Malta-based Binance is close to reaching BitMEX's level of liquidity, according to data provided by crypto research company Skew.

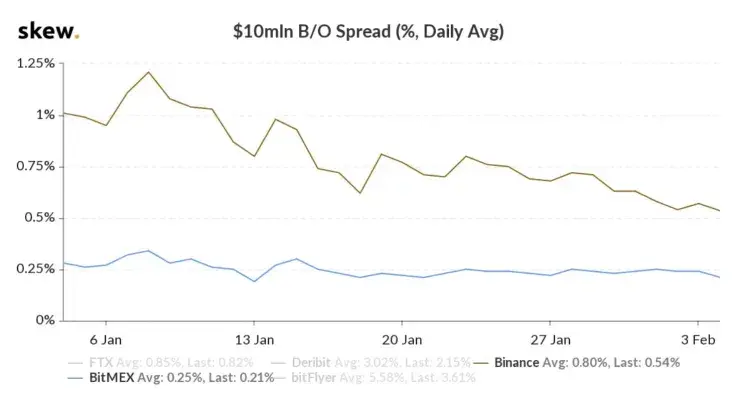

As of now, Binance has a bid-offer spread of 50 basis points (BPS) for $10 mln compared to the 25 BPS spread on BitMEX. As the chart below shows, the gap between the two exchanges has been drastically reduced in January.

Exchanges with the lowest bid-offer spread boast the highest level of liquidity.

Negative fees for increasing liquidity

Recently, Binance moved to increase the liquidity of its futures platform by rewarding market makers. The exchange made an announcement about implementing negative trading fees.

In order to qualify for the program, traders need to record at least 1,000 BTC in monthly trading volume on Binance or other exchanges.

Binance Futures hits its stride

The aforementioned fee structure adjustment is meant to spur more interest in Binance's futures platform that has to compete with the likes of BitMEX, CME Group, and Bakkt.

Back in December, CryptoCompare estimated that Binance’s BTC perpetual future was the third most traded derivatives product by monthly volume.

In January, Binance Futures debuted eight new futures products, including the TRX/USDT perpetual contract.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team