Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

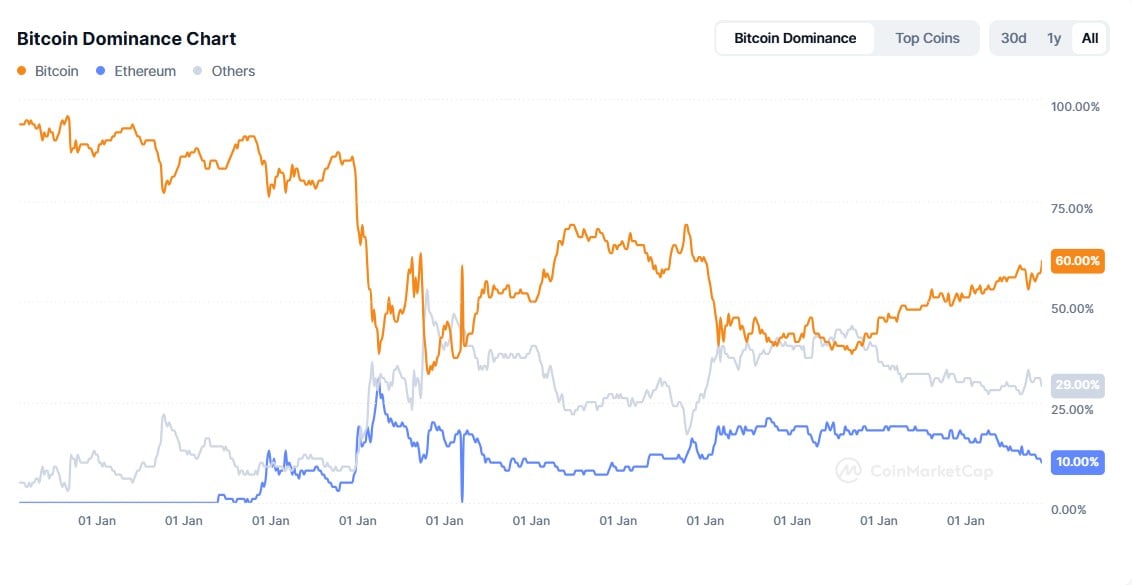

CoinMarketCap data reveals that Bitcoin (BTC) dominance has reached 60.6%. This represents a 5.01% increase due to a shift in market dynamics within the last 48 hours. The increase occurred despite the price volatility being witnessed by Bitcoin in the same time frame.

Is rising Bitcoin dominance a bullish indicator?

This rise in BTC dominance is significant, indicating that Bitcoin receives more capital inflows at the expense of altcoins. That is, investors still consider the future outlook of Bitcoin promising and are betting on it despite price volatility.

Notably, this high dominance rate suggests that the coin may soon experience a long-term bullish cycle. Additionally, with this surge, altcoins could rebound as this dominance, if accompanied by a price increase, will lead to price appreciation.

However, analysts maintain that for altcoins to rally, the market has to experience fresh liquidity injection. This is also critical to avoid market pressure.

Interestingly, Bitcoin stands at a wide margin compared to Ethereum, which dropped by 2.36% and 10.1%. Other assets registered 29.3% in dominance, signifying a 2.65% decline.

Veteran traders remain bullish

Within the last 24 hours, Bitcoin has fluctuated between a low of $91,242.89 and a high of $99,397.65. As of this writing, the Bitcoin price was changing hands at $95,553.51, a 3.35% increase in the last 24 hours. The trading volume has also soared by 163.04% to $102.37 billion.

Despite the price volatility, this spike in trading volume shows investors have sustained their interest in the coin. Experts see this as indicative of likely bullish potential.

As reported by U.Today, veteran trader Peter Brandt has called on investors to stay bullish despite current liquidations in the market. According to Brandt, even if the leading altcoin should slip to $80,000, BTC is still bullish, and there is no need to despair.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov