Binance Futures, the futures trading platform of the world’s largest cryptocurrency exchange by reported trading volumes, is set to launch two new perpetual contracts for XRP and Ethereum Classic (ETC), according to its Tuesday announcement.

- The contracts will be paired against the USD Coin (USDC) stablecoin.

- They will offer traders an opportunity to go long or short on the base assets with up to 75x leverage.

- The new products will become available for trading on Sept. 9 at 7:00 AM UTC.

Binance pioneers XRP derivatives

XRP made its debut on the Binance Futures platform back in January. It became the first major exchange to add an XRP perpetual contract margined against the Tether (USDT) stablecoin.

In a week, a similar product was rolled out for Ethereum Classic, which made the cryptocurrency spike nearly 40 percent within 24 hours.

As reported by U.Today, Binance also added options contracts for XRP and Ethereum in late May. Their main difference from futures is that the trader is not obliged to execute the contract at a particular date.

Bitcoin Futures turns one

The reveal of the two new products came on the verge of the one-year anniversary of Binance Futures.

Launched on Sept. 13, 2019, it quickly gained a foothold in the derivatives market because of Binance’s huge user base, creating serious competition for other exchanges.

In April, the Cayman Islands-based exchange also ventured into options trading, aiming to chip away at Deribit’s dominance.

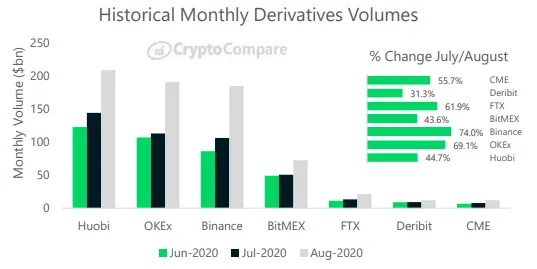

According to the latest CryptoCompare report, Binance was the third-largest exchange by monthly derivatives volumes in August (only behind Huobi and OKEx).

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov