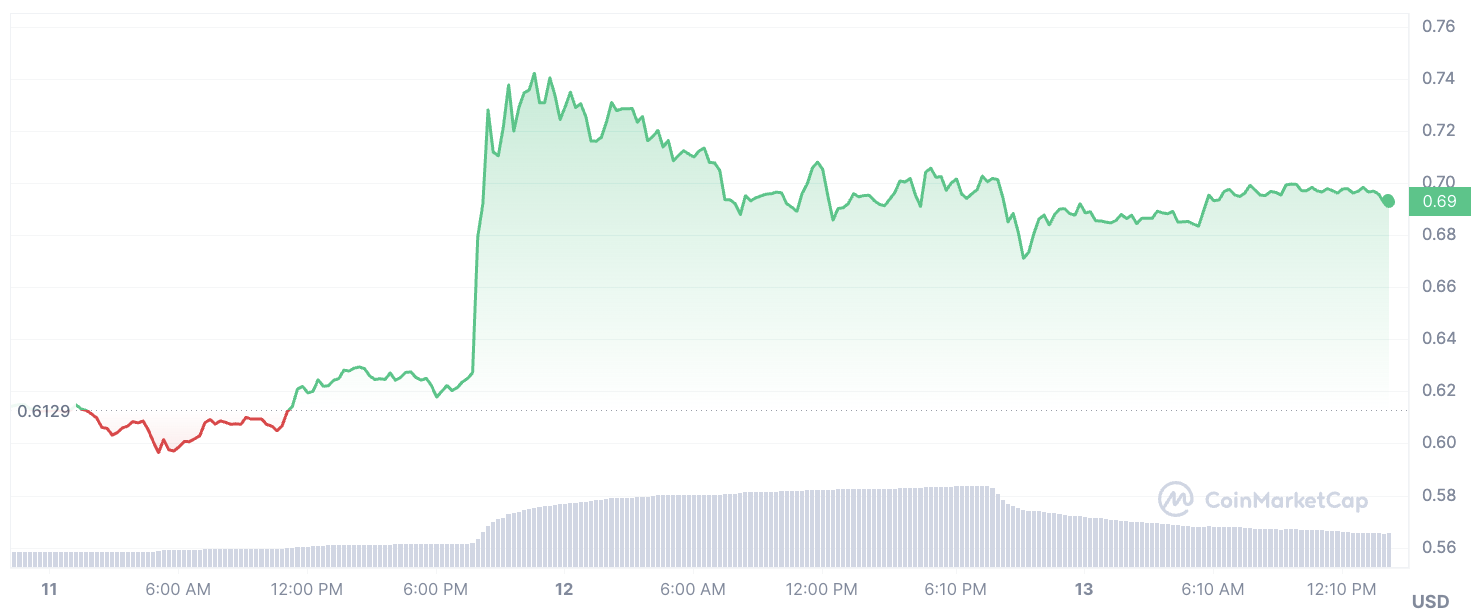

In a significant development within the cryptocurrency market, the price of XRP has experienced a notable surge, climbing by over 14% in the past week. At its peak, the surge reached an impressive 22%, with the token's value soaring to $0.7. This surge has sparked discussion and speculation regarding the potential approval of an XRP exchange-traded fund (ETF).

Martin Hiesboeck, Head of Research at Uphold Inc, shared insights into this remarkable price run, suggesting that increased development efforts on XRP following the lawsuit settlement are bearing fruit. Hiesboeck hinted at an imminent XRP exchange-traded product (ETP), stating, "There is life in the old girl."

Brad Garlinghouse, CEO of Ripple, has also weighed in on the possibility of an XRP ETF. Drawing parallels to historical market trends, the executive expressed optimism, highlighting the potential for diversification within the cryptocurrency market. He emphasized Ripple's support for an XRP ETF, indicating its inevitability in the evolving landscape of digital assets.

XRP adoption

Further fueling speculation is Uphold's significant holdings in XRP, totaling $1.53 billion. Data reveals that XRP accounts for approximately 27.62% of total transactions on the Uphold platform, exceeding 19.9 million transactions. This data underscores the enduring relevance and popularity of XRP among cryptocurrency investors.

As discussions surrounding the potential approval of an XRP ETF continue to gain momentum, market participants eagerly await further developments. The prospect of an XRP ETF represents a significant milestone for the cryptocurrency market, potentially opening up new avenues for investment and adoption.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov