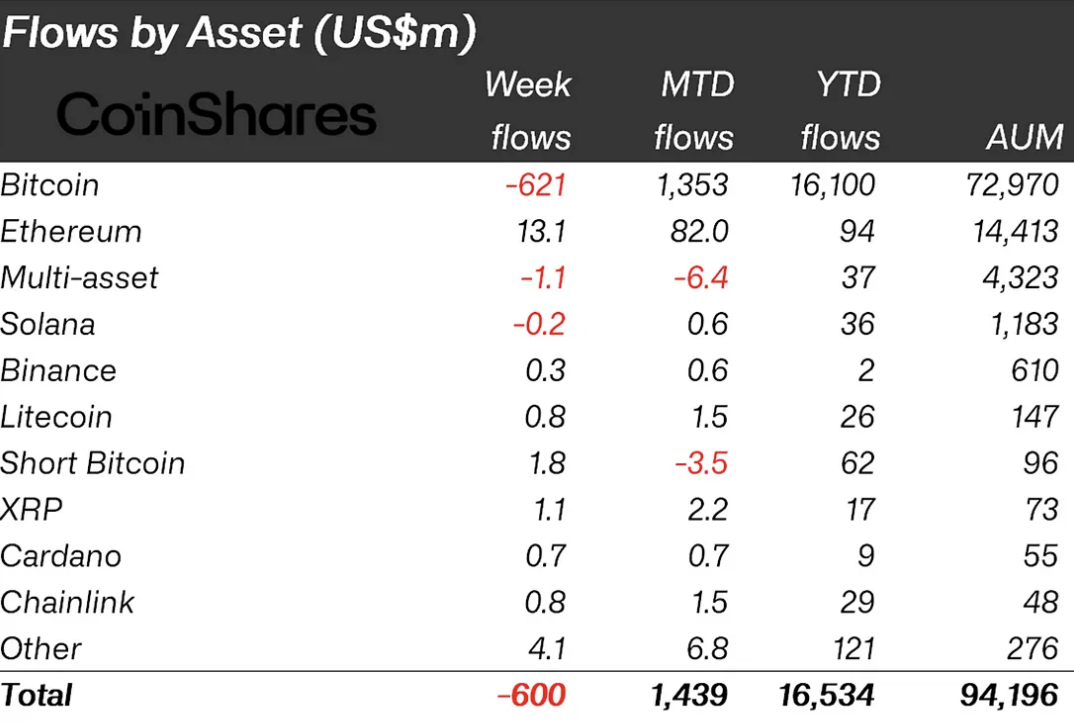

In the latest weekly report from CoinShares on fund flows into crypto-oriented exchange-traded products, XRP has emerged as a standout despite a tough week for digital assets.

While overall investments in digital asset products saw outflows totaling $600 million, XRP-focused investments bucked the trend with inflows reaching $1.1 million over the past seven days. This marks the second consecutive week of strong investor interest in XRP-related financial instruments, reflecting a steady increase in confidence.

In total, since the start of the year, total inflows into XRP investment products have now reached $17 million, surpassing rivals like Binance Coin and Cardano in this metric.

Ripple v. SEC

For those who review inflows into crypto investment products, the figure of $1 million in a week is quite compelling. When it continues for a second week in a row, especially with an asset like XRP, one begins to suspect that investors into traditional markets are gearing up for some big movement on the popular cryptocurrency.

A similar thing with XRP could be seen last year, when a lot of money flowed into investment products focused on it starting in the spring, and then in mid-July a court ruled that XRP is not a security, and its price rose by 100% during the day.

Perhaps this time too, someone in traditional finance is plotting a quick resolution of the SEC's case against Ripple. Recall that now the parties are arguing over remedies that the crypto company must pay as a penalty for unregistered sales of XRP to institutional investors. The regulator is demanding almost $2 billion from Ripple, while the company wants to pay only $10 million.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov