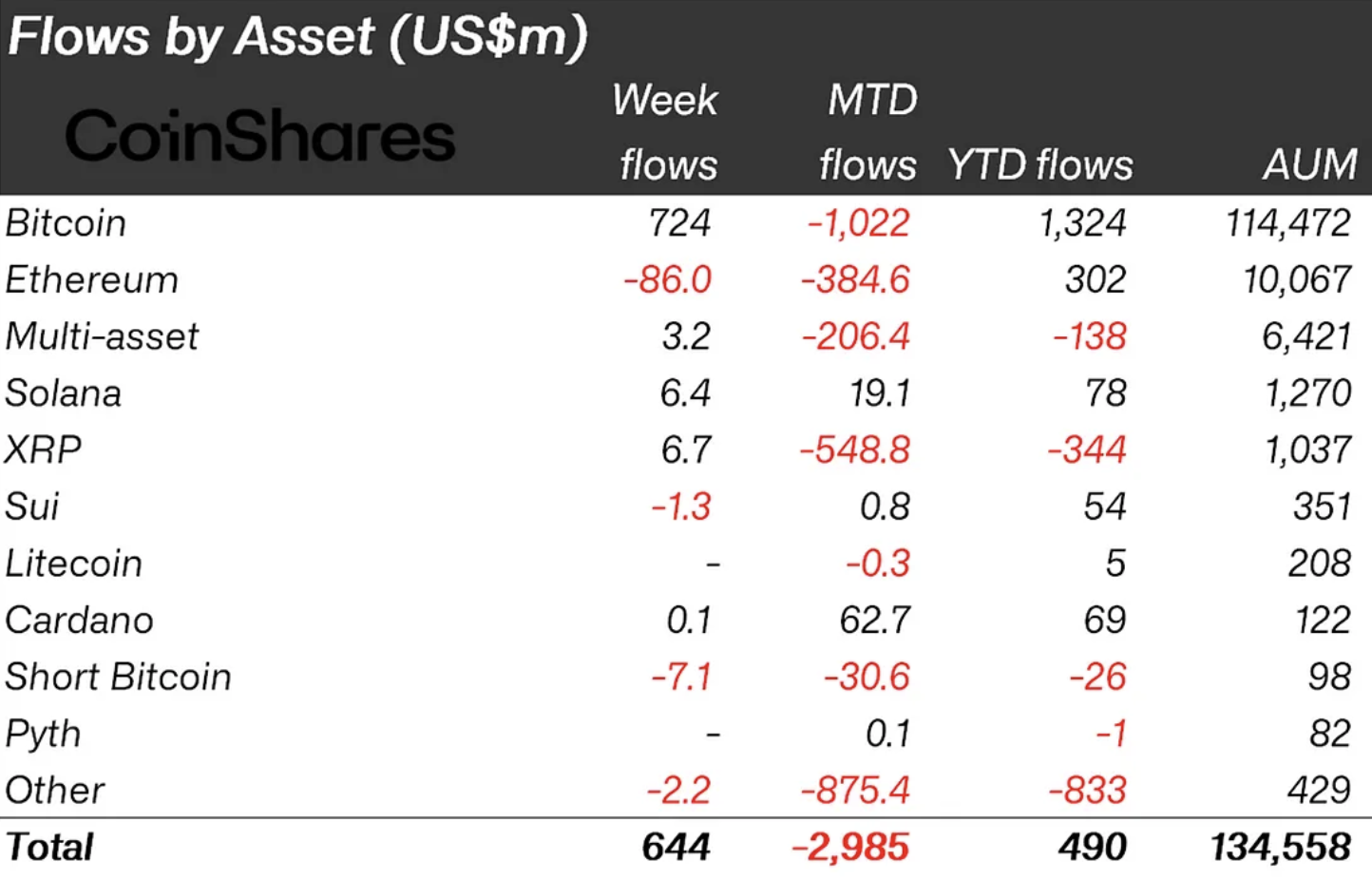

According to a recent report from CoinShares, investments in exchange traded funds focused on digital assets totaled $664 million last week.

Digging deeper into the report, however, shows slightly different numbers as, for example, Bitcoin ETFs alone saw flows worth $724 million. This total was shrunk by outflows from other alternative cryptocurrencies.

One of these is Ethereum (ETH), whose ETFs saw $86 million, bringing the total since the start of March to a negative $384.6 million. However, there are bright spots in the altcoin space - XRP to be exact. In the week before last, $1.8 million flowed into XRP ETPs, and in the past seven days, $6.7 million. That is a whopping 372% increase in just one week.

The reasons for such explosive performance are several, as XRP, unlike 99% of other cryptocurrencies, has its own narrative that is not directly linked to broader crypto market trends.

XRP ETF

The first one is definitely the XRP ETF, talks and speculations about which are getting hotter and more concrete by the day. There are already a lot of applications from the most prominent of the issuers, such as Franklin Templeton and Grayscale, although they have not yet received the green light from the SEC.

According to Ripple CEO Brad Garlinghouse, ETFs on the third-largest cryptocurrency will launch this year, and judging by the constant inflows into available XRP-focused investment products, many are already getting ahead of the news.

Ripple v. SEC

The second story for XRP is Ripple's legal battle with the SEC, which, as Garlinghouse himself announced, came to a formal end last week when the regulator dropped its appeal.

However, there is still a cross-appeal from the crypto company in place, so the market will definitely be hearing more about it, and if Ripple manages to get its conditions applied, more positive things could come for XRP.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov