Flows into XRP-focused investment products have seen another weekly increase, according to a new report from CoinShares. Data shows that inflows into XRP ETPs soared by more than $400,000 last week, bringing the total to more than $18.4 million since the beginning of the year.

This surge puts XRP-related investment products at the top of the charts, alongside Solana, Polkadot and Litecoin.

Last week also saw the launch of the new Virtune XRP ETP on Nasdaq Stockholm, joining the existing 21Shares Ripple XRP ETP (AXRP), CoinShares Physical XRP ETP, ETC Group Physical XRP and Valour Ripple (XRP).

Altcoins take over

This shift in investor sentiment toward XRP and other altcoins suggests a strategic pivot on the market, where investors are increasingly viewing current price levels as attractive entry points for future gains.

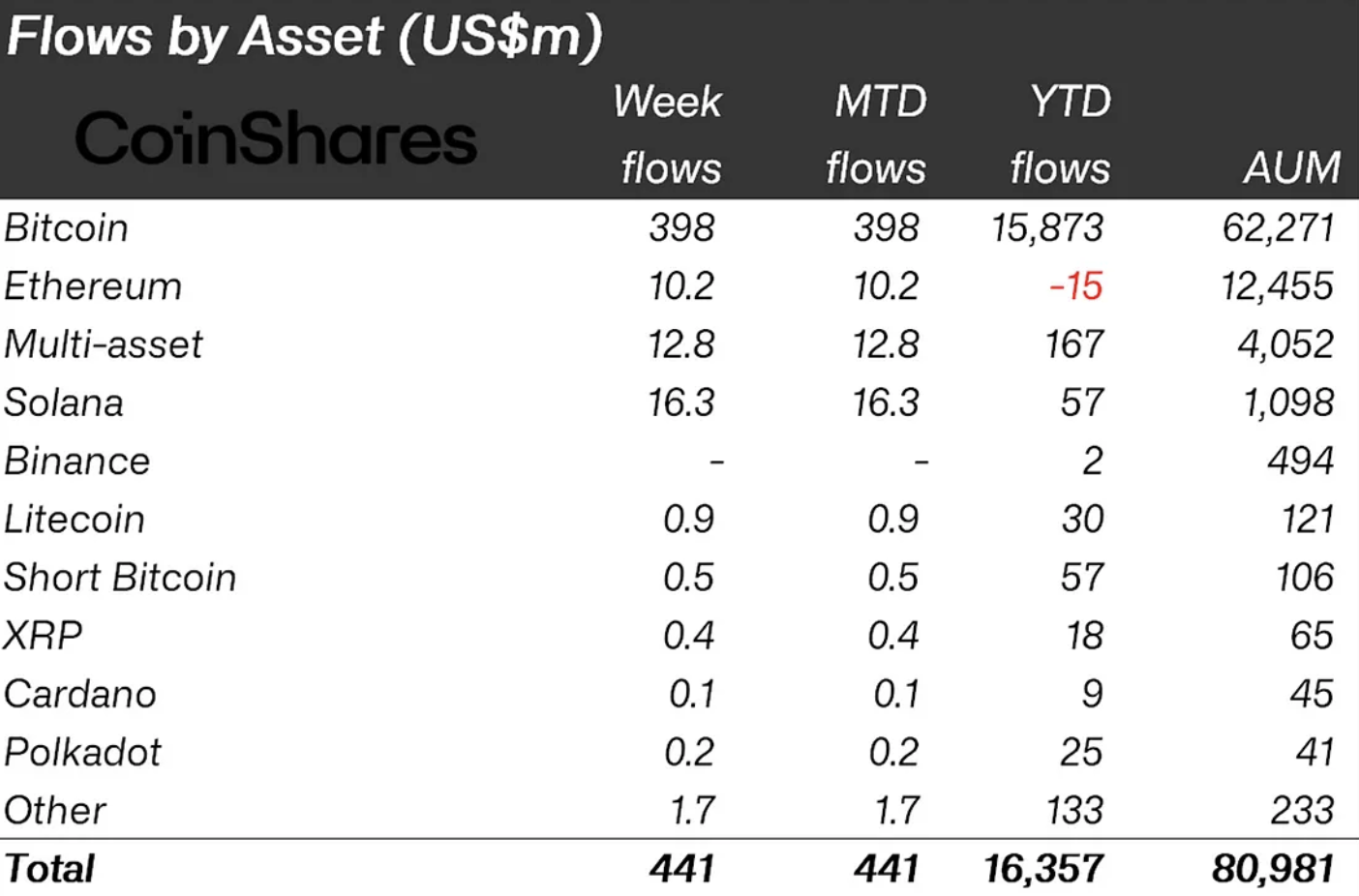

Overall, digital asset investment products saw inflows totaling $441 million, despite recent price weakness driven by selling pressure from Mt. Gox and the German government.

Bitcoin led the way, with inflows of $398 million, but unusually accounted for only 90% of the total as investors diversified across a broader range of altcoins.

In particular, Solana ETPs saw $16 million in inflows last week, bringing its year-to-date total to $57 million, making it the best performing altcoin in terms of flows. Ethereum, while seeing $10 million in inflows recently, remains the only investment product oriented to crypto with a net outflow year-to-date.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov