Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

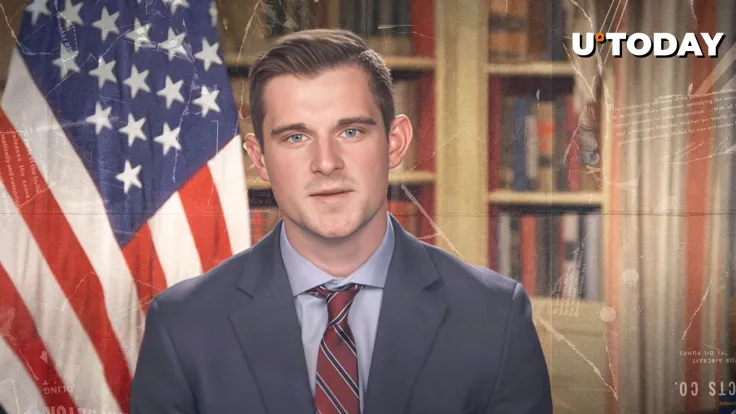

Prominent Bitcoiner and entrepreneur Anthony Pompliano (also frequently known as Pomp) sat down with Bo Hine, Executive Director of the US President’s Council of Advisers for Digital Assets, to talk about not only BTC and the U.S. government’s plans for it, but also about Hine’s personal view of Bitcoin and its future performance on the market.

The interview took place in the White House, where Hine made several interesting statements about Bitcoin, including the plan to establish the Strategic Bitcoin Reserve.

"Bitcoin to perform similarly to gold" in long run

Answering Pompliano’s question about Bitcoin and gold in terms of similarities and the resilience both of these assets have shown recently, Hine shared that while gold has been acting as a safe haven for thousands of years, he believes that Bitcoin will behave in a very similar way to gold over the next few thousands of years.

He voiced the official opinion of the U.S. Council of Advisers for Digital Assets, and Donald Trump himself, who believes Bitcoin is a digital analogue of gold. By establishing the Strategic Bitcoin Reserve, the president’s administration wants to build a “digital Fort Knox” for BTC.

Hine's Bitcoin message to average Americans

At Pompliano’s request, Bo Hine issued an important Bitcoin message to the American viewers of Pomp's podcast. First of all, Hine reminded listeners that while Bitcoin is digital gold and the U.S. government is already holding almost 200,000 Bitcoins, planning to accumulate a million BTC more over the next few years, the crypto market can be quite volatile.

Therefore, it is important not only to use the advice of professionals in the investment market but also to consider how to protect your investments among other volatile asset classes.

He also believes that blockchain technology will help revolutionize the financial and banking systems. The way humans communicate via the internet has changed drastically over the past two decades, Hine pointed out, but the financial system remains full of friction, and blockchain is going to change that radically, he believes.

He added that despite the original anti-establishment ethos of Bitcoin and BTC adoption by companies like BlackRock now, BTC still provides what it was invented for — storing value and moving funds quickly and cheaply.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin