Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

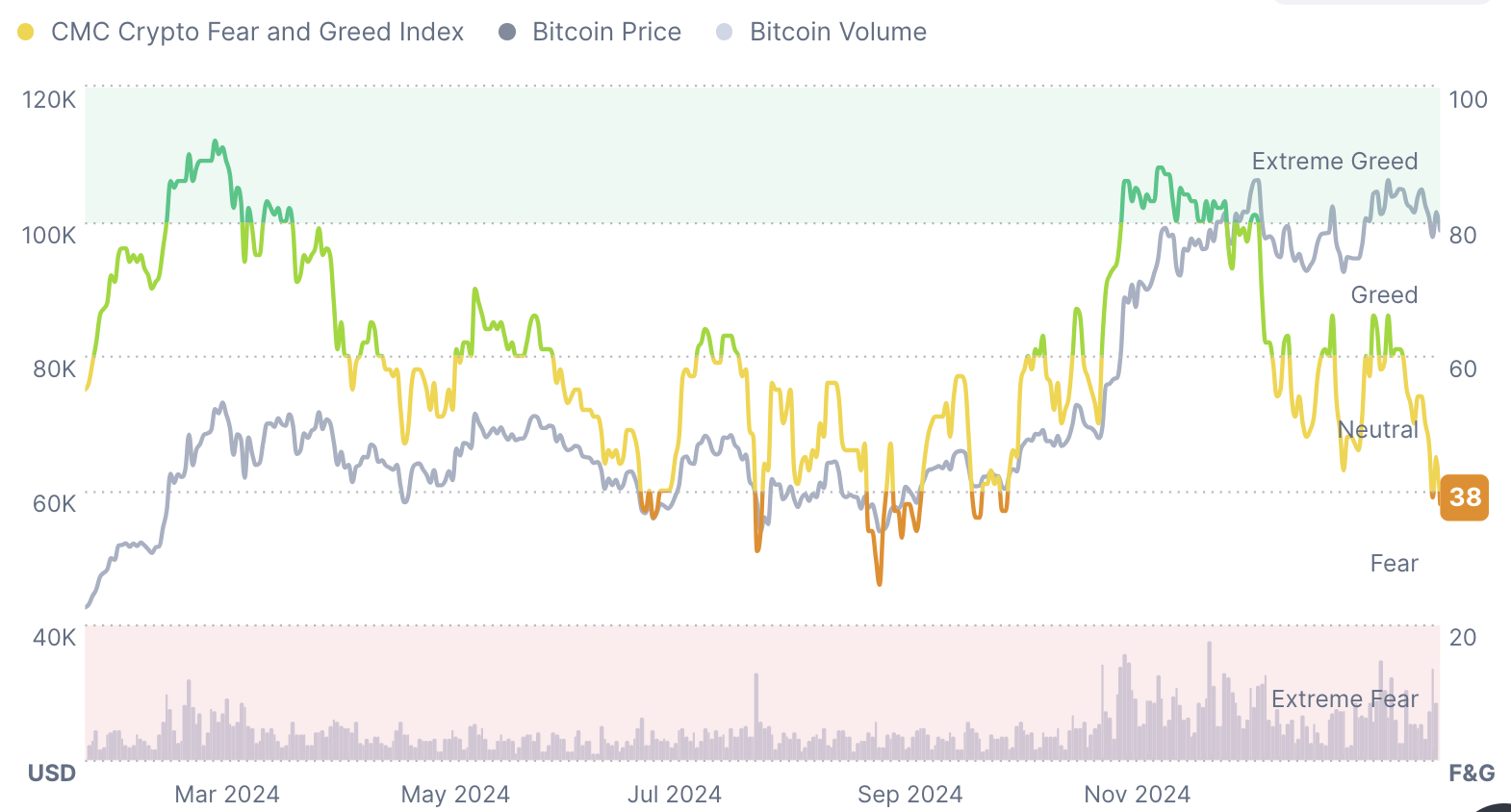

Fear is back on the cryptocurrency market. According to the Fear and Greed Index from CoinMarketCap, the sentiment has dropped to 38 - cautious, but not extreme. The last time market confidence was this low, Bitcoin (BTC) traded around $60,000, and altcoins together held a total market cap of $900 billion. That was then.

Fast forward to early February, and the picture has changed. Bitcoin is now just under $100,000, and the altcoin market cap has climbed to $1.24 trillion, marking a 40% market-wide increase.

Fear did not last forever last time. Within just a month - from October to November - sentiment flipped from fear to extreme greed. The driving force? A wave of optimism surrounding the U.S. elections and speculation that the new administration might take a more crypto-friendly stance. The market reacted accordingly, pushing prices higher.

So what happens next?

This time, it is less clear. Unlike before, there is no major external catalyst on the horizon that could spark another sharp rally. The narratives that boosted confidence have played out, and what remains is a market trying to figure out its next move.

Historically, though, fear phases have not lasted indefinitely. Almost every significant market upswing has come after a period of doubt and hesitation.

What is different this time? The triggers are not as obvious, and market conditions have shifted. That does not mean a rebound is not coming - it just means it might not look like the last one.

The past suggests that when fear dominates, opportunity often follows. But sentiment alone will not dictate the future.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov