Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

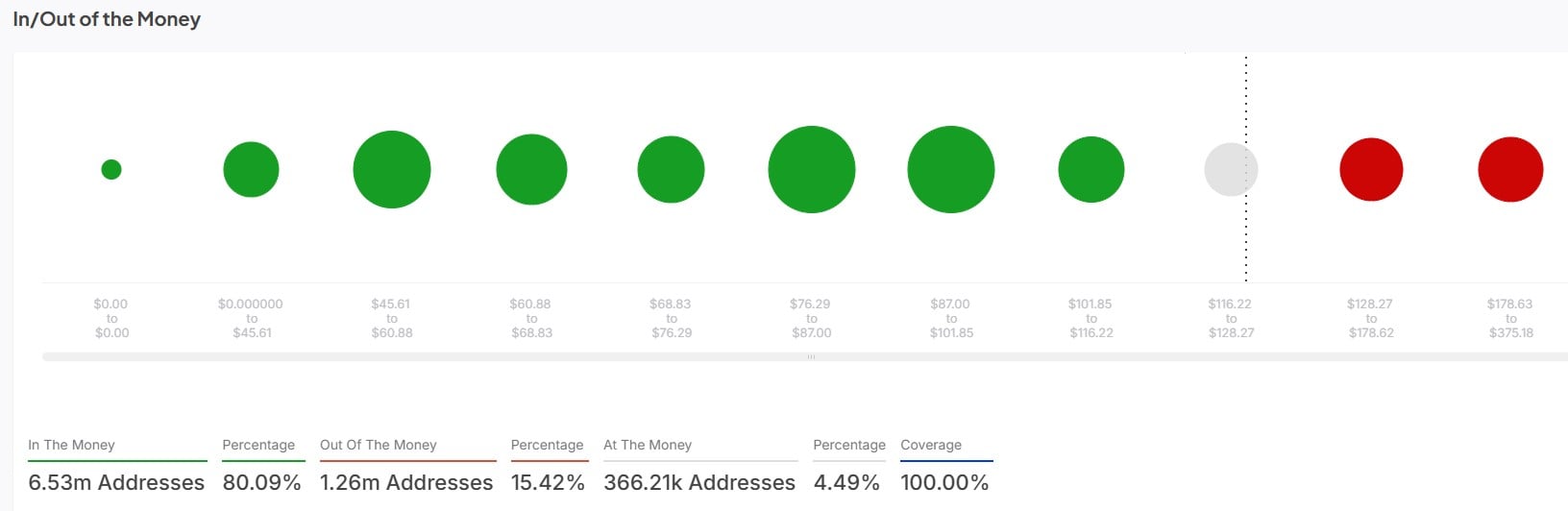

The ongoing hype surrounding approvals for a Litecoin exchange-traded fund (ETF) has triggered an unusual boost for LTC. IntoTheBlock data shows approximately 80% of addresses in the Litecoin network are profitable, demonstrating the bullish momentum.

Analyzing IntoTheBlock data

The data shows 6.53 million addresses; approximately 80% of tracked addresses are "in the money" or amassing profit. Addresses out of the money or recording losses total 1.26 million (15.42%). Meanwhile, Litecoin addresses the break-even point of 366,210, or 4.49%.

Notably, the profit occurred amid heightened expectations of a potential Litecoin ETF launch. As reported earlier by U.Today, Bloomberg’s Senior ETF Analyst Eric Balchunas claims Litecoin is the next crypto to receive ETF approval.

The analyst’s comments come after the U.S. Securities and Exchange Commission (SEC) received the amended Canary Capital’s S-1 LTC ETF filing. Many view this action as indicating that the SEC is moving toward approving the ETF product.

Polymarket has predicted a 54% odds of a Litecoin ETF being approved by 2025 and a 39% chance of regulatory nod by July 31. Market analysts believe the eventual approval of an LTC ETF may lead to surging cryptocurrency prices.

This sentiment is based on expectations of increased adoption from institutional investors.

What's next for Litecoin

The prospects of a breakout remain relatively high since most addresses are in profits.

However, Litecoin is currently facing intense pressure in its daily chart. Within the last 24 hours, the price of LTC declined by 6.9% to trade at $126.3. However, LTC has increased by 22% and 14.5% in the past week and month, respectively. This uptrend shows that LTC can have a more impressive uptick in the short and long term.

Thus, the daily price decline indicates that Litecoin is consolidating after hitting crucial milestones this year. This means a recovery in the broader market is expected soon and may help further boost Litecoin’s price and profitability.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov