Renowned crypto analyst Willy Woo has suggested that BlackRock's $9.5 trillion in assets under management could potentially migrate toward digital assets, particularly Bitcoin, as younger generations express growing confidence in cryptocurrency.

Woo's comments come in the wake of recent statements by BlackRock CEO Larry Fink, who emphasized the need to engage younger investors disillusioned with conventional financial systems, particularly regarding retirement savings. Bloomberg's analysis echoes this sentiment, suggesting that Fink's interest in BTC stems from its appeal to digitally native demographics.

Bitcoin's potential to attract younger investors could position BlackRock favorably, potentially leading to a sustained relationship as these investors mature and seek additional financial services.

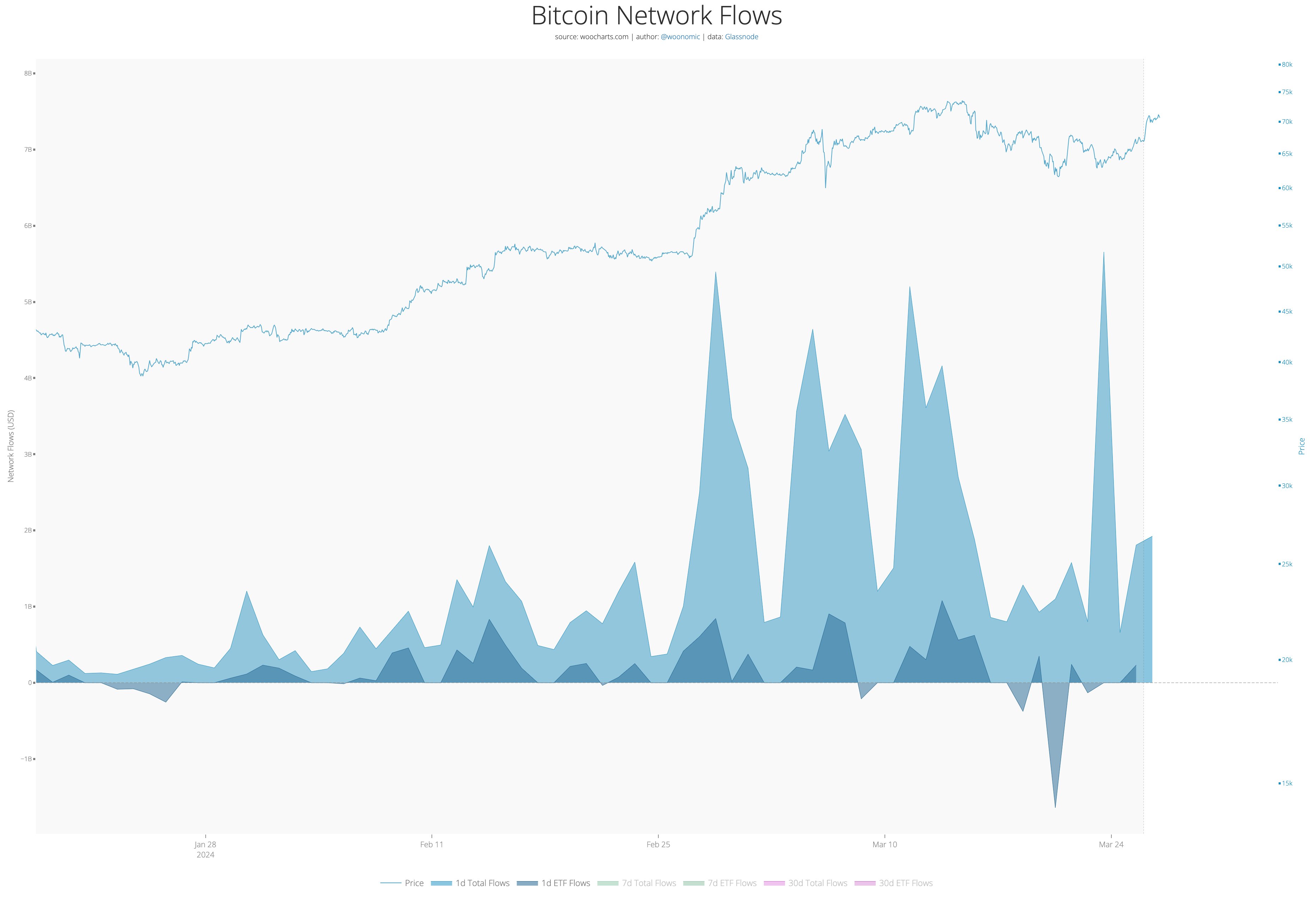

Current Bitcoin ETF data

Recent data indicates a notable increase in inflows into spot Bitcoin ETFs, with a daily net inflow of $418 million recorded March 26, marking the largest influx since March 13. This surge comes amid a backdrop of general market volatility, including significant sell-offs in Grayscale and modest inflows to Bitcoin ETFs.

Woo further notes that Bitcoin ETF flows have rebounded following a period of selling, with significant interest from self-custody investors during market dips. This resurgence in ETF activity reflects renewed confidence in Bitcoin among both institutional and retail investors.

As the cryptocurrency market matures and garners interest from traditional financial institutions, the gradual adoption of digital assets by large players like BlackRock could further solidify Bitcoin's role in finances.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin