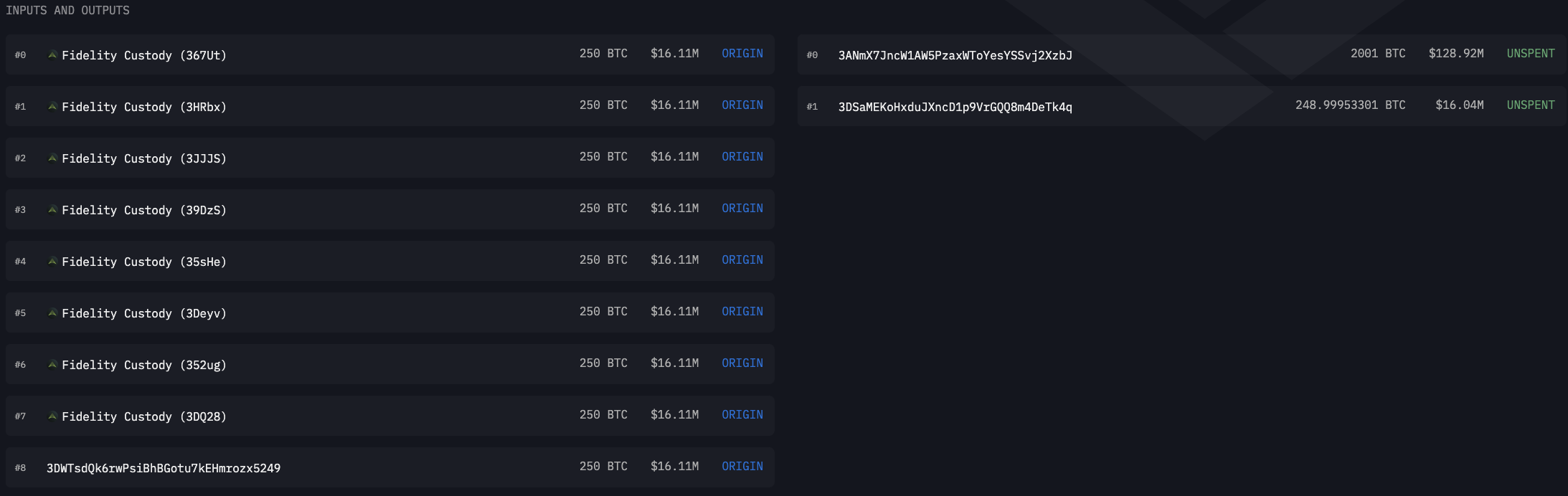

Unexplained large Bitcoin (BTC) transfers from one unknown wallet to another have been observed over the past few days. The latest episode of this unexplained activity is the transfer of $1 billion in Bitcoin from a number of unknown addresses to brand new wallets in batches of exactly 2,000 BTC.

It is not known what this is related to or what the purpose is, nor is it known who is hiding behind these addresses.

However, one of the clues that has surfaced is that, thanks to data from Arkham Intelligence, one of the sender addresses may belong to Fidelity Custody, a crypto custodian for one of the largest hedge funds in the world with approximately $5.4 trillion in assets under management.

This year, Fidelity added its own spot Bitcoin ETF, FBTC, to its asset-heavy portfolio.

Fidelity and Bitcoin

The crypto hedge fund custodian, if the data is to be believed, now has 287,153 BTC worth $18.35 billion and 287,064 ETH worth $753.91 million. It is important to clarify that these funds include MicroStrategy, Fidelity FBTC ETF and Fidelity FETH ETF, which are clients of this custodian.

Are these transfers some sort of internal operation to get their wallets in order, or is there more to it?

It is an open question, and we should not rule anything out. In recent days, FBTC has seen more inflows than outflows.

Perhaps the movement of $1 billion of Bitcoin between addresses is a confirmation that a new period of positive flows into Bitcoin ETFs awaits us for some time and, therefore, the presence of demand for the cryptocurrency. Demand is, of course, favorable for the price of BTC, which is frozen at 16.5% of its all-time high.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov