Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

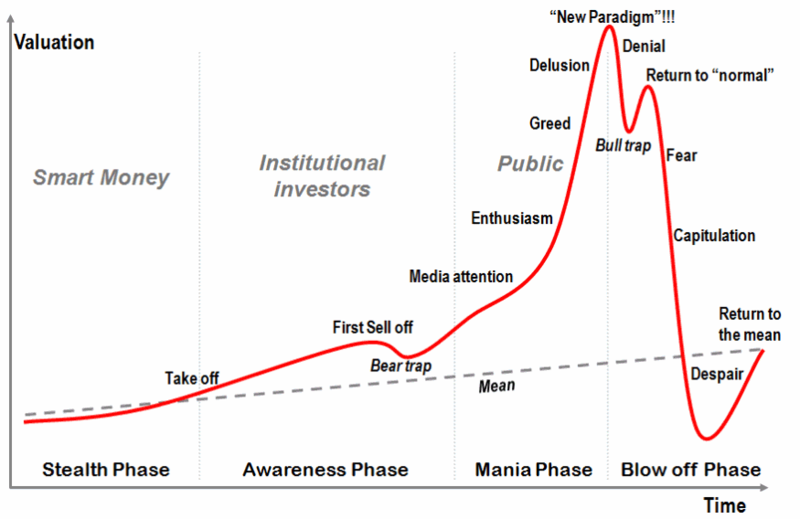

One of the most popular patterns in the world, known as "stages of bubble," was developed by professor Jean-Paul Rodrigue. It is still considered a viable tool for making cycle-based predictions, which is especially useful during a lack of fundamental events happening around the digital assets industry.

According to the pattern, the cryptocurrency market is currently going through the capitulation into despair phase, which is the last stage before the "return to mean" part, where assets or entire industries start to gradually recover.

Bitcoin was once guided by the pattern back in the 2013-2015 correction period, when it reached $1,300 and made a new ATH. The retrace began in the first months of 2014 and lasted until October 2015.

Sometimes assets do not exactly follow the textbook definition of the bubble pattern, but they are still going through distinctive phases on the market. In accordance with the cyclical nature of the bubbles, Bitcoin should bounce in upcoming weeks right after the consolidation we are seeing today, or it will take another hit and plunge once again.

Bitcoin's position on market today

Both the overheating of the whole industry and the macroeconomic structure of financial markets caused the sell-off on the cryptocurrency market that we saw in the last few months. Investors are no longer willing to accept risks that come with investment in digital assets and would rather choose stable options like bonds that are now offering better rates.

The majority of cryptocurrency investors are currently waiting for the release of CPI June data that will affect the upcoming rate hike meeting in July and the direction of U.S. monetary policy.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov