The performance of XRP has reached a new milestone, with its market capitalization surging by 23% in the past 24 hours. This impressive increase has been driven by groundbreaking news as the final ruling in the SEC v. Ripple legal battle was delivered.

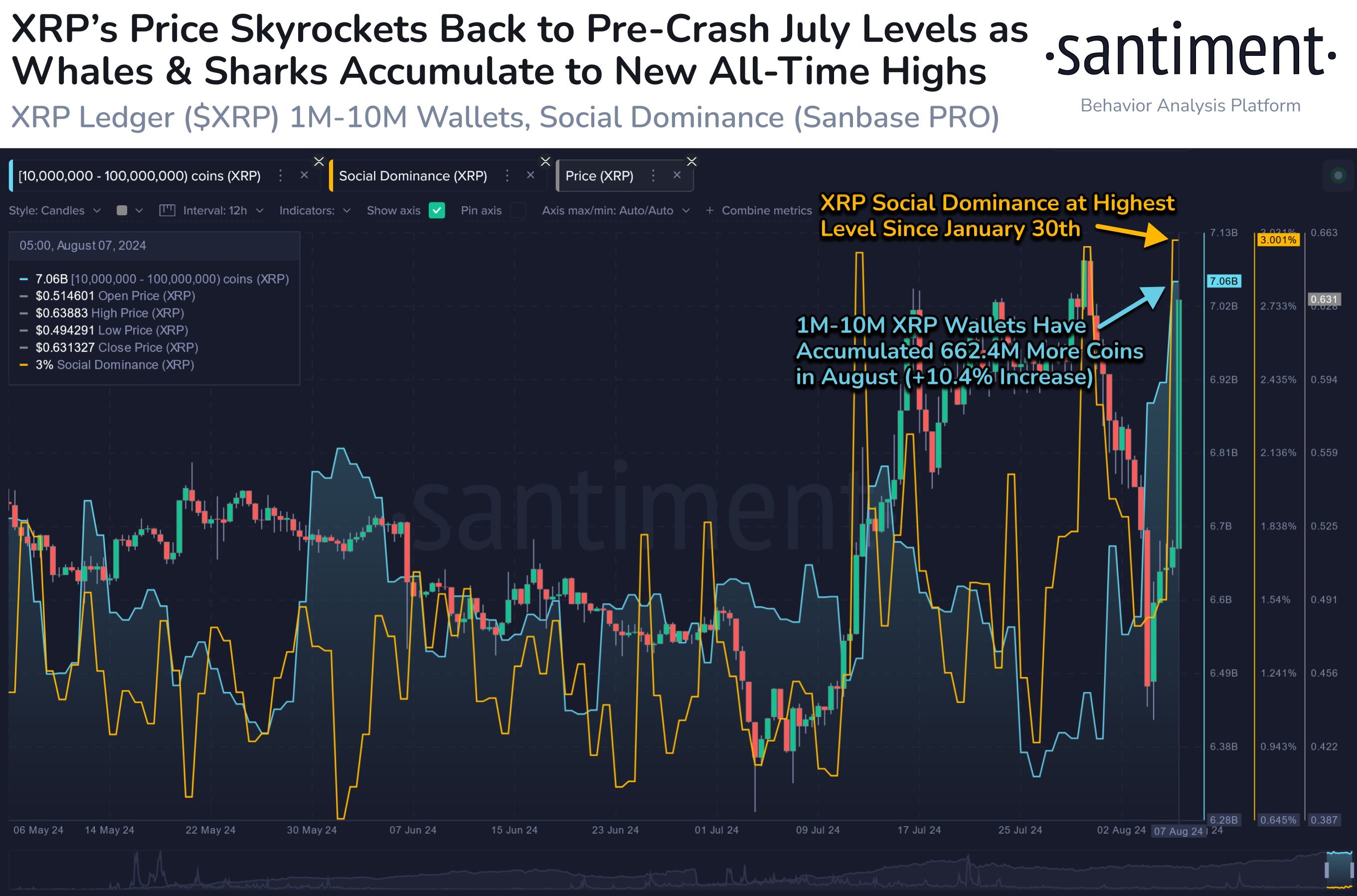

However, on-chain platform Santiment reports that there are more reasons behind the price surge. In particular, there is significant accumulation among high-net-worth holders, or "whales" and "sharks." Thus, recent data reveals that wallets containing between 1 million and 10 million XRP now hold a record 7.06 billion coins, valued at approximately $4.42 billion.

The surge in accumulation is noteworthy, reflecting a 10.4% increase of 662.4 million XRP acquired this August alone. This accumulation trend has pushed XRP's social media discussions to their highest levels since January, indicating growing public interest and market sentiment.

Sell wall or stone wall?

It is interesting to see how things will change within these wallets after the news of the SEC v. Ripple ruling broke. It may seem that all of this accumulation was built specifically in anticipation of a resolution in the case that has been dragging on for the last four years.

Now, the burden of legal troubles is gone for XRP and Ripple, although the appeal may still be filed, and it will be other narratives that will influence the price action of the popular cryptocurrency.

The 7.06 billion XRP is an enormous amount, representing 12.5% of the circulating supply of the token, according to data from CoinMarketCap. Once released on a market, it can cause irreparable damage to the price of XRP. On the other hand, the concentration of so many tokens in whales' wallets provides a kind of support for XRP.

Thus, such an ambivalent situation arises.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov