The Ethereum decentralized application (Dapp) ecosystem has been seeing unprecedented levels of user activity. The rise of decentralized finance (DeFi) has led to a frenzy around Dapps.

Uniswap, as an example, processes nearly as much fees as the Bitcoin blockchain network. Data shows Uniswap V2 settles $939,000 fees daily, all of which are processed on the Ethereum network.

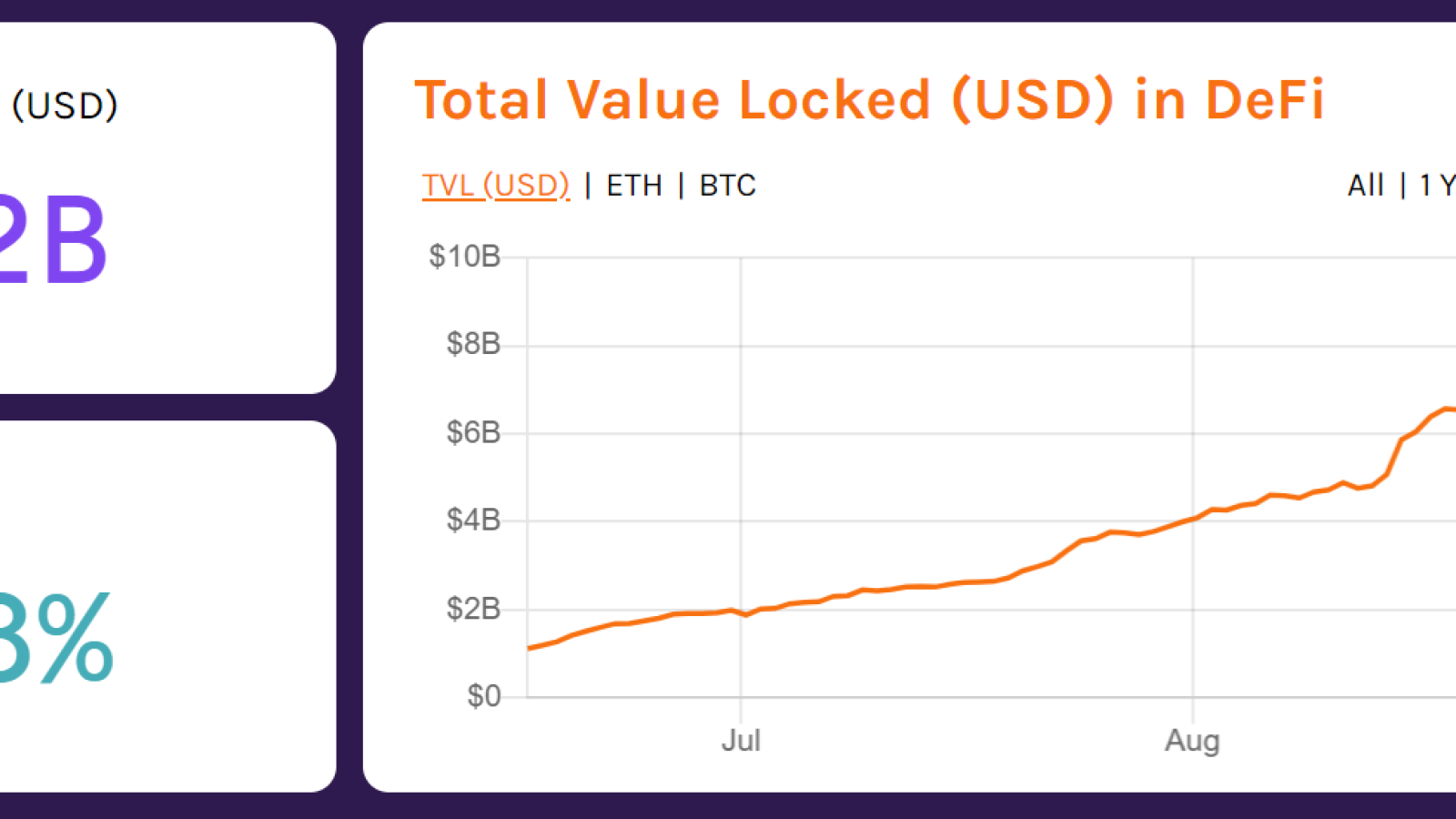

Optimistic metrics for the long-term growth of DeFi

The surging demand for Dapps and DeFi boosts the overall bull case for Ethereum over the long run.

Three years ago, when the price of ETH hit an all-time high at around $1,450, the user activity of Dapps was nowhere close to current levels.

John Todaro, the head of research at TradeBlock, said it was unthinkable three to four years ago to expect such large user activity. He said:

“3-4 years ago those of us in the crypto space thought it was a moon shot that Ethereum and other decentralized applications would see millions of dollars in fee based revenues per day. Today we are seeing the fruition of decentralized ecosystems.”

The difference between the current Dapp ecosystem and during the 2017 bubble is that users are utilizing Dapps for a clear purpose.

For instance, Uniswap processed more volume than Coinbase for the first time in history, on August 30.

Hayden Adams, the creator of Uniswap, noted:

“Wow, Uniswap Protocol 24hr trading volume is higher than Coinbase for the first time ever. Uniswap: $426M, Coinbase: $348M. Hard to express with how crazy this is.”

Users on Ethereum are not utilizing Dapps like Uniswap for the sake of using decentralized applications. They provide clear incentives and advantages that centralized platforms cannot offer.

As an example, Uniswap allows any trading pair to be listed in a decentralized manner at any given time. That allows cryptocurrencies that are not listed on exchanges to be traded in a peer-to-peer ecosystem.

Dapps still have many disadvantages in comparison to centralized applications. Namely, the scalability of Ethereum is still a problem for Dapps as it results in high fees when the blockchain network activity spikes.

Regardless, Ethereum Dapps are seeing sustainable high demand that levels centralized platforms for the first time.

For the long-term growth of Ethereum, the ongoing trends are optimistic. As the network continues to scale through ETH 2.0, there is significant potential for Ethereum to further expand.

Benefiting the value of ETH

Over time, as ETH 2.0 launches, analysts say that the high demand for DeFi could complement the trend of ETH.

Su Zhu, the CEO of Three Arrows Capital, said:

“Agree with this. Also the fact that shittons of ETH is getting withdrawn from exchanges and being used onchain in DeFi raises average user proficiency levels immensely, which is bullish for decentralization of staking. The idea that everyone will stake on exchanges because ease is stale.”