Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

According to renowned ETF analyst Eric Balchunas, the future of Bitcoin ETFs looks remarkably promising, with all 10 currently existing funds anticipated to maintain their presence on the market over the next year. Balchunas confidently asserted that the resilience of these ETFs is indisputable, backed by data that showcases their robust performance.

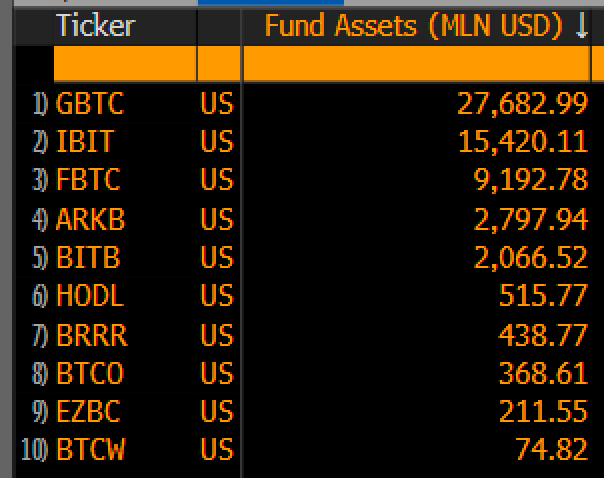

Even the lowest-performing ETF, WisdomTree's BTCW, boasts a substantial $74 million in assets under management, securing its position among the top 15% of newly launched ETFs in 2024.

The Bloomberg terminal data shared by Balchunas reveals that leading the pack are Grayscale's GBTC, BlackRock's IBIT and Fidelity's FBTC, with assets under management reaching $27.68 billion, $15.42 billion and $9.19 billion, respectively. These figures underscore the significant market share held by these established players in the Bitcoin ETF landscape.

Numbers go long term

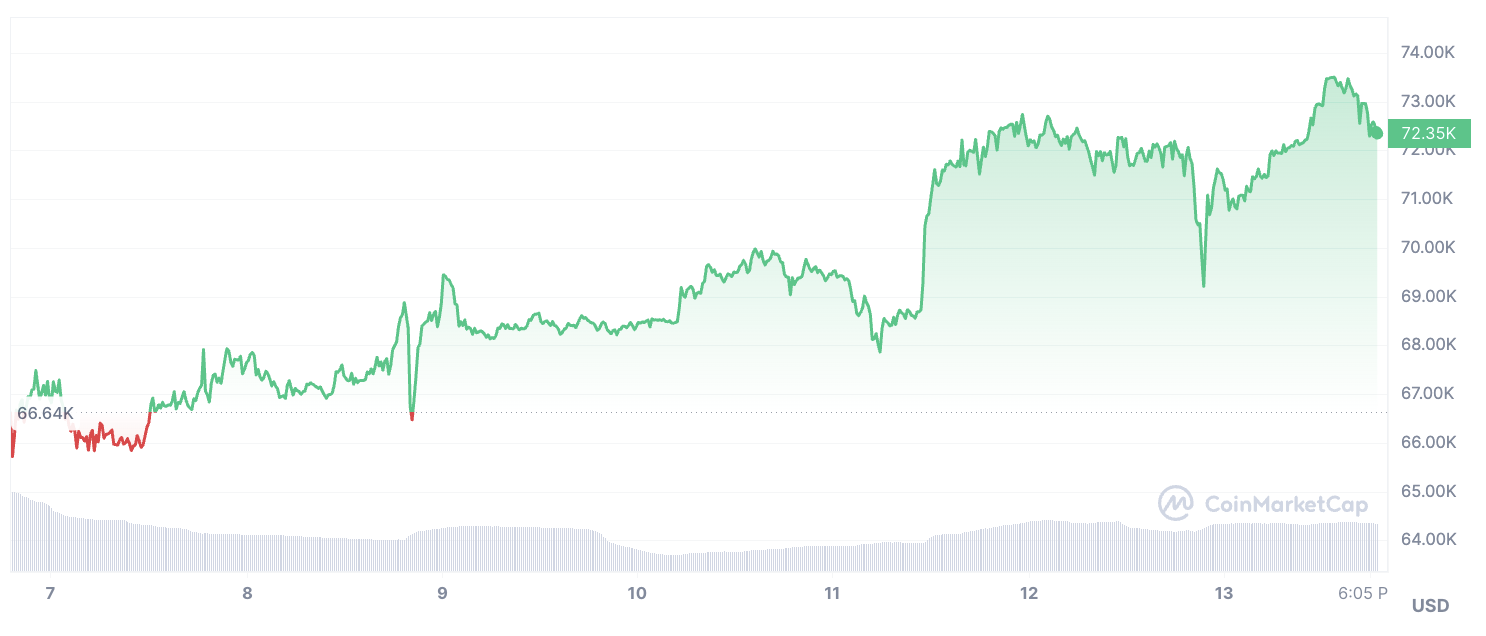

With the cryptocurrency market experiencing unprecedented growth and adoption, investor interest in Bitcoin-related investment products has surged. The stability and continued success of Bitcoin ETFs are a testament to their appeal and potential for long-term viability.

As the crypto market continues to evolve, Bitcoin ETFs are poised to play a crucial role in facilitating mainstream adoption and providing investors with convenient access to this burgeoning asset class.

Balchunas' optimistic outlook reflects the confidence of many industry experts in the enduring relevance and sustainability of Bitcoin ETFs in the investment landscape. The expert consensus suggests that BTC ETFs are not only here to stay but are primed for further growth and success in the coming years, offering investors an attractive avenue to participate in the digital asset revolution.

Arman Shirinyan

Arman Shirinyan Yuri Molchan

Yuri Molchan Alex Dovbnya

Alex Dovbnya