Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

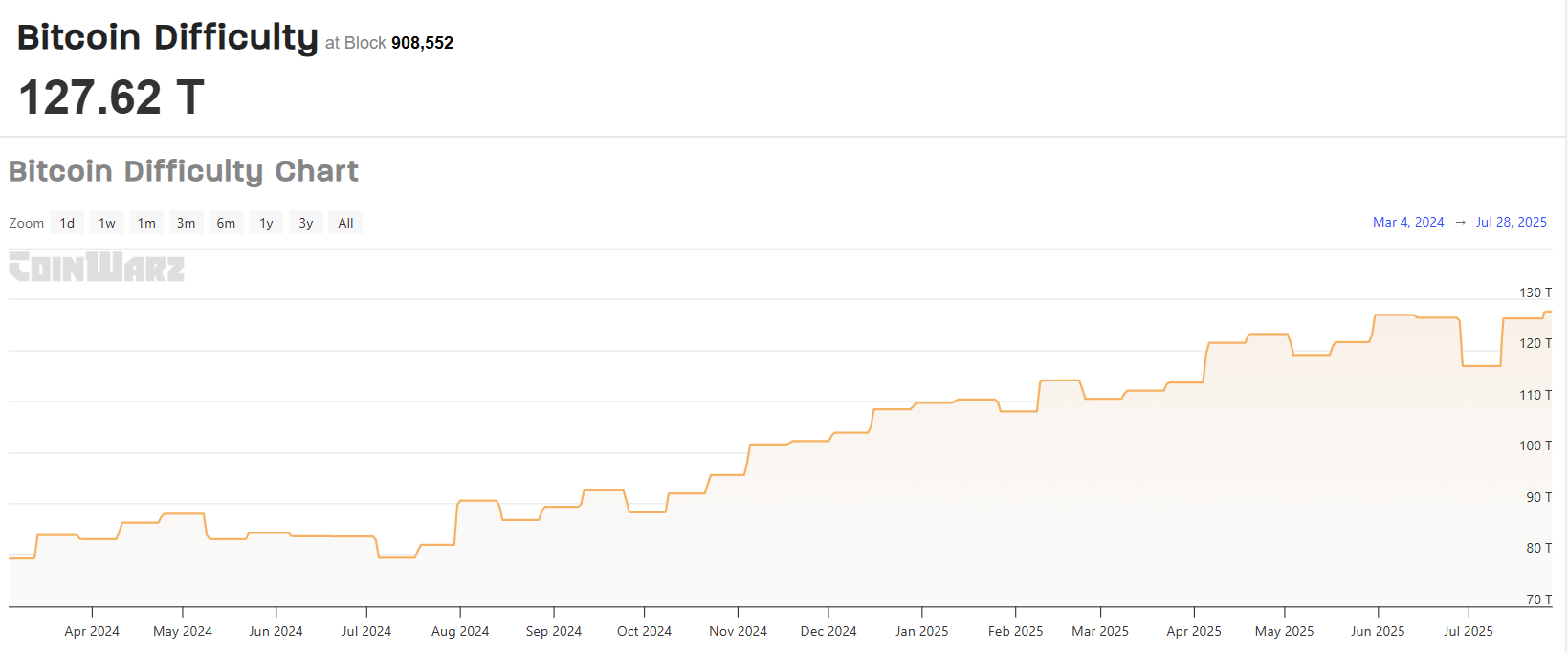

Bitcoin mining difficulty has surged to peak levels, hitting a new all-time high (ATH) on Sunday, Aug. 3, 2025. According to data provided by CoinWarz, Bitcoin mining difficulty has soared to 127.6 trillion.

Bitcoin mining difficulty jumps 9% in 30 days

The latest positive difficulty surge occurred at block 908,544 on the Bitcoin blockchain network. The widely tracked metric has increased by 9.12% over the past 30 days. Bitcoin mining difficulty also grew by 7.14% over the past 90 days.

However, the next difficulty adjustment, scheduled for Aug. 9, is expected to come lower. The metric is projected to plunge slightly by 0.03% to 127.29 trillion.

Bitcoin mining difficulty refers to the rigor of mining the next block. It measures the number of hashes that must be generated to find a valid solution to the next Bitcoin block and earn the mining reward.

Typically, mining difficulty adjustments take place every two weeks. These biweekly recalibrations ensure block issuance remains steady regardless of fluctuations in mining power.

When mining difficulty continues to increase, it means Bitcoin has become harder to mine. Thus, miners have to increase their efficiency to remain profitable.

Surprisingly, the surge in difficulty has not dampened miners’ earnings. According to data from YCHARTS, profitability has climbed to $58.43 million per exahash per day.

Implications for BTC price

The growing mining difficulty also has implications for Bitcoin. Essentially, the harder it is to mine one block, the scarcer Bitcoin emissions will become. Direct impact on the circulating supply, which, if matched with higher demand, could trigger a price rally for BTC.

Besides, experts claim the decoupling between difficulty and miner profitability could signal a new phase for Bitcoin.

As of press time, the BTC price was trading at $114,348, demonstrating a 0.34% increase over the past 24 hours. In the last seven days, Bitcoin dipped by 3.52%, sparking concerns about the ongoing bull run. However, long-term holders strengthen the case that the bull run might not be over.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov