Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Not all coins could keep yesterday's sharp growth as some cryptocurrencies have come back to the bearish zone.

BTC/USD

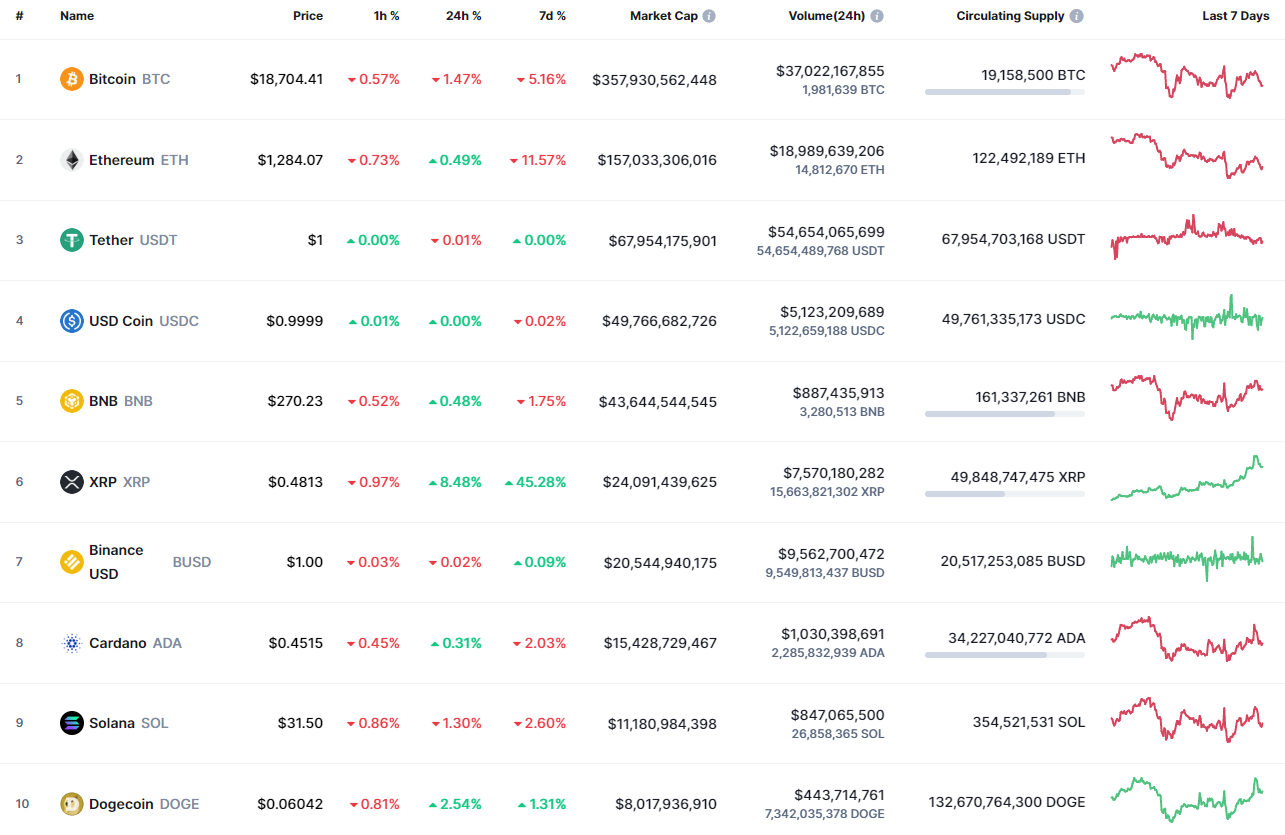

Bitcoin (BTC) is one of the biggest losers with a decline of 1.47% over the past 24 hours.

Despite the drop, the fall may continue as the price is on the way to the support level at $18,271 after a false breakout. This means that sellers tend to be more powerful than buyers.

If bulls cannot seize the initiative in the near future, there are chances to see a sharp decrease to the closest level at $17,592 by the end of the current month.

Bitcoin is trading at $18,635 at press time.

ETH/USD

Ethereum (ETH) is looking better than Bitcoin (BTC) as the price has changed since yesterday by +0.49%.

Ethereum (ETH) could not keep the rise going after yesterday's bullish candle, which means it is too early to think about a midterm rise. If the bar closes near the $1,230 mark, one can expect a sharp price drop to the zone around $1,000 as enough power has been accumulated for that.

Ethereum is trading at $1,285 at press time.

Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya