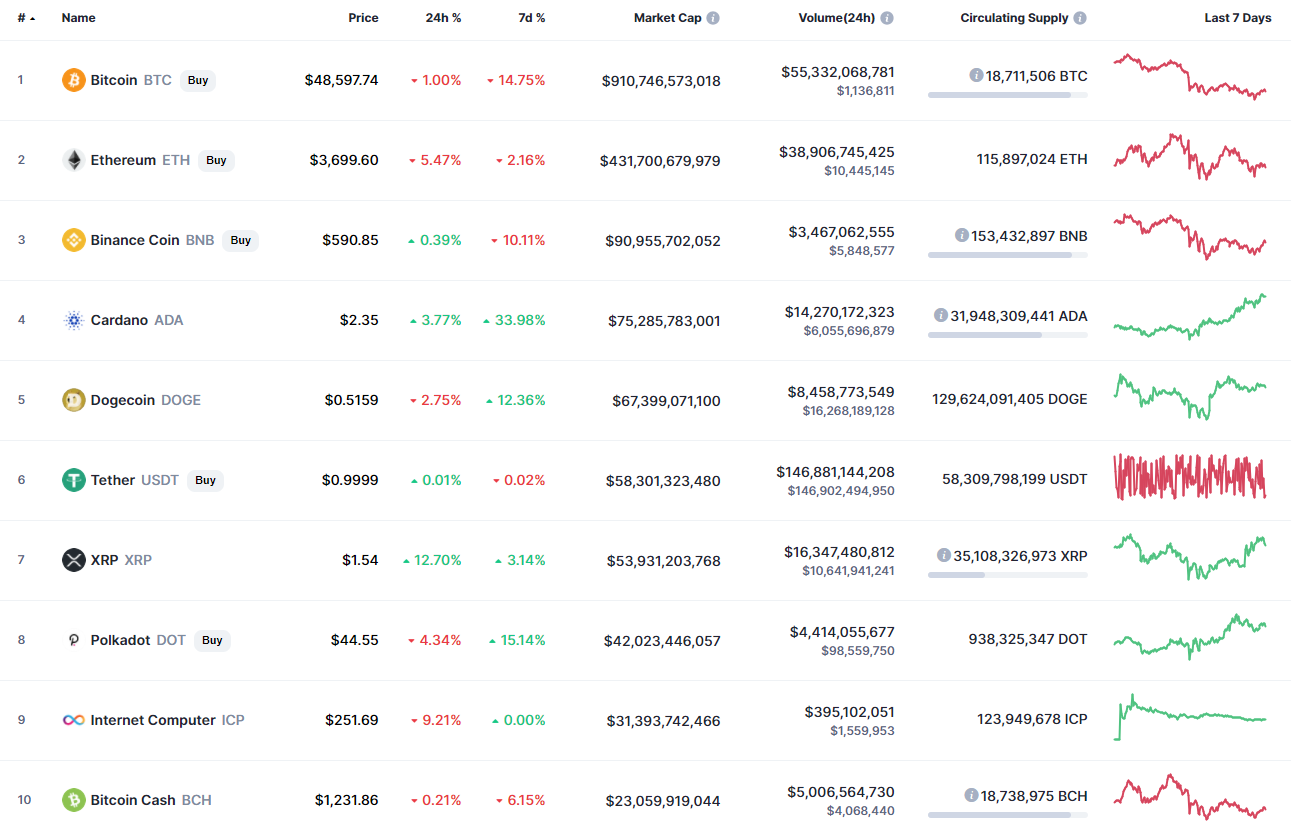

The rate of Bitcoin (BTC) has gone down by 0.61% since yesterday while the decline over the last week has been a whopping 14%.

Bitcoin (BTC) has almost tested the support of $45,000. However, the price has bounced back from it. Today, bulls are showing power, which means that short-term growth may occur in the next week. If that happens, the nearest resistance at $53,500 might be tested shortly. But there are low chances for bulls to break it as the rise is not supported by large trading volume.

Bitcoin is trading at $48,708 at press time.

ETH/USD

The rate of the main altcoin has decreased by 4.72%.

Ethereum (ETH) is not looking as bullish as Bitcoin (BTC), as buyers might have run out of power to keep the price at new peaks. Thus, the coin has already tested the support at $3,610 many times, which confirms the weakness of bulls.

From the other side, the selling trading volume is low, considering a bounceback to the area around the MA 50 ($4,000) before a further decline.

Ethereum is trading at $3,720 at press time.

XRP/USD

XRP is the biggest gainer today as its rate has rocketed by 13%.

XRP is slightly approaching the resistance of $1.66 on the daily chart. However, the buying trading volume is still low, which means that bulls have not accumulated enough power yet to set new peaks. But if they manage to fix above $1.66, the next resistance at $1.88 might be easily attained.

XRP is trading at $1.55 at press time.

ADA/USD

Cardano (ADA) is not an exception to the rule as its price has increased by 3%.

Cardano (ADA) has already shown its growth potential and, to keep the growth, it needs to gain more power by trading sideways. The coin has made a false breakout of the $2.46 mark on the daily time frame, which means that a possible drop to the area of $2.20-$2.30 might occur soon.

ADA is trading at $2.36 at press time.

BNB/USD

Binance Coin (BTC) has not shown such a big rise as Cardano (ADA) as it has only risen by 2%.

Binance Coin (BTC) is located in a wide sideways range on the daily chart after it has bounced back a few times from the level of $562. Until the native exchange coin remains trading above it, the bullish scenario remains active.

Binance Coin is trading at $592 at press time.

Tomiwabold Olajide

Tomiwabold Olajide Caroline Amosun

Caroline Amosun Dan Burgin

Dan Burgin Godfrey Benjamin

Godfrey Benjamin